PNC Bank 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

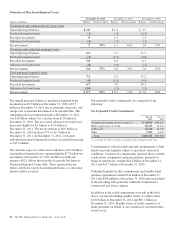

Total loans above include purchased impaired loans of $6.7

billion, or 4% of total loans, at December 31, 2011, and $7.8

billion, or 5% of total loans, at December 31, 2010.

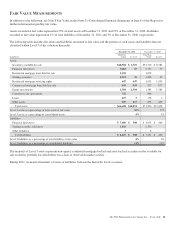

We are committed to providing credit and liquidity to

qualified borrowers. Total loan originations and new

commitments and renewals totaled $147 billion for 2011.

Our loan portfolio continued to be diversified among

numerous industries and types of businesses in our principal

geographic markets.

Commercial lending is the largest category and is the most

sensitive to changes in assumptions and judgments underlying

the determination of the allowance for loan and lease losses

(ALLL). This estimate also considers other relevant factors

such as:

• Industry concentrations and conditions,

• Recent credit quality trends,

• Recent loss experience in particular portfolios,

• Recent macro economic factors,

• Changes in risk selection and underwriting standards,

and

• Timing of available information.

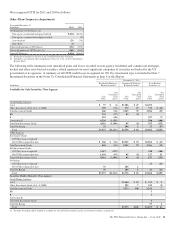

Higher Risk Loans

Our loan portfolio includes certain loans deemed to be higher

risk. As of December 31, 2011, we established specific and

pooled reserves on the total commercial lending category of

$2.0 billion. This commercial lending reserve included what

we believe to be appropriate loss coverage on the higher risk

commercial loans in the total commercial portfolio. The

commercial lending reserve represented 46% of the total

ALLL of $4.3 billion at that date. The remaining 54% of

ALLL pertained to the total consumer lending category,

including loans with certain attributes that we would consider

to be higher risk. We do not consider government insured or

guaranteed loans to be higher risk as defaults are materially

mitigated by payments of insurance or guarantee amounts for

approved claims. Additional information regarding our higher

risk loans is included in Note 5 Asset Quality and Allowances

for Loan and Lease Losses and Unfunded Loan Commitments

and Letters of Credit in the Notes To Consolidated Financial

Statements included in Item 8 of this Report.

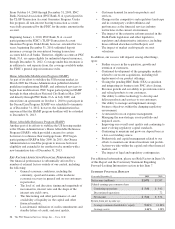

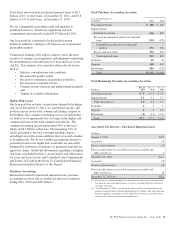

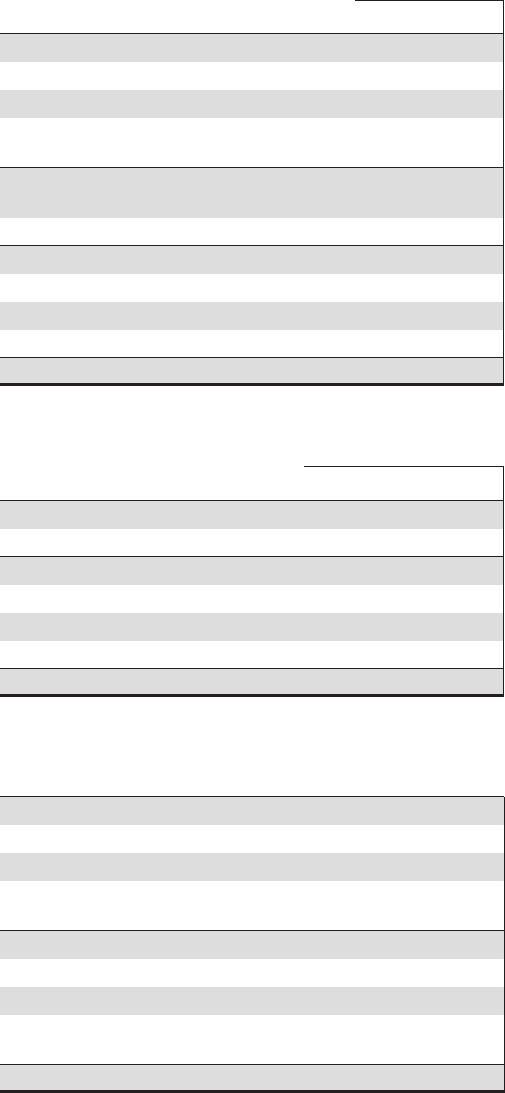

Purchase Accounting

Information related to purchased impaired loans, purchase

accounting accretion and accretable net interest recognized

during 2011, 2010 and 2009 follows.

Total Purchase Accounting Accretion

Year ended December 31

In millions 2011 2010

Non-impaired loans $ 288 $ 366

Impaired loans

Scheduled accretion 666 885

Reversal of contractual interest on impaired

loans (395) (529)

Scheduled accretion net of contractual

interest 271 356

Excess cash recoveries 254 483

Total impaired loans 525 839

Securities 49 54

Deposits 358 545

Borrowings (101) (155)

Total $1,119 $1,649

Total Remaining Purchase Accounting Accretion

In billions

Dec. 31

2011

Dec. 31

2010

Dec. 31

2009

Non-impaired loans $.9 $ 1.2 $ 1.6

Impaired loans 2.1 2.2 3.5

Total loans (gross) 3.0 3.4 5.1

Securities .4 .5 .5

Deposits .1 .5 1.0

Borrowings (.8) (1.1) (1.2)

Total $2.7 $ 3.3 $ 5.4

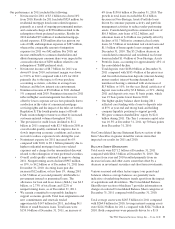

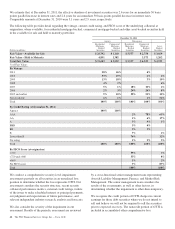

Accretable Net Interest – Purchased Impaired Loans

In billions

January 1, 2010 $3.5

Accretion (.9)

Excess cash recoveries (.5)

Net reclassifications to accretable from non-accretable and

other activity (a) .1

December 31, 2010 $2.2

Accretion (.7)

Excess cash recoveries (.2)

Net reclassifications to accretable from non-accretable and

other activity (a) .8

December 31, 2011 (b) $2.1

(a) The net reclass includes the impact of improvements in the excess cash expected to

be collected from credit improvements, as well as accretable differences related to

cash flow extensions.

(b) As of December 31, 2011, we estimate that the reversal of contractual interest on

purchased impaired loans will total approximately $1.4 billion. This will reduce the

benefit of purchase accounting accretion and offset the total net accretable interest

income of $2.1 billion on purchased impaired loans.

The PNC Financial Services Group, Inc. – Form 10-K 39