PNC Bank 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

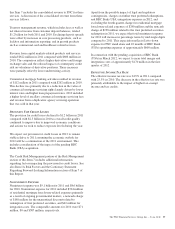

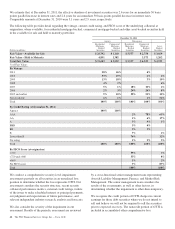

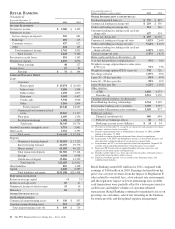

We estimate that, at December 31, 2011, the effective duration of investment securities was 2.6 years for an immediate 50 basis

points parallel increase in interest rates and 2.4 years for an immediate 50 basis points parallel decrease in interest rates.

Comparable amounts at December 31, 2010 were 3.1 years and 2.9 years, respectively.

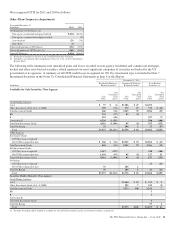

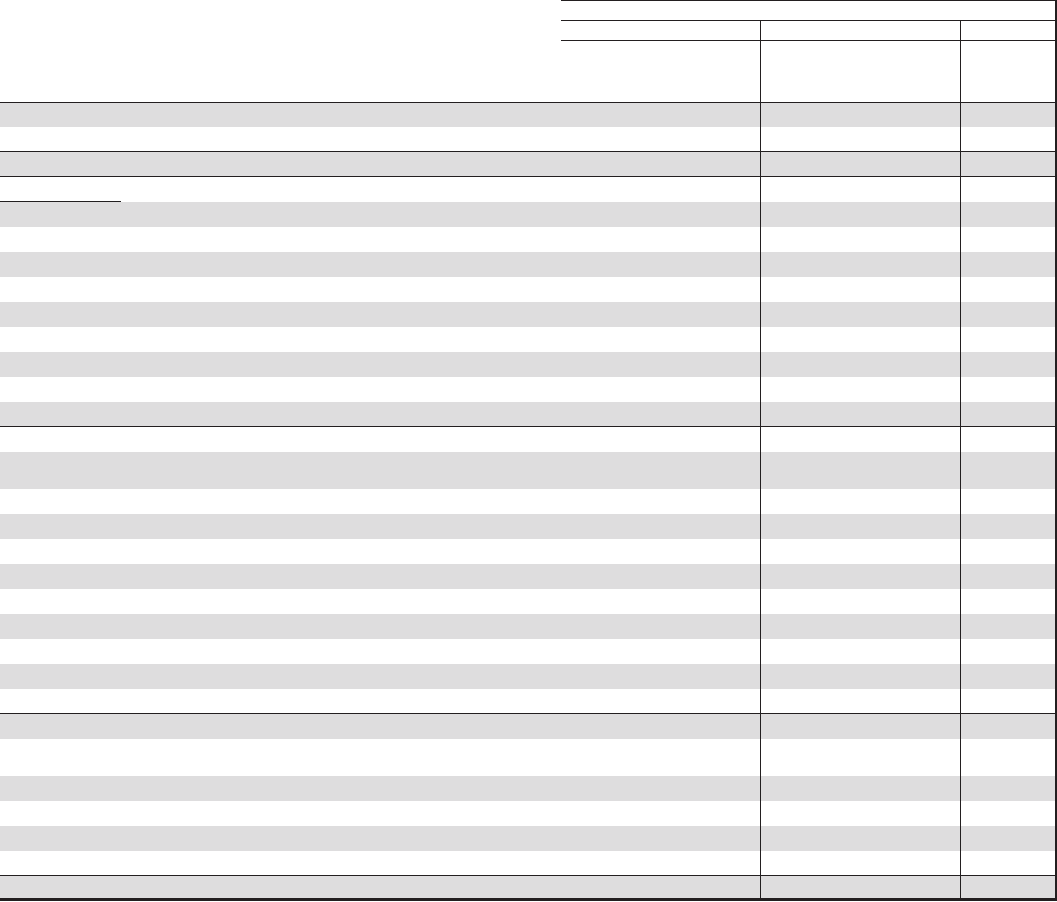

The following table provides detail regarding the vintage, current credit rating, and FICO score of the underlying collateral at

origination, where available, for residential mortgage-backed, commercial mortgage-backed and other asset-backed securities held

in the available for sale and held to maturity portfolios:

December 31, 2011

Agency Non-agency

Dollars in millions

Residential

Mortgage-

Backed

Securities

Commercial

Mortgage-

Backed

Securities

Residential

Mortgage-

Backed

Securities

Commercial

Mortgage-

Backed

Securities

Asset-

Backed

Securities

Fair Value – Available for Sale $ 26,792 $ 1,140 $ 5,557 $ 2,756 $ 3,669

Fair Value – Held to Maturity 4,891 1,382 3,573 1,262

Total Fair Value $ 31,683 $ 2,522 $ 5,557 $ 6,329 $ 4,931

% of Fair Value:

By Vintage

2011 28% 46% 4%

2010 33% 19% 4% 6%

2009 13% 18% 3% 10%

2008 4% 2% 4%

2007 5% 1% 18% 10% 6%

2006 2% 3% 24% 26% 8%

2005 and earlier 9% 10% 58% 52% 10%

Not Available 6% 1% 1% 56%

Total 100% 100% 100% 100% 100%

By Credit Rating (at December 31, 2011)

Agency 100% 100%

AAA 2% 78% 65%

AA 1% 6% 17%

A3% 9% 1%

BBB 5% 4%

BB 5% 1%

B7% 2%

Lower than B 76% 12%

No rating 1% 2% 3%

Total 100% 100% 100% 100% 100%

By FICO Score (at origination)

>720 55% 3%

<720 and >660 35% 8%

<660 1% 2%

No FICO score 9% 87%

Total 100% 100%

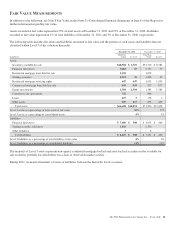

We conduct a comprehensive security-level impairment

assessment quarterly on all securities in an unrealized loss

position to determine whether the loss represents OTTI. Our

assessment considers the security structure, recent security

collateral performance metrics, external credit ratings, failure

of the issuer to make scheduled interest or principal payments,

our judgment and expectations of future performance, and

relevant independent industry research, analysis and forecasts.

We also consider the severity of the impairment in our

assessment. Results of the periodic assessment are reviewed

by a cross-functional senior management team representing

Asset & Liability Management, Finance, and Market Risk

Management. The senior management team considers the

results of the assessments, as well as other factors, in

determining whether the impairment is other-than-temporary.

We recognize the credit portion of OTTI charges in current

earnings for those debt securities where we do not intend to

sell and believe we will not be required to sell the securities

prior to expected recovery. The noncredit portion of OTTI is

included in accumulated other comprehensive loss.

42 The PNC Financial Services Group, Inc. – Form 10-K