PNC Bank 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

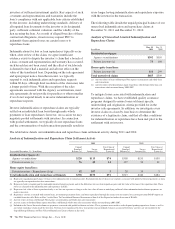

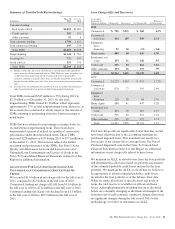

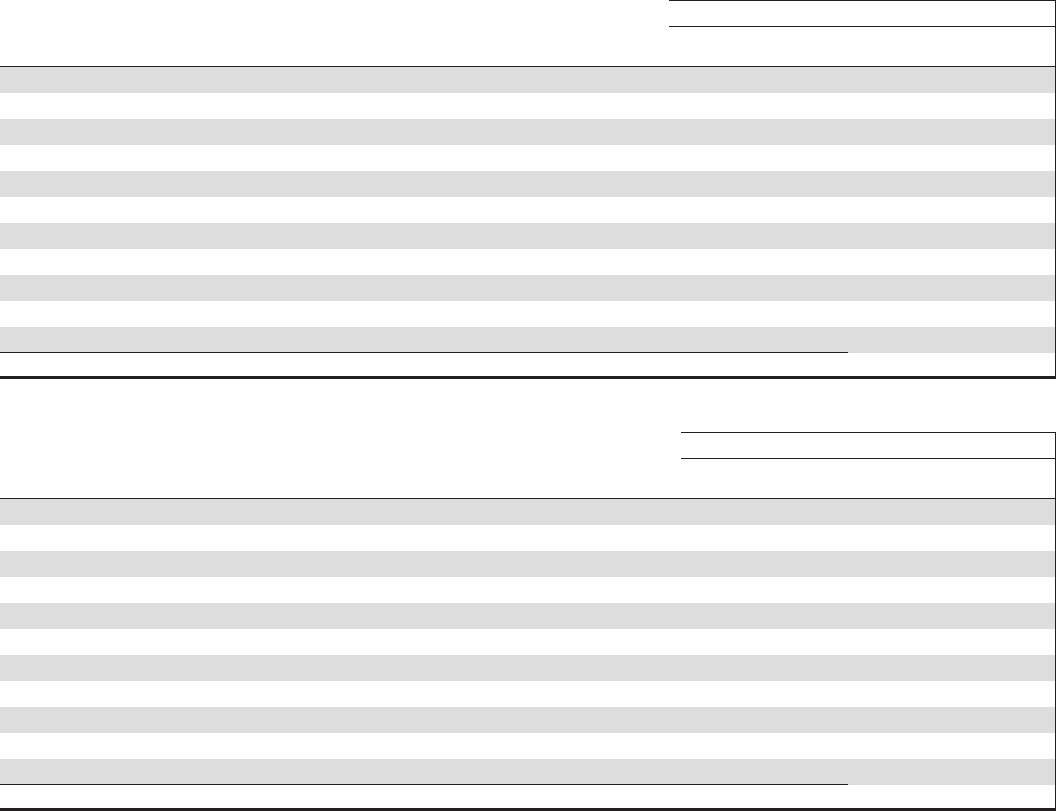

Loan Delinquencies

We regularly monitor the level of loan delinquencies and

believe these levels may be a key indicator of loan portfolio

asset quality. Measurement of delinquency status is based on

the contractual terms of each loan. Loans that are 30 days or

more past due in terms of payment are considered delinquent.

Loan delinquencies exclude loans held for sale and purchased

impaired loans, but include government insured or guaranteed

loans.

Total early stage loan delinquencies (accruing loans past due

30 to 89 days) decreased by $252 million from December 31,

2010, to $1.6 billion at December 31, 2011. Commercial

lending early stage delinquencies declined by $245 million

from December 31, 2010, while consumer lending

delinquencies fell by $7 million. Improvement in early stage

delinquency levels was experienced across most loan classes,

offset by modest increases in government insured, primarily

other consumer education loans, and home equity.

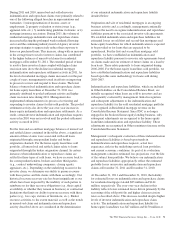

Accruing loans past due 90 days or more are referred to as late

stage delinquencies. These loans are not included in

nonperforming loans and continue to accrue interest because

they are well secured by collateral, are in the process of

collection and are reasonably expected to result in repayment

or restoration to current status, or are managed in homogenous

portfolios with specified charge-off timeframes adhering to

regulatory guidelines. These loans increased 10% from $2.7

billion at December 31, 2010, to $3.0 billion at December 31,

2011, reflecting higher government insured delinquent

residential real estate and other consumer loans, primarily

education loans, and higher delinquent home equity loans,

partially offset by improvement in commercial lending

delinquency levels, primarily commercial real estate. The

following tables display the delinquency status of our accruing

loans past due at December 31, 2011 and December 31, 2010.

Additional information regarding accruing loans past due is

included in Note 5 Asset Quality and Allowances for Loan

and Lease Losses and Unfunded Loan Commitments and

Letters of Credit in the Notes To Consolidated Financial

Statements in Item 8 of this Report.

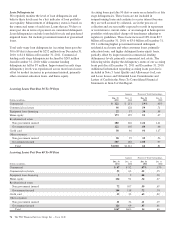

Accruing Loans Past Due 30 To 59 Days

Amount Percent of Total Outstandings

Dollars in millions

Dec. 31

2011

Dec. 31

2010

Dec. 31

2011

Dec. 31

2010

Commercial $ 122 $ 251 .19% .45%

Commercial real estate 96 128 .59 .71

Equipment lease financing 22 37 .34 .58

Home equity 173 159 .52 .47

Residential real estate

Non government insured 180 226 1.24 1.41

Government insured 122 105 .84 .66

Credit card 38 46 .96 1.17

Other consumer

Non government insured 58 95 .30 .56

Government insured 207 165 1.08 .97

Total $1,018 $1,212 .64 .81

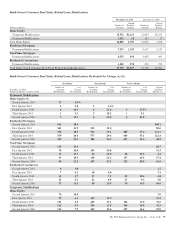

Accruing Loans Past Due 60 To 89 Days

Amount Percent of Total Outstandings

Dollars in millions

Dec. 31

2011

Dec. 31

2010

Dec. 31

2011

Dec. 31

2010

Commercial $47 $92 .07% .17%

Commercial real estate 35 62 .22 .35

Equipment lease financing 52.08 .03

Home equity 114 91 .34 .27

Residential real estate

Non government insured 72 107 .50 .67

Government insured 104 118 .72 .74

Credit card 25 32 .63 .82

Other consumer

Non government insured 21 32 .11 .19

Government insured 124 69 .65 .41

Total $547 $605 .34 .40

76 The PNC Financial Services Group, Inc. – Form 10-K