PNC Bank 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTE

2A

CQUISITION AND

D

IVESTITURE

A

CTIVITY

P

ENDING

A

CQUISITION OF

RBC B

ANK

(USA)

On June 19, 2011, we entered into a definitive agreement with

Royal Bank of Canada and RBC USA Holdco Corporation to

acquire RBC Bank (USA), the US retail banking subsidiary of

Royal Bank of Canada, for $3.45 billion. The purchase price is

subject to certain adjustments, including adjustments based on

the closing date tangible net asset value of RBC Bank (USA),

as defined in the definitive agreement. Although PNC has the

option to pay up to $1.0 billion of the purchase price using

shares of PNC common stock under the terms of the

agreement, PNC currently does not plan to issue any shares of

PNC common stock as part of the consideration. PNC has also

agreed to acquire certain credit card accounts of RBC Bank

(USA) customers issued by RBC Bank (Georgia), National

Association, a wholly-owned subsidiary of Royal Bank of

Canada.

RBC Bank (USA) has approximately $25 billion (unaudited)

in “proforma” assets as reflected in the definitive agreement to

be included in the transaction and more than 400 branches in

North Carolina, Florida, Alabama, Georgia, Virginia and

South Carolina. The transaction is expected to close in March

2012, subject to remaining customary closing conditions.

F

LAGSTAR

B

RANCH

A

CQUISITION

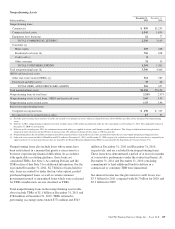

Effective December 9, 2011, PNC acquired 27 branches in the

northern metropolitan Atlanta, Georgia area from Flagstar

Bank, FSB, a subsidiary of Flagstar Bancorp, Inc. The fair

value of the assets acquired totaled approximately $211.8

million, including $169.3 million in cash, $24.3 million in

fixed assets and $18.2 million of goodwill and intangible

assets. We also assumed approximately $210.5 million of

deposits associated with these branches. No deposit premium

was paid and no loans were acquired in the transaction. Our

Consolidated Income Statement includes the impact of the

branch activity subsequent to our December 9, 2011

acquisition.

B

ANK

A

TLANTIC

B

RANCH

A

CQUISITION

Effective June 6, 2011, PNC acquired 19 branches in the

greater Tampa, Florida area from BankAtlantic, a subsidiary

of BankAtlantic Bancorp, Inc. The fair value of the assets

acquired totaled approximately $324.9 million, including

$256.9 million in cash, $26.0 million in fixed assets and $42.0

million of goodwill and intangible assets. We also assumed

approximately $324.5 million of deposits associated with

these branches. A $39.0 million deposit premium was paid

and no loans were acquired in the transaction. Our

Consolidated Income Statement includes the impact of the

branch activity subsequent to our June 6, 2011 acquisition.

S

ALE OF

PNC G

LOBAL

I

NVESTMENT

S

ERVICING

On July 1, 2010, we sold PNC Global Investment Servicing

Inc. (GIS), a leading provider of processing, technology and

business intelligence services to asset managers, broker-

dealers and financial advisors worldwide, for $2.3 billion in

cash pursuant to a definitive agreement entered into on

February 2, 2010. This transaction resulted in a pretax gain of

$639 million, net of transaction costs, in the third quarter of

2010. This gain and results of operations of GIS through

June 30, 2010 are presented as Income from discontinued

operations, net of income taxes, on our Consolidated Income

Statement. As part of the sale agreement, PNC has agreed to

provide certain transitional services on behalf of GIS until

completion of related systems conversion activities. There

were no assets or liabilities of GIS remaining on our

Consolidated Balance Sheet at December 31, 2010.

N

OTE

3L

OAN

S

ALE AND

S

ERVICING

A

CTIVITIES

AND

V

ARIABLE

I

NTEREST

E

NTITIES

L

OAN

S

ALE AND

S

ERVICING

A

CTIVITIES

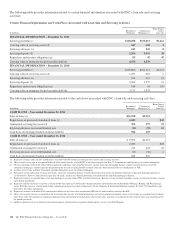

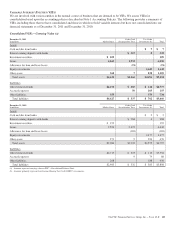

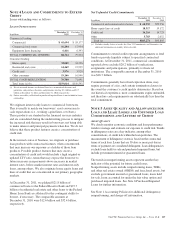

We have transferred residential and commercial mortgage

loans in securitization or sales transactions in which we have

continuing involvement. These transfers have occurred

through Agency securitization, Non-Agency securitization,

and whole-loan sale transactions. Agency securitizations

consist of securitization transactions with Federal National

Mortgage Association (FNMA), Federal Home Loan

Mortgage Corporation (FHLMC), and Government National

Mortgage Association (GNMA) (collectively the Agencies).

FNMA and FHLMC generally securitize our transferred loans

into mortgage-backed securities for sale into the secondary

market through special purpose entities (SPEs) they sponsor.

We, as an authorized GNMA issuer/servicer, pool Federal

Housing Administration (FHA) and Department of Veterans

Affairs (VA) insured loans into mortgage-backed securities

for sale into the secondary market. In Non-Agency

securitizations, we have transferred loans into securitization

SPEs. In other instances third-party investors have purchased

(in whole-loan sale transactions) and subsequently sold our

loans into securitization SPEs. Third-party investors have also

purchased our loans in whole-loan sale transactions.

Securitization SPEs, which are legal entities that are utilized

in the Agency and Non-Agency securitization transactions, are

VIEs.

Our continuing involvement in the Agency securitizations,

Non-Agency securitizations, and whole-loan sale transactions

generally consists of servicing, repurchases of previously

transferred loans and loss share arrangements, and, in limited

circumstances, holding of mortgage-backed securities issued

by the securitization SPEs.

120 The PNC Financial Services Group, Inc. – Form 10-K