PNC Bank 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238

|

|

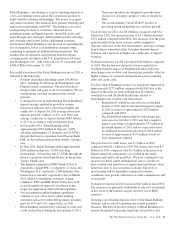

• PNC Equipment Finance is the 4th largest bank-

affiliated leasing company with over $9 billion in

equipment finance assets.

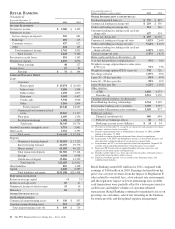

Average deposits were $50.0 billion in 2011, an increase of

$6.2 billion, or 14%, compared with 2010.

• Deposit growth has been very strong, particularly in

the second half of 2011, and is an industry-wide trend

as clients are holding record levels of cash and

liquidity.

• Deposit inflows into noninterest-bearing demand

deposits continued as FDIC insurance has been an

attraction for customers maintaining liquidity during

this prolonged period of low interest rates.

• The repeal of Regulation Q limitations on interest-

bearing commercial demand deposit accounts

became effective in the third quarter of 2011. As

expected, interest in this product has been muted due

to the current rate environment and the limited

amount of FDIC insurance coverage.

The commercial mortgage servicing portfolio was $267 billion

at December 31, 2011 compared with $266 billion

December 31, 2010. Servicing additions were mostly offset by

portfolio run-off.

See the additional revenue discussion regarding treasury

management, capital markets-related products and services,

and commercial mortgage banking activities in the Product

Revenue section of the Consolidated Income Statement

Review.

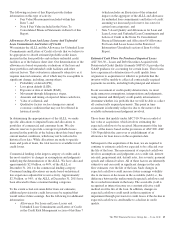

A

SSET

M

ANAGEMENT

G

ROUP

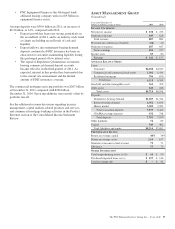

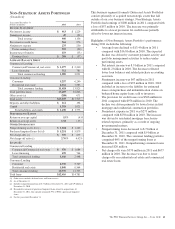

(Unaudited)

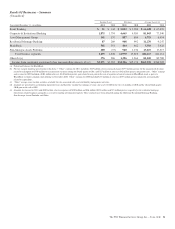

Year ended December 31

Dollars in millions, except as noted 2011 2010

I

NCOME

S

TATEMENT

Net interest income $ 238 $ 256

Noninterest income 649 628

Total revenue 887 884

Provision for credit losses (benefit) (24) 20

Noninterest expense 687 647

Pretax earnings 224 217

Income taxes 83 80

Earnings $ 141 $ 137

A

VERAGE

B

ALANCE

S

HEET

Loans

Consumer $4,108 $4,025

Commercial and commercial real estate 1,301 1,434

Residential mortgage 706 850

Total loans 6,115 6,309

Goodwill and other intangible assets 361 399

Other assets 243 246

Total assets $6,719 $6,954

Deposits

Noninterest-bearing demand $1,209 $1,324

Interest-bearing demand 2,361 1,835

Money market 3,589 3,283

Total transaction deposits 7,159 6,442

CDs/IRAs/savings deposits 632 748

Total deposits 7,791 7,190

Other liabilities 74 89

Capital 349 402

Total liabilities and equity $8,214 $7,681

P

ERFORMANCE

R

ATIOS

Return on average capital 40% 34%

Return on average assets 2.10 1.97

Noninterest income to total revenue 73 71

Efficiency 77 73

O

THER

I

NFORMATION

Total nonperforming assets (a) (b) $60$90

Purchased impaired loans (a) (c) $ 127 $ 146

Total net charge-offs $–$42

The PNC Financial Services Group, Inc. – Form 10-K 57