PNC Bank 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In November 2011, the FASB issued Proposed Accounting

Standards Update – Consolidation (Topic 810) – Principal

versus Agent Analysis. This proposal would require a

reporting entity to evaluate whether a decision maker is using

its power as a principal or an agent. This evaluation would

affect whether an entity is a variable interest entity and, if so,

whether the reporting entity should consolidate the entity. The

principal or agent decision would be based on the rights held

by other parties, the compensation received by the decision

maker and the decision maker’s exposure to variability of

returns from any other interests that it holds in the entity. This

proposal would change the evaluation of kick-out and

participating rights held by noncontrolling shareholders in a

consolidation analysis. Additionally, the proposal would

impact the requirements for determining when a general

partner controls a limited partnership. Lastly, the proposal

would rescind the indefinite deferral of variable interest entity

analysis provided for an investment manager and other similar

entities. The comment period ended February 15, 2012. We

are evaluating the impact of this proposal on our financial

statements.

In November 2011, the FASB issued Proposed Accounting

Standards Update (Revised) – Revenue Recognition (Topic

605) – Revenue from Contracts with Customers. Under the

proposal, an entity would recognize revenue from contracts

with customers when it transfers promised goods or services

to the customer. The revenue recognized would be the

transaction price based upon the consideration promised by

the customer in exchange for the transferred goods or services.

The proposal includes guidance on how to determine when a

good or service is transferred over time, how to account for

warranties, how to determine a transaction price (including

collectability, time value of money, and variable

consideration), and a practical expedient that permits an entity

to recognize as an expense costs of obtaining a contract (if one

year or less). The effective date has not yet been determined.

The comment period ends on March 13, 2012. On January 4,

2012, the FASB issued a second proposal on Revenue

Recognition that illustrates the proposed amendments to the

FASB Accounting Standards Codification,which were

excluded from the first proposal issued in November 2011.

The comment period for the second proposal also ends on

March 13, 2012. We are evaluating the impact of these

proposals on our financial statements.

In October 2011, the FASB issued Proposed Accounting

Standards Update – Financial Services – Investment

Companies (Topic 946). This proposal would change the

definition of an investment company. Additionally, it would

require that an investment company consolidate another

investment company in which it holds a controlling financial

interest. Consistent with current U.S. GAAP, a noninvestment

company parent of an investment company would continue to

retain the specialized consolidation accounting. The effective

date has not yet been determined. The comment period ended

February 15, 2012. We are evaluating the impact of this

proposal on our financial statements.

In October 2011, the FASB also issued Proposed Accounting

Standards Update – Real Estate – Investment Property Entities

(Topic 973). This proposal provides accounting guidance for

an entity that meets the criteria to be an investment property

entity. Investment properties acquired by an investment

property entity would be required to be recorded at fair value

with changes in value recorded in earnings. The effective date

has not yet been determined. The comment period ended

February 15, 2012. We are evaluating the impact of this

proposal on our financial statements.

In January 2011, the FASB issued Supplementary Document –

Accounting for Financial Instruments and Revisions to the

Accounting for Derivative Instruments and Hedging

Activities – Impairment. Subsequent to this proposal, in June

2011, the FASB and IASB proposed a credit impairment

model that would divide loans into three buckets for purposes

of calculating impairment. The three buckets are:

(1) portfolios with little to no evidence of credit impairment,

(2) portfolios with observable evidence of credit impairment,

and (3) individual instruments that are credit impaired. The

proposed impairment calculations for the three buckets are as

follows: (1) expected losses for the next 12 months for

portfolios of instruments, (2) expected lifetime losses for

portfolios of instruments, and (3) expected lifetime losses for

individual instruments, respectively. All instruments would be

initially classified in bucket 1 and transition to

buckets 2 and 3 if credit performance deteriorates from

origination or acquisition. This proposal continues to be

discussed among the FASB and IASB. A new exposure draft

is expected to be issued in the second quarter of 2012. We are

evaluating the impact of this proposal on our financial

statements.

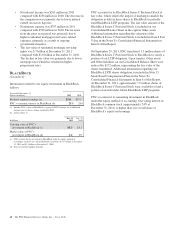

Recent Accounting Pronouncements

See Note 1 Accounting Policies in the Notes To the

Consolidated Financial Statements in Item 8 of this Report

regarding the impact of new accounting pronouncements.

The PNC Financial Services Group, Inc. – Form 10-K 67