PNC Bank 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

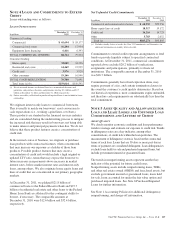

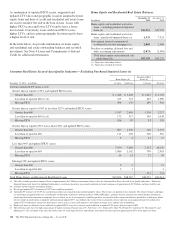

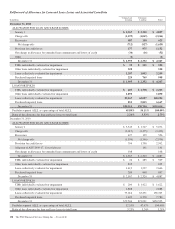

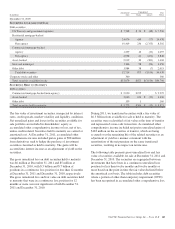

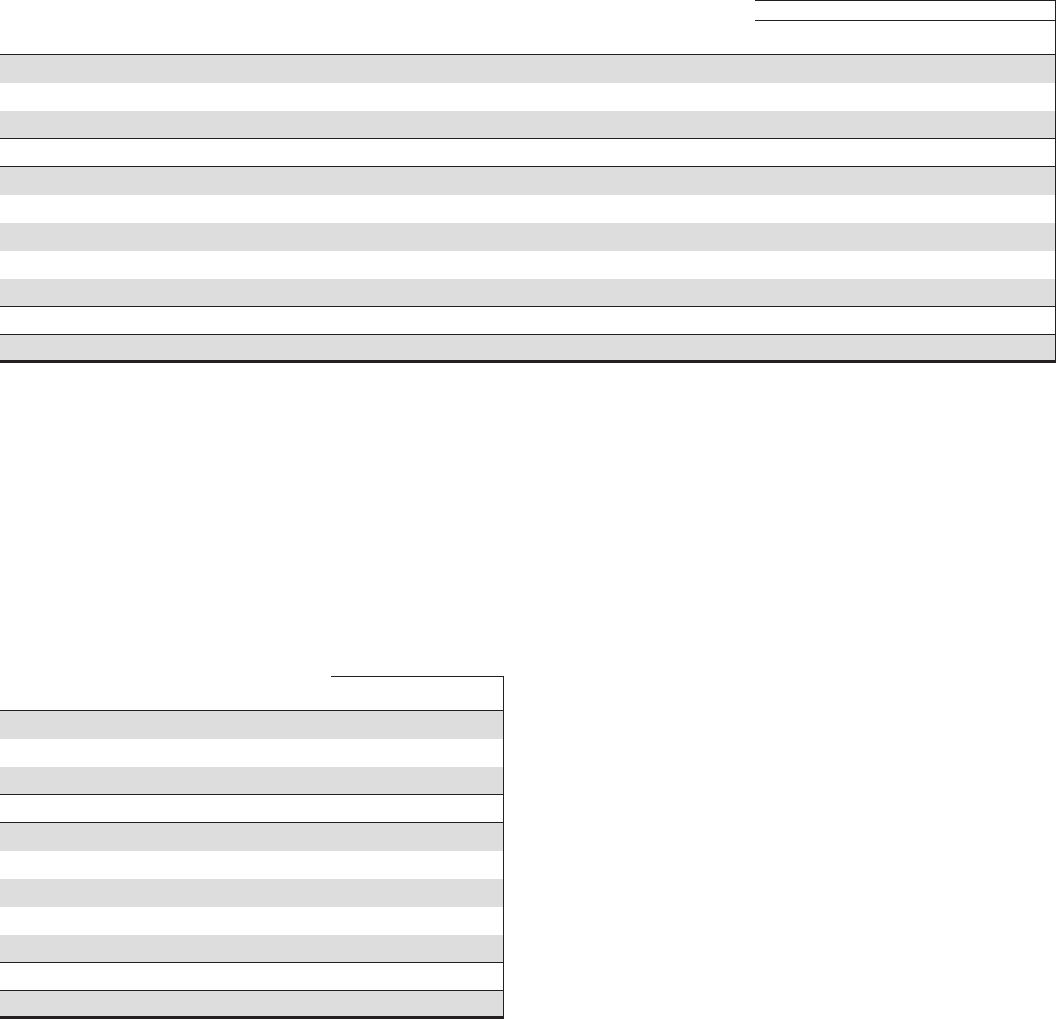

The table below provides additional TDR information. The

Principal Forgiveness category includes principal forgiveness

and accrued interest forgiveness. These types of TDRs result

in a write down of the recorded investment and a charge-off if

such action has not already taken place. The Rate Reduction

TDRs category includes reduced interest rate and interest

deferral. The TDRs within this category would result in

reductions to future interest income. The Other TDR category

primarily includes postponement/reduction of scheduled

amortization, as well as contractual extensions.

In some cases, there have been multiple concessions granted

on one loan. When there have been multiple concessions

granted, the principal forgiveness TDR was prioritized for

purposes of determining the inclusion in the table below. For

example, if there is principal forgiveness in conjunction with

lower interest rate and postponement of amortization, the type

of concession will be reported as Principal Forgiveness.

Second in priority would be rate reduction. For example, if

there is an interest rate reduction in conjunction with

postponement of amortization, the type of concession will be

reported as a Rate Reduction.

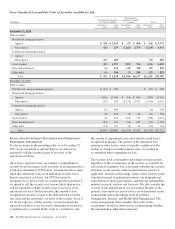

TDRs by Type

Post-TDR Recorded Investment

During the year ended December 31, 2011

Dollars in millions

Principal

Forgiveness

Rate

Reduction Other Total

Commercial lending

Commercial $ 19 $ 33 $ 60 $ 112

Commercial real estate 83 123 54 260

TOTAL COMMERCIAL LENDING (a) 102 156 114 372

Consumer lending

Home equity 281 39 320

Residential real estate 236 115 351

Credit card 92 92

Other consumer 112 13

TOTAL CONSUMER LENDING 610 166 776

Total TDRs $102 $766 $280 $1,148

(a) Excludes less than $1 million of Equipment lease financing in Other TDRs.

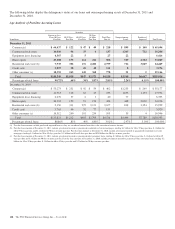

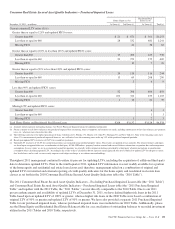

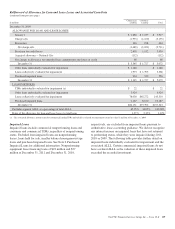

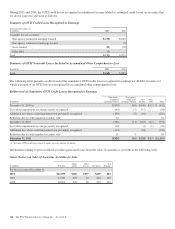

After a loan is determined to be a TDR, we continue to track

its performance under its most recent restructured terms. In

the table below, we consider a TDR to have subsequently

defaulted when it becomes 60 days past due after the most

recent date the loan was restructured. The following table

presents the recorded investment of loans that were classified

as TDRs during a 12-month period within 2010 and 2011 and

subsequently defaulted during 2011.

TDRs which have Subsequently Defaulted

During the year ended December 31, 2011

Dollars in millions

Number of

Contracts

Recorded

Investment

Commercial lending

Commercial 37 $ 57

Commercial real estate 41 136

TOTAL COMMERCIAL LENDING (a) 78 193

Consumer lending

Home equity 1,166 90

Residential real estate 421 93

Credit card 38,256 28

Other consumer 47 1

TOTAL CONSUMER LENDING 39,890 212

Total TDRs 39,968 $405

(a) Amount for Equipment lease financing totaled less than $1 million.

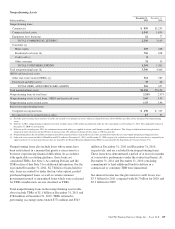

The impact to the ALLL for commercial loan TDRs is the effect

of moving to the specific reserve methodology from the

quantitative reserve methodology for those loans that were not

already put on nonaccrual status. There is an impact to the

ALLL as a result of the concession made, which generally

results in the expectation of fewer future cash flows. The

decline in expected cash flows, as well as the application of a

present value discount rate, when compared to the recorded

investment, results in a charge-off or increased ALLL.

Subsequent defaults of commercial loan TDRs do not have a

significant impact on the ALLL as these TDRs are individually

evaluated under the specific reserve methodology.

For consumer TDRs the ALLL is calculated using a

discounted cash flow model, which leverages subsequent

default, prepayment, and severity rate assumptions based upon

historically observed data. Similar to the commercial loan

specific reserve methodology, the reduced expected cash

flows resulting from the concessions granted impact the

consumer ALLL. The decline in expected cash flows, as well

as the application of a present value discount rate, when

compared to the recorded investment, results in a charge-off

or increased ALLL.

136 The PNC Financial Services Group, Inc. – Form 10-K