PNC Bank 2011 Annual Report Download - page 62

Download and view the complete annual report

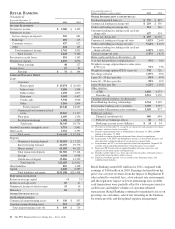

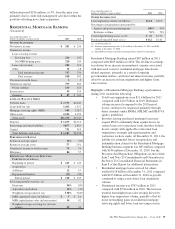

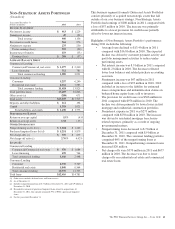

Please find page 62 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail Banking’s core strategy is to grow checking deposits as

a low-cost funding source and as the cornerstone product to

build valuable customer relationships. The goal is to acquire

and retain customers who maintain their primary checking and

transaction relationships with PNC. The business is focused

on deepening its share of customers’ financial assets,

including savings and liquid deposits, investable assets and

loans through sales strategies, differentiated product offerings

and customer satisfaction. In this challenging economic

environment, Retail Banking is also focused on expanding the

use of alternative, lower cost distribution channels while

continuing to optimize its traditional branch network. The

business has an expansive and growing branch footprint

covering nearly one-third of the U.S. population in 14 states

and Washington, D.C. with a network of 2,511 branches and

6,806 ATMs at December 31, 2011.

Successful execution of the Retail Banking strategy in 2011 is

reflected in the following:

• Net new checking relationships grew 296,000 in

2011, including 41,000 from the BankAtlantic and

Flagstar branch acquisitions. The growth reflects

strong results and gains in all of our markets. We are

seeing strong customer retention in the overall

network.

• Continued success in implementing Retail Banking’s

deposit strategy resulted in growth in average

transaction deposits and a reduction in higher rate

certificates of deposit. In 2011 average transaction

deposits grew $4.3 billion, or 6%, over 2010 and

average certificates of deposit declined $8.5 billion,

or 21% in accordance with our business plan.

• In December 2011, Retail Banking added

approximately $210 million in deposits, 9,000

checking relationships, 27 branches and 29 ATMs

through the branch acquisition from Flagstar Bank,

FSB, in the northern metropolitan Atlanta, Georgia

area.

• In June 2011, Retail Banking added approximately

$280 million in deposits, 32,000 checking

relationships, 19 branches and 27 ATMs through the

branch acquisition from BankAtlantic in the greater

Tampa, Florida area.

• The planned acquisition of RBC Bank (USA) is

expected to expand PNC’s footprint to 17 states and

Washington, D.C. and nearly 2,900 branches. The

transaction is currently expected to close in March

2012 subject to remaining customary closing

conditions. PNC and RBC Bank (USA) have both

received regulatory approvals in relation to the

respective applications filed with the regulators.

• Our investment in online banking capabilities

continues to pay off as active online banking

customers and active online bill payment customers

grew by 15% and 13%, respectively, in 2011.

• Retail Banking launched new checking account and

credit card products during the first quarter of 2011.

These new products are designed to provide more

choices for customers and grow value of clients for

PNC.

• Our award-winning Virtual Wallet®product is

providing strong momentum for customer growth.

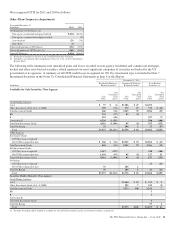

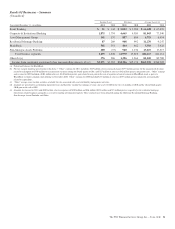

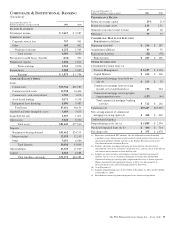

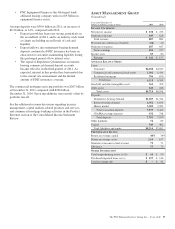

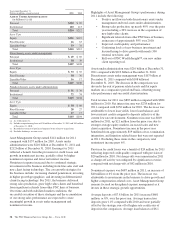

Total revenue for 2011 was $5.0 billion compared with $5.4

billion for 2010. Net interest income of $3.3 billion declined

$155 million compared with 2010. The decrease over the prior

period resulted from lower interest credits assigned to

deposits, reflective of the rate environment, and lower average

loan balances somewhat offset by higher demand deposit

balances and a decrease in higher rate certificates of deposit

balances.

Noninterest income for 2011 declined $189 million compared

to 2010. The decline was driven by lower overdraft fees

resulting from the impact of Regulation E rules and lower

interchange rates on debit card transactions, partially offset by

higher volumes of customer-initiated transactions including

debit and credit cards.

For 2011, Retail Banking revenue was negatively impacted by

approximately $275 million compared with 2010 due to the

impact of the rules set forth in Regulation E related to

overdraft fees and the Dodd-Frank limits related to

interchange rates on debit card transactions.

• Regulation E, which became effective in the third

quarter of 2010, had an incremental negative impact

to 2011 revenues of approximately $200 million

compared with 2010.

• The Dodd-Frank limits related to interchange fees

were effective October 1, 2011 and had a negative

impact on revenues of approximately $75 million in

the fourth quarter of 2011 and are expected to have

an additional incremental reduction in 2012 annual

revenue of approximately $175 million, based on

2011 transaction volumes.

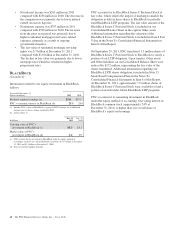

The provision for credit losses was $.9 billion in 2011

compared with $1.1 billion in 2010. Net charge-offs were $.9

billion for 2011 compared with $1.1 billion in the prior year.

Improvements in credit quality are evident in the small

business and credit card portfolios. We have continued to see

increases in home equity delinquencies and as a result, we

have worked with borrowers as employment and home values

have been slow to recover in this economy. The level of

provisioning will be dependent on general economic

conditions, loan growth, utilization of credit commitments and

asset quality.

Noninterest expense in 2011 increased $47 million from 2010.

The increase was primarily attributable to selective investment

in key areas of the business largely offset by lower FDIC

expenses.

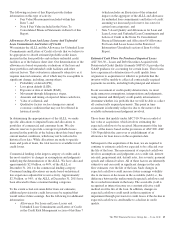

Growing core checking deposits is key to the Retail Banking

strategy, and is critical to growing our overall payments

business. The deposit product strategy of Retail Banking is to

remain disciplined on pricing, target specific products and

The PNC Financial Services Group, Inc. – Form 10-K 53