PNC Bank 2011 Annual Report Download - page 103

Download and view the complete annual report

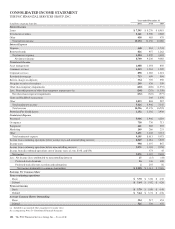

Please find page 103 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National City integration costs included in noninterest expense

totaled $387 million in 2010 and $421 million in 2009. We

achieved National City acquisition cost savings of $1.8 billion

on an annualized basis in the fourth quarter of 2010 through

the reduction of operational and administrative redundancies.

This amount was higher than our original goal of $1.2 billion,

and ahead of schedule. During 2010, we completed the

customer and branch conversions to our technology platforms

and integrated the businesses and operations of National City

with those of PNC.

Effective Tax Rate

Our effective tax rate was 25.5% for 2010 and 26.9% for

2009.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

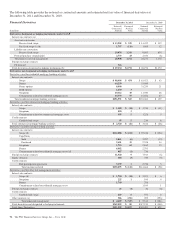

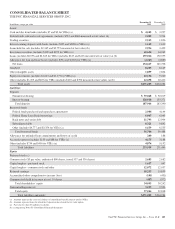

Loans

Loans decreased $6.9 billion, or 4%, to $150.6 billion as of

December 31, 2010 compared with December 31, 2009. An

increase in loans of $3.5 billion from the initial consolidation

of Market Street and the securitized credit card portfolio

effective January 1, 2010 was more than offset by the impact

of soft customer loan demand combined with loan repayments

and payoffs in the portfolio.

Loans represented 57% of total assets at December 31, 2010

and 58% at December 31, 2009. Commercial lending

represented 53% of the loan portfolio and consumer lending

represented 47% at both December 31, 2010 and

December 31, 2009. Commercial real estate loans represented

7% of total assets at December 31, 2010 and 9% of total assets

at December 31, 2009.

Investment Securities

The carrying amount of investment securities totaled $64.3

billion at December 31, 2010, an increase of $8.3 billion, or

15%, from $56.0 billion at December 31, 2009. The increase

in investment securities primarily reflected an increase in

securities available for sale as excess liquidity was invested in

short duration, high quality securities. Investment securities

represented 24% of total assets at December 31, 2010 and

21% at December 31, 2009.

In March 2010, we transferred $2.2 billion of available for

sale commercial mortgage-backed non-agency securities to

the held to maturity portfolio. The transfer involved high

quality securities where management’s intent to hold changed.

At December 31, 2010, the securities available for sale

portfolio included a net unrealized loss of $861 million, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2009 was a net

unrealized loss of $2.3 billion. The expected weighted-average

life of investment securities (excluding corporate stocks and

other) was 4.7 years at December 31, 2010 and 4.1 years at

December 31, 2009.

Loans Held For Sale

Loans held for sale totaled $3.5 billion at December 31, 2010

compared with $2.5 billion at December 31, 2009. We stopped

originating certain commercial mortgage loans designated as

held for sale during the first quarter of 2008 and continue

pursuing opportunities to reduce these positions at appropriate

prices. We sold $241 million of commercial mortgage loans

held for sale carried at fair value in 2010 and sold $272

million in 2009.

Residential mortgage loan origination volume was $10.5

billion in 2010. Substantially all such loans were originated

under agency or Federal Housing Administration (FHA)

standards. We sold $10.0 billion of loans and recognized

related gains of $231 million during 2010. The comparable

amounts for 2009 were $19.8 billion and $435 million,

respectively.

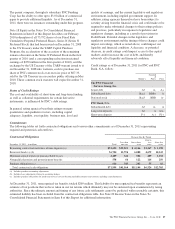

Asset Quality

Nonperforming assets decreased $1.1 billion to $5.1 billion at

December 31, 2010 compared with $6.2 billion at

December 31, 2009. Nonperforming loans decreased $1.2

billion to $4.5 billion since December 31, 2009 while OREO

and foreclosed assets increased $124 million to $657 million.

The decrease in nonperforming loans was primarily due to

improvements in our commercial lending and residential real

estate portfolios, partially offset by increases in our consumer

home equity portfolio. These consumer home equity

nonperforming loan increases were largely due to increases in

troubled debt restructurings (TDRs).

At December 31, 2010, our largest nonperforming asset was

$35 million in the Accommodation and Food Services

Industry and our average nonperforming loan associated with

commercial lending was approximately $1 million.

Goodwill and Other Intangible Assets

Goodwill and other intangible assets totaled $10.8 billion at

December 31, 2010 compared with $12.9 billion at December,

31, 2009. Goodwill declined $1.4 billion, to $8.1 billion, at

December 31, 2010 compared with the December 31, 2009

balance primarily due to the sale of GIS which reduced

goodwill by $1.2 billion. The $.8 billion decline in other

intangible assets from December 31, 2009 included $.3 billion

declines in both commercial and residential mortgage

servicing rights due primarily to the sale of commercial

mortgage servicing rights and residential mortgage servicing

rights value changes resulting primarily from market-driven

changes in interest rates.

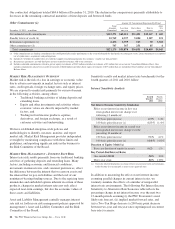

Funding Sources

Total funding sources were $222.9 billion at December 31,

2010 and $226.2 billion at December 31, 2009. Funding

sources decreased $3.3 billion, primarily driven by declines in

retail certificates of deposit and Federal Home Loan Bank

borrowings, partially offset by increases in demand deposits

and other borrowings.

94 The PNC Financial Services Group, Inc. – Form 10-K