PNC Bank 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

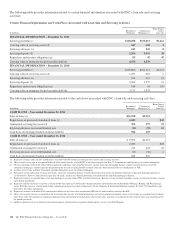

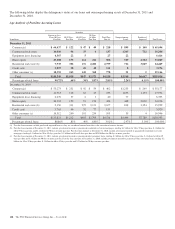

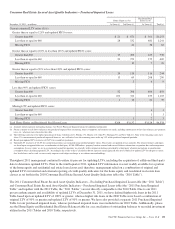

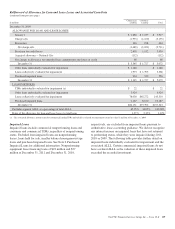

Nonperforming Assets

Dollars in millions

December 31,

2011

December 31,

2010

Nonperforming loans

Commercial $ 899 $1,253

Commercial real estate 1,345 1,835

Equipment lease financing 22 77

TOTAL COMMERCIAL LENDING 2,266 3,165

Consumer (a)

Home equity 529 448

Residential real estate (b) 726 818

Credit card (c) 8

Other consumer 31 35

TOTAL CONSUMER LENDING 1,294 1,301

Total nonperforming loans (d) 3,560 4,466

OREO and foreclosed assets

Other real estate owned (OREO) (e) 561 589

Foreclosed and other assets 35 68

TOTAL OREO AND FORECLOSED ASSETS 596 657

Total nonperforming assets $4,156 $5,123

Nonperforming loans to total loans 2.24% 2.97%

Nonperforming assets to total loans, OREO and foreclosed assets 2.60 3.39

Nonperforming assets to total assets 1.53 1.94

Interest on nonperforming loans

Computed on original terms $ 278 $ 329

Recognized prior to nonperforming status 47 53

(a) Excludes most consumer loans and lines of credit, not secured by residential real estate, which are charged off after 120 to 180 days past due and are not placed on nonperforming

status.

(b) Effective in 2011, nonperforming residential real estate excludes loans of $61 million accounted for under the fair value option as of December 31, 2011. The comparable balance at

December 31, 2010 was not material.

(c) Effective in the second quarter 2011, the commercial nonaccrual policy was applied to certain small business credit card balances. This change resulted in loans being placed on

nonaccrual status when they become 90 days or more past due. We continue to charge off these loans at 180 days past due.

(d) Nonperforming loans do not include government insured or guaranteed loans, loans held for sale, loans accounted for under the fair value option and purchased impaired loans.

(e) Other real estate owned excludes $280 million and $178 million at December 31, 2011, and December 31, 2010, respectively, related to residential real estate that was acquired by us

upon foreclosure of serviced loans because they are insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA).

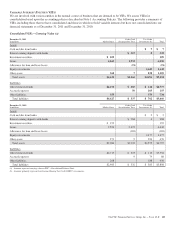

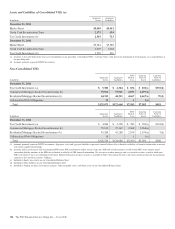

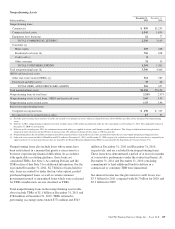

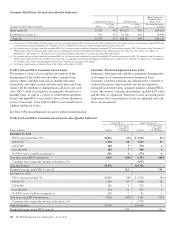

Nonperforming loans also include loans whose terms have

been restructured in a manner that grants a concession to a

borrower experiencing financial difficulties. In accordance

with applicable accounting guidance, these loans are

considered TDRs. See Note 1 Accounting Policies and the

TDR section of this Note 5 for additional information. For the

year ended December 31, 2011, $2.7 billion of loans held for

sale, loans accounted for under the fair value option, pooled

purchased impaired loans, as well as certain consumer

government insured or guaranteed loans which were evaluated

for TDR consideration, are not classified as TDRs.

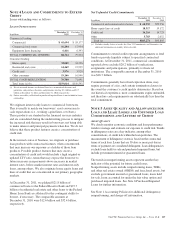

Total nonperforming loans in the nonperforming assets table

above include TDRs of $1.1 billion at December 31, 2011 and

$784 million at December 31, 2010. TDRs returned to

performing (accruing) status totaled $771 million and $543

million at December 31, 2011 and December 31, 2010,

respectively, and are excluded from nonperforming loans.

These loans have demonstrated a period of at least six months

of consecutive performance under the restructured terms. At

December 31, 2011 and December 31, 2010, remaining

commitments to lend additional funds to debtors in a

commercial or consumer TDR were immaterial.

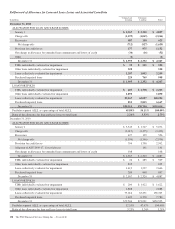

Net interest income less the provision for credit losses was

$7.5 billion for 2011 compared with $6.7 billion for 2010 and

$5.2 billion for 2009.

The PNC Financial Services Group, Inc. – Form 10-K 129