PNC Bank 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

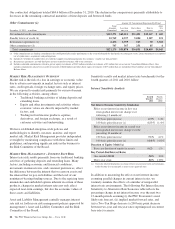

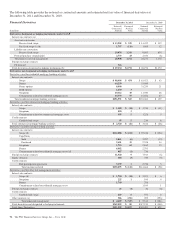

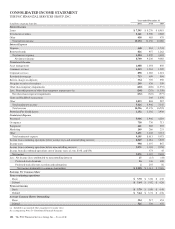

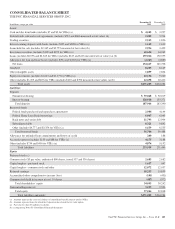

Total deposits decreased $3.5 billion at December 31, 2010

compared with December 31, 2009. Deposits decreased in the

comparison primarily due to declines in retail certificates of

deposit, time deposits in foreign offices and money market

deposits, partially offset by an increase in demand deposits.

Total borrowed funds increased $.2 billion to $39.5 billion at

December 31, 2010 compared to December 31, 2009. Other

borrowed funds increased in the comparison primarily due to

the consolidation of Market Street and a credit card

securitization trust. Additionally, bank notes and senior debt

increased since December 31, 2009 due to net issuances.

These increases were partially offset in the comparison by a

decline of Federal Home Loan Bank borrowings.

PNC issued $3.25 billion of senior notes in 2010. In March

2009, PNC issued $1.0 billion of floating rate senior notes

guaranteed by the FDIC under the FDIC’s TLGP-Debt

Guarantee Program (TLGP). In addition, PNC issued

$1.5 billion of senior notes during the second and third

quarters of 2009 that were not issued under the TLGP.

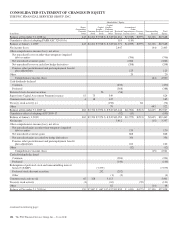

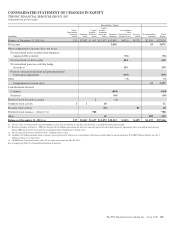

Shareholders’ Equity

Total shareholders’ equity increased $.3 billion, to $30.2

billion, at December 31, 2010 compared with December 31,

2009 and included the impact of the following:

• The first quarter 2010 issuance of 63.9 million shares

of common stock in an underwritten offering at $54

per share resulted in a $3.4 billion increase in total

shareholders’ equity,

• An increase of $2.7 billion to retained earnings, and

• A $1.5 billion decline in accumulated other

comprehensive loss largely due to decreases in net

unrealized securities losses.

The factors above were mostly offset by a decline of $7.3

billion in capital surplus-preferred stock in connection with

our February 2010 redemption of the Series N (TARP)

Preferred Stock as explained further in Note 18 Equity in the

Notes To Consolidated Financial Statements in Item 8 of this

Report.

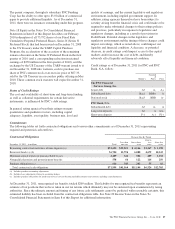

Regulatory capital ratios at December 31, 2010 were 10.2%

for leverage, 12.1% for Tier 1 risk-based and 15.6% for total

risk-based capital. At December 31, 2009, the regulatory

capital ratios were 10.1% for leverage, 11.4% for Tier 1 risk-

based and 15.0% for total risk-based capital. The increase in

Tier 1 risk-based capital was attributable to retention of

earnings in 2010, the first quarter 2010 equity offering, the

third quarter 2010 sale of GIS, and lower risk-weighted assets.

G

LOSSARY

O

F

T

ERMS

Accretable net interest (Accretable yield) – The excess of cash

flows expected to be collected on a purchased impaired loan

over the carrying value of the loan. The accretable net interest

is recognized into interest income over the remaining life of

the loan using the constant effective yield method.

Adjusted average total assets – Primarily comprised of total

average quarterly (or annual) assets plus (less) unrealized

losses (gains) on investment securities, less goodwill and

certain other intangible assets (net of eligible deferred taxes).

Annualized – Adjusted to reflect a full year of activity.

Assets under management – Assets over which we have sole

or shared investment authority for our customers/clients. We

do not include these assets on our Consolidated Balance Sheet.

Basis point – One hundredth of a percentage point.

Carrying value of purchased impaired loans – The net value

on the balance sheet which represents the recorded investment

less any valuation allowance.

Cash recoveries – Cash recoveries used in the context of

purchased impaired loans represent cash payments from

customers that exceeded the recorded investment of the

designated impaired loan.

Charge-off – Process of removing a loan or portion of a loan

from our balance sheet because it is considered uncollectible.

We also record a charge-off when a loan is transferred from

portfolio holdings to held for sale by reducing the loan

carrying amount to the fair value of the loan, if fair value is

less than carrying amount.

Combined Loan-to-value ratio (CLTV) – This is the aggregate

principal balance(s) of the mortgages on a property divided by

its appraised value or purchase price.

Commercial mortgage banking activities – Includes

commercial mortgage servicing, originating commercial

mortgages for sale and related hedging activities. Commercial

mortgage banking activities revenue includes commercial

mortgage servicing (including net interest income and

noninterest income from loan servicing and ancillary services,

net of commercial mortgage servicing rights amortization, and

commercial mortgage servicing rights valuations), and

revenue derived from commercial mortgage loans intended for

sale and related hedges (including loan origination fees, net

interest income, valuation adjustments and gains or losses on

sales).

Common shareholders’ equity to total assets – Common

shareholders’ equity divided by total assets. Common

shareholders’ equity equals total shareholders’ equity less the

liquidation value of preferred stock.

Core net interest income – Total net interest income less

purchase accounting accretion.

Credit derivatives – Contractual agreements, primarily credit

default swaps, that provide protection against a credit event of

one or more referenced credits. The nature of a credit event is

The PNC Financial Services Group, Inc. – Form 10-K 95