PNC Bank 2011 Annual Report Download - page 81

Download and view the complete annual report

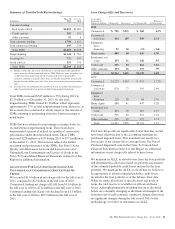

Please find page 81 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2011 and December 31, 2010, respectively. The

year-over-year reduction in this liability was reflective of

lower anticipated indemnification and repurchase activity for

the sold portfolio due to pooled settlement activities, improved

investor rescission rates as described above, and the seasoning

of the sold home equity portfolio.

R

ISK

M

ANAGEMENT

We encounter risk as part of the normal course of operating

our business and we design risk management processes to help

manage these risks. This Risk Management section describes

our risk management philosophy, principles, governance and

various aspects of our corporate-level risk management

program. We also provide an analysis of our primary areas of

risk: credit, operational, model, liquidity, and market. The

discussion of market risk is further subdivided into interest

rate, trading, and equity and other investment risk areas. Our

use of financial derivatives as part of our overall asset and

liability risk management process is also addressed within the

Risk Management section of this Item 7. In appropriate places

within this section, historical performance is also addressed.

Risk Management Philosophy and Profile

We fundamentally believe that risk management is a critical

activity in successfully operating our business. We have

adopted and implemented a risk philosophy with a goal of

managing to an overall moderate level of risk to capture

opportunities and optimize shareholder value. We actively

support a risk management culture which promotes

communication, teamwork, and our governance structure to

help us manage our risks in the best interest of our business

and shareholders. We dynamically set our strategies and make

distinct risk taking decisions with consideration for the impact

to our aggregate risk position. During 2011, our corporate risk

profile returned to an overall moderate level due to continued

improvement in a number of key measures, disciplined credit

management, and the successful execution and

implementation of strategic business initiatives.

Risk Management Principles

In managing the risks we encounter, we employ the following

accepted guiding principles to establish boundaries for the

risks which we are willing to accept in the course of doing

business. These include being able to effectively:

• Identify and Understand Risks and Returns

• Make Balanced Risk Decisions

• Monitor and Manage Risks

Risk Management Governance

We employ a comprehensive Risk Management governance

structure to help ensure that risks are identified; balanced

decisions are made that consider risk and return; and risks are

adequately monitored and managed. Risk committees

established within this governance structure provide oversight

for risk management activities at the Board, Corporate, and

Business level. We utilize our governance structure to assess

the effectiveness of our Risk Management practices on an

ongoing basis, based on how we manage our day-to-day

business activities and on our development and execution of

more specific strategies to mitigate risks. Our businesses strive

to enhance risk management and internal control processes in

light of heightened regulatory expectations focused on large

financial institutions. We have integrated and comprehensive

processes in place that are designed to adequately identify,

measure, manage, monitor, and report risks which may

significantly impact our business. The roles and

responsibilities for our Risk Management activities rest with

the following groups:

Line of Business Management and corporate support

functions have the responsibility for identifying and managing

risks generated in day-to-day business activities. This includes

performing quality assurance testing on processes to identify

risks and implementing necessary mitigation measures; setting

control level policies and procedures designed to manage

program execution within boundaries defined by risk

management; and supporting risk reporting activities and

escalation of key risks.

Risk Management supports business management in meeting

their responsibilities for managing risk in a partnership role by

proactively assessing risk, as well as an oversight role of

measuring, monitoring, and challenging firm-wide risk

management capabilities. This includes establishing enterprise

level risk management policies that govern the control level

policies, performing quality control on process outcomes,

establishing appropriate governance and challenge functions

via the risk committees, and creating risk transparency

through ownership of risk reporting activities.

Internal Audit develops a risk-based audit program to help

provide assurance on the management of risk throughout the

organization. This includes auditing business processes across

the organization and reporting on the effectiveness of controls,

as well as auditing the risk management policy and

infrastructure implemented by the enterprise risk management

function.

Corporate-Level Risk Management Program

The corporate risk management organization has the following

key roles:

• Facilitate the identification, assessment and

monitoring of risk across PNC,

• Provide support and oversight to the businesses,

• Help identify and implement risk management best

practices, as appropriate, and

• Work with the lines of business to shape and define

PNC’s business risk limits.

Risk Measurement

We conduct risk measurement activities specific to each area

of risk utilizing a variety of methodologies. The primary

vehicle for aggregation of enterprise-wide risk is a

comprehensive risk management methodology which focuses

on maximizing economic capital. This primary risk

72 The PNC Financial Services Group, Inc. – Form 10-K