PNC Bank 2011 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238

|

|

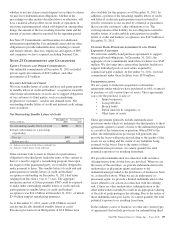

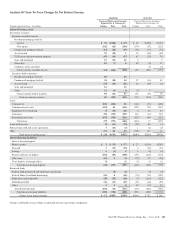

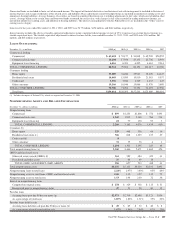

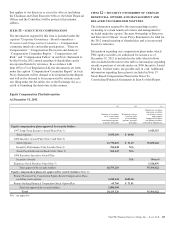

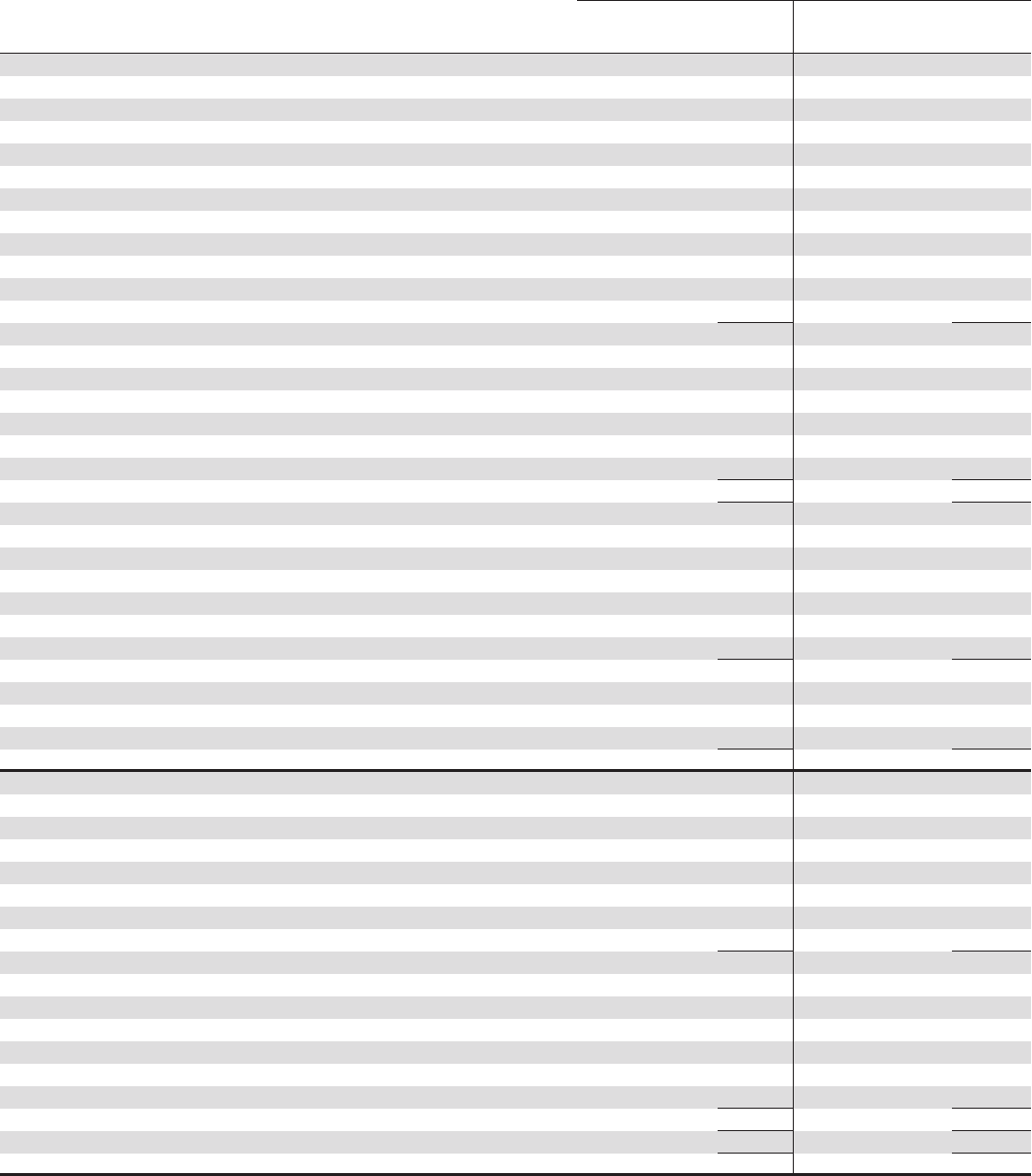

Analysis Of Year-To-Year Changes In Net Interest Income

2011/2010 2010/2009

Increase/(Decrease) in Income/

Expense Due to Changes in:

Increase/(Decrease) in Income/

Expense Due to Changes in:

Taxable-equivalent basis - in millions Volume Rate Total Volume Rate Total

Interest-Earning Assets

Investment securities

Securities available for sale

Residential mortgage-backed

Agency $ 91 $(108) $ (17) $ 69 $(196) $(127)

Non-agency (102) (62) (164) (170) (52) (222)

Commercial mortgage-backed (11) (22) (33) (56) (17) (73)

Asset-backed 35 (34) 1 18 (80) (62)

US Treasury and government agencies (87) (10) (97) 87 (13) 74

State and municipal 27 (15) 12 55

Other debt 15 (7) 8 42 (9) 33

Corporate stocks and other (3) (3)

Total securities available for sale (24) (266) (290) 132 (507) (375)

Securities held to maturity

Residential mortgage-backed 83 83

Commercial mortgage-backed 38 (24) 14 97 (14) 83

Asset-backed (33) (13) (46) 45 (49) (4)

State and municipal 12 12

Other 12 (8) 4 (2) 2

Total securities held to maturity 90 (23) 67 135 (56) 79

Total investment securities 69 (292) (223) 274 (570) (296)

Loans

Commercial 258 (222) 36 (363) (37) (400)

Commercial real estate (192) 26 (166) (222) (25) (247)

Equipment lease financing (3) (13) (16) 42327

Consumer (18) (174) (192) 136 (16) 120

Residential real estate (176) (150) (326) (227) 100 (127)

Total loans (93) (571) (664) (644) 17 (627)

Loans held for sale (9) (61) (70) (87) 80 (7)

Federal funds sold and resale agreements 7 (11) (4) 1 (6) (5)

Other (15) 44 29 (100) 111 11

Total interest-earning assets $ (20) $(912) $(932) $(690) $(234) $(924)

Interest-Bearing Liabilities

Interest-bearing deposits

Money market $ 2 $ (79) $ (77) $ 27 $(314) $(287)

Demand 3 (13) (10) 4 (38) (34)

Savings 3 (1) 2 1 (2) (1)

Retail certificates of deposit (120) (80) (200) (197) (218) (415)

Other time (12) 3 (9) (75) 37 (38)

Time deposits in foreign offices (1) (1) (2) (1) (3)

Total interest-bearing deposits (38) (257) (295) (128) (650) (778)

Borrowed funds

Federal funds purchased and repurchase agreements (6) (6) (3) (3)

Federal Home Loan Bank borrowings (26) 8 (18) (70) (59) (129)

Bank notes and senior debt (38) (30) (68) (7) (116) (123)

Subordinated debt (36) (13) (49) (31) (64) (95)

Other 35 8 32 (17) 15

Total borrowed funds (102) (31) (133) (110) (225) (335)

Total interest-bearing liabilities (100) (328) (428) (231) (882) (1,113)

Change in net interest income $ (17) $(487) $(504) $(543) $ 732 $ 189

Changes attributable to rate/volume are prorated into rate and volume components.

The PNC Financial Services Group, Inc. – Form 10-K 207