PNC Bank 2011 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

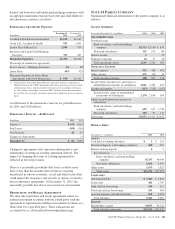

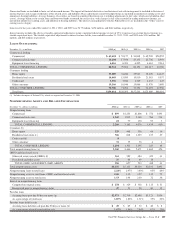

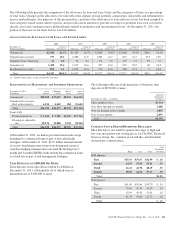

(a) Includes the impact of National City, which we acquired on December 31, 2008.

(b) Excludes most consumer loans and lines of credit, not secured by residential real estate, which are charged off after 120 to 180 days past due and are not placed on nonperforming

status.

(c) Effective in 2011, nonperforming residential real estate excludes loans of $61 million accounted for under the fair value option as of December 31, 2011. The comparable balances for

prior periods presented were not material.

(d) Effective in the second quarter 2011, the commercial nonaccrual policy was applied to certain small business credit card balances. This change resulted in loans being placed on

nonaccrual status when they become 90 days or more past due. We continue to charge off these loans at 180 days past due.

(e) Includes TDRs of $1,141 million at December 31, 2011, $784 million at December 31, 2010, $440 million at December 31, 2009 and $2 million at December 31, 2007.

Nonperforming loans do not include government insured or guaranteed loans, loans held for sale, loans accounted for under the fair value option and purchased impaired loans.

(f) Other real estate owned excludes $280 million, $178 million, $112 million, $81 million and zero at December 31, 2011, December 31, 2010, December 31, 2009, December 31, 2008

and December 31, 2007, respectively, related to residential real estate that was acquired by us upon foreclosure of serviced loans because they are insured by the Federal Housing

Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA).

(g) Amounts include government insured or guaranteed consumer loans totaling $2,474 million, $2,167 million, $1,814 million, $926 million and $8 million at December 31,

2011, December 31, 2010, December 31, 2009, December 31, 2008 and December 31, 2007, respectively. Past due loan amounts exclude purchased impaired loans as they are

considered current loans due to the accretion of interest income.

(h) Amounts include government insured or guaranteed consumer loans held for sale totaling $15 million, $22 million, and $27 million at December 31, 2011, December 31, 2010, and

December 31, 2009, respectively. Government insured or guaranteed consumer loans held for sale were zero for the other periods presented.

S

UMMARY OF

L

OAN

L

OSS

E

XPERIENCE

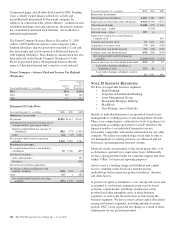

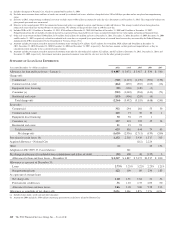

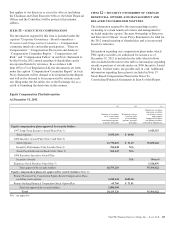

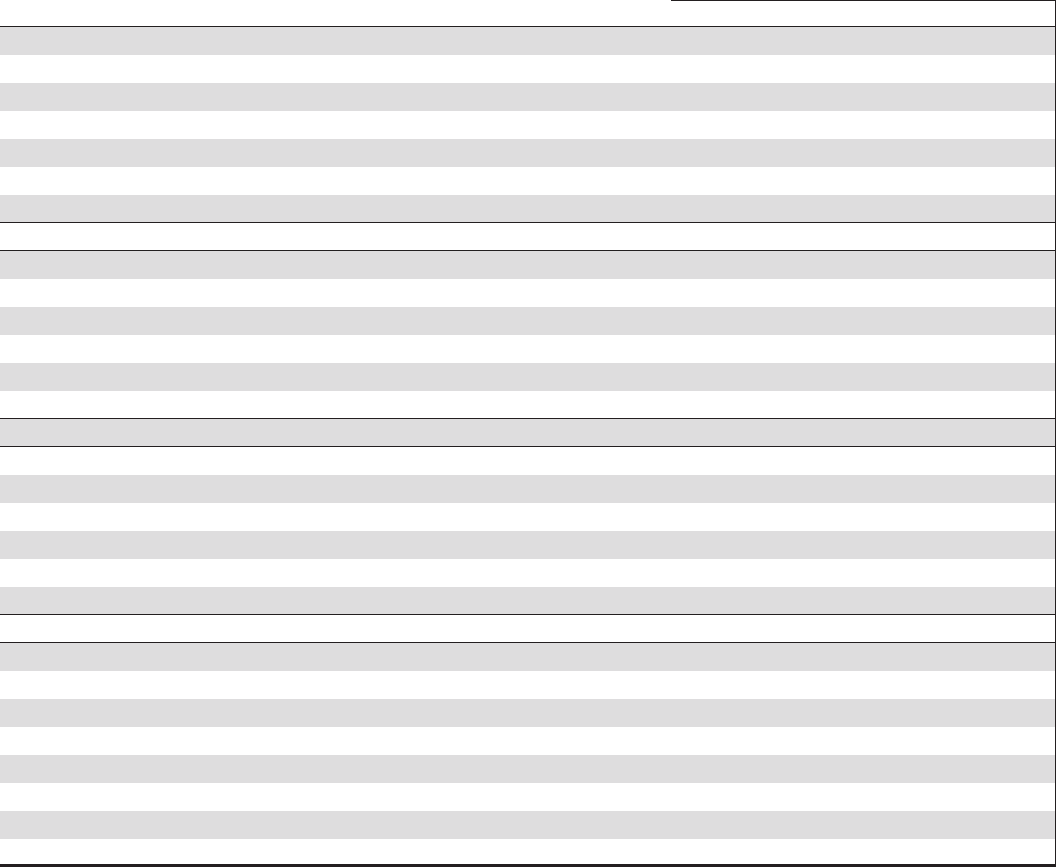

Year ended December 31 - dollars in millions 2011 2010 2009 2008 2007

Allowance for loan and lease losses – January 1 $ 4,887 $ 5,072 $ 3,917 $ 830 $ 560

Charge-offs

Commercial (700) (1,227) (1,276) (301) (156)

Commercial real estate (464) (670) (510) (165) (16)

Equipment lease financing (35) (120) (149) (3)

Consumer (a) (912) (1,069) (961) (143) (73)

Residential real estate (153) (406) (259) (6)

Total charge-offs (2,264) (3,492) (3,155) (618) (245)

Recoveries

Commercial 332 294 181 53 30

Commercial real estate 105 77 38 10 1

Equipment lease financing 50 56 27 1

Consumer (a) 127 110 105 15 14

Residential real estate 11 19 93

Total recoveries 625 556 444 79 45

Net charge-offs (1,639) (2,936) (2,711) (539) (200)

Provision for credit losses (b) 1,152 2,502 3,930 1,517 315

Acquired allowance – National City (112) 2,224

Other (1) 20 152

Adoption of ASU 2009-17, Consolidations 141

Net change in allowance for unfunded loan commitments and letters of credit (52) 108 48 (135) 3

Allowance for loan and lease losses – December 31 $ 4,347 $ 4,887 $ 5,072 $3,917 $ 830

Allowance as a percent of December 31:

Loans 2.73% 3.25% 3.22% 2.23% 1.21%

Nonperforming loans 122 109 89 236 183

As a percent of average loans

Net charge-offs 1.08 1.91 1.64 .74 .32

Provision for credit losses .76 1.63 2.37 2.09 .50

Allowance for loan and lease losses 2.86 3.18 3.06 5.38 1.33

Allowance as a multiple of net charge-offs 2.65x 1.66x 1.87x 7.27x 4.15x

(a) Includes home equity, credit card and other consumer.

(b) Amount for 2008 included a $504 million conforming provision for credit losses related to National City.

210 The PNC Financial Services Group, Inc. – Form 10-K