PNC Bank 2011 Annual Report Download - page 56

Download and view the complete annual report

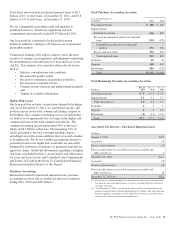

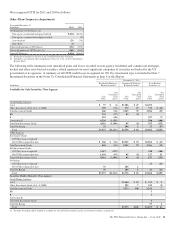

Please find page 56 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Federal banking regulators have stated that they expect all

bank holding companies to have a level and composition of

Tier 1 capital well in excess of the 4% regulatory minimum,

and they have required the largest US bank holding

companies, including PNC, to have a capital buffer sufficient

to withstand losses and allow them to meet credit needs of

their customers through estimated stress scenarios. They have

also stated their view that common equity should be the

dominant form of Tier 1 capital. As a result, regulators are

now emphasizing the Tier 1 common capital ratio in their

evaluation of bank holding company capital levels, although a

formal ratio for this metric is not provided for in current

regulations. We seek to manage our capital consistent with

these regulatory principles, and believe that our December 31,

2011 capital levels were aligned with them.

Dodd-Frank requires the Federal Reserve Board to establish

capital requirements that would, among other things, eliminate

the Tier 1 treatment of trust preferred securities following a

phase-in period expected to begin in 2013. Accordingly, PNC

will evaluate its alternatives, including the potential for

redemption on the first call date of some or all of its trust

preferred securities, based on such considerations it may

consider relevant, including dividend rates, the specifics of the

future capital requirements, capital market conditions,

replacement capital covenants with respect to certain trust

preferred securities, and other factors. See Capital and

Liquidity Actions in the Executive Summary section of this

Item 7 for additional information regarding our November

2011 redemption of trust preferred securities and Note 13

Capital Securities of Subsidiary Trusts and Perpetual Trust

Securities in the Notes To Consolidated Financial Statements

in Item 8 of this Report for additional information on trust

preferred securities.

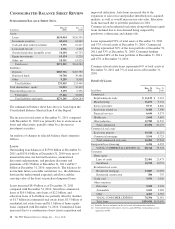

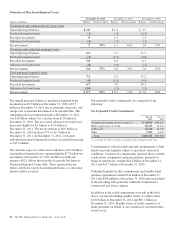

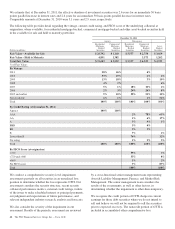

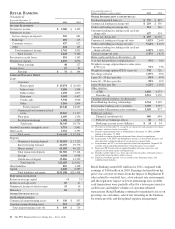

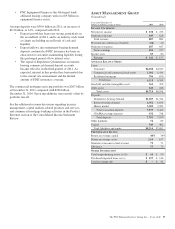

Our Tier 1 common capital ratio was 10.3% at December 31,

2011, an increase of 50 basis points compared with 9.8% at

December 31, 2010. Our Tier 1 risk-based capital ratio

increased 50 basis points to 12.6% at December 31, 2011 from

12.1% at December 31, 2010. The Tier 1 common capital ratio

increased when compared with December 31, 2010 due to the

retention of earnings partially offset by higher risk-weighted

assets primarily from loan growth. The increase in the Tier 1

risk-based capital ratio compared with December 31, 2010

resulted from the issuance of preferred stock in July 2011 and

retention of earnings somewhat offset by the redemption of

trust preferred securities in November 2011 and higher risk-

weighted assets. See Note 18 Equity in the Notes To

Consolidated Financial Statements in Item 8 of this Report for

additional information regarding the Series O Preferred Stock

issuance.

At December 31, 2011, PNC Bank, N.A., our domestic bank

subsidiary, was considered “well capitalized” based on US

regulatory capital ratio requirements under Basel I. To qualify

as “well-capitalized”, regulators currently require banks to

maintain capital ratios of at least 6% for Tier 1 risk-based,

10% for total risk-based, and 5% for leverage. See the

“Supervision and Regulation” section of Item 1 and Note 21

Regulatory Matters in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information.

We believe PNC Bank, N.A., will continue to meet these

requirements during 2012.

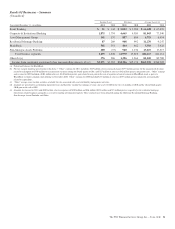

The access to, and cost of, funding for new business initiatives

including acquisitions, the ability to engage in expanded

business activities, the ability to pay dividends, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in part, on a financial institution’s capital

strength.

We provide additional information regarding enhanced capital

requirements and some of their potential impacts on PNC in

Item 1A Risk Factors of this Report.

The PNC Financial Services Group, Inc. – Form 10-K 47