PNC Bank 2011 Annual Report Download - page 199

Download and view the complete annual report

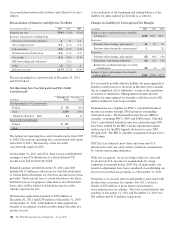

Please find page 199 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.among others, one or more of the following: the proceeding is

in its early stages; the damages sought are unspecified,

unsupported or uncertain; it is unclear whether a case brought

as a class action will be allowed to proceed on that basis or, if

permitted to proceed as a class action, how the class will be

defined; the plaintiff is seeking relief other than or in addition

to compensatory damages; the matter presents meaningful

legal uncertainties, including novel issues of law; we have not

engaged in meaningful settlement discussions; discovery has

not started or is not complete; there are significant facts in

dispute; and there are a large number of parties named as

defendants (including where it is uncertain how liability, if

any, will be shared among multiple defendants). Generally,

the less progress that has been made in the proceedings or the

broader the range of potential results, the harder it is for us to

estimate losses or ranges of losses that it is reasonably

possible we could incur. Therefore, as the estimated aggregate

amount disclosed above does not include all of the Disclosed

Matters, the amount disclosed above does not represent our

maximum reasonably possible loss exposure for all of the

Disclosed Matters. The estimated aggregate amount also does

not reflect any of our exposure to matters not so disclosed, as

discussed below under “Other.”

We include in some of the descriptions of individual

Disclosed Matters certain quantitative information related to

the plaintiff’s claim against us alleged in the plaintiff’s

pleadings or otherwise publicly available. While information

of this type may provide insight into the potential magnitude

of a matter, it does not necessarily represent our estimate of

reasonably possible loss or our judgment as to any currently

appropriate accrual.

Some of our exposure in Disclosed Matters may be offset by

applicable insurance coverage. We do not consider the

possible availability of insurance coverage in determining the

amounts of any accruals (although we record the amount of

related insurance recoveries that are deemed probable up to

the amount of the accrual) or in determining any estimates of

possible losses or ranges of possible losses.

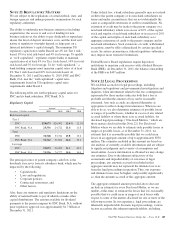

Securities and State Law Fiduciary Cases against National

City

• In January 2008, a lawsuit (In re National City

Corporation Securities, Derivative & ERISA

Litigation (The Securities Case) (MDL No. 2003,

Case No: 1:08-nc-70004-SO)) was filed in the United

States District Court for the Northern District of Ohio

against National City and certain officers and

directors of National City. As amended, this lawsuit

was brought as a class action on behalf of purchasers

of National City’s stock during the period April 30,

2007 to April 21, 2008 and also on behalf of

everyone who acquired National City stock pursuant

to a registration statement filed in connection with its

acquisition of MAF Bancorp in 2007. The amended

complaint alleges violations of federal securities laws

regarding public statements and disclosures relating

to, among other things, the nature, quality,

performance, and risks of National City’s non-prime,

residential construction, and National Home Equity

portfolios, its loan loss reserves, its financial

condition, and related allegedly false and misleading

financial statements. In the amended complaint, the

plaintiffs seek, among other things, unspecified

damages and attorneys’ fees. A motion to dismiss the

amended complaint is pending. A magistrate judge

has recommended dismissal of the lawsuit without

prejudice, with a right for the plaintiffs to file a

further amended complaint within 30 days. The

magistrate’s recommendation is subject to adoption

by the district court. The plaintiffs have filed

objections to that recommendation. In August 2011,

the parties entered into a memorandum of

understanding providing for the settlement of the

lawsuit for $168 million and in November filed

formal settlement papers with the district court. The

settlement is conditioned on, among other things,

final court approval. The court has scheduled a

hearing in March 2012 to determine if it will grant

final approval to the settlement. As a result of

existing accruals and recorded probable insurance

recoveries, PNC expects the impact of this settlement

on our future results of operations to be immaterial.

• In May 2008, a lawsuit (The Dispatch Printing

Company, et al. v. National City Corporation, et al.

(Case No. 08CVH-6506)) was filed on behalf of an

individual plaintiff in the Franklin County, Ohio,

Court of Common Pleas against National City,

certain directors of National City, and Corsair

Co-Invest, L.P. and unnamed other investors

participating in the April 2008 capital infusion into

National City, alleging that National City’s directors

breached their fiduciary duties by entering into this

capital infusion transaction. A motion to dismiss the

case as originally filed was denied. After the initial

filing, two additional plaintiffs were added. The

plaintiffs filed an amended complaint in December

2010. The amended complaint adds PNC as a

defendant as successor in interest to National City. In

the amended complaint, which included some

additional allegations, the plaintiffs seek, among

other things, unspecified actual and punitive

damages, and attorneys’ fees. In December 2011, we

filed a motion for summary judgment. The court has

not yet ruled on this motion. The court has currently

scheduled the trial to begin in July 2012.

Interchange Litigation

Beginning in June 2005, a series of antitrust lawsuits were

filed against Visa®, MasterCard®, and several major financial

institutions, including cases naming National City (since

merged into PNC) and its subsidiary, National City Bank of

Kentucky (since merged into National City Bank which in

190 The PNC Financial Services Group, Inc. – Form 10-K