PNC Bank 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

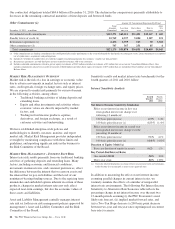

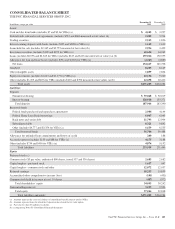

(a) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of notional amount, 57% were based on 1-month LIBOR and 43% on 3-month

LIBOR at December 31, 2011 compared with 58% and 42%, respectively, at December 31, 2010.

(b) Fair value amount includes net accrued interest receivable of $140 million at December 31, 2011 and $132 million at December 31, 2010.

(c) Includes zero-coupon swaps.

(d) The increases in the negative fair values from December 31, 2010 to December 31, 2011 for interest rate contracts, foreign exchange, equity contracts and other contracts were due to

the changes in fair values of the existing contracts along with new contracts entered into during 2011 and contracts terminated during that period.

(e) Includes PNC’s obligation to fund a portion of certain BlackRock LTIP programs and other contracts.

2010 V

ERSUS

2009

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Summary Results

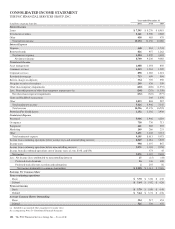

Net income for 2010 was $3.4 billion, or $5.74 per diluted

common share and for 2009 was $2.4 billion or $4.36 per

diluted common share. For 2010, net income attributable to

common shareholders and diluted earnings per common share

were impacted by a noncash reduction of $250 million related

to our redemption of TARP preferred stock.

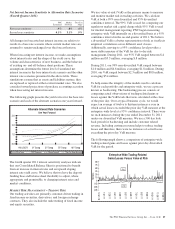

Net Interest Income

Net interest income was $9.2 billion for 2010 up 2% from

2009, while the net interest margin rose to 4.14% in 2010

compared with 3.82% for 2009.

Noninterest Income

Summary

Noninterest income was $5.9 billion for 2010 and $7.1 billion

for 2009. The primary driver of this change was a reduction of

$916 million for BlackRock related transactions. During

fourth quarter 2010, we realized a pretax gain of $160 million

on 7.5 million BlackRock common shares sold by PNC as a

part of a BlackRock secondary common stock offering.

During fourth quarter 2009, we recognized a $1.1 billion

pretax gain related to BlackRock’s acquisition of Barclays

Global Investors (BGI).

Asset management revenue was $1.1 billion in 2010 compared

with $858 million in 2009. This increase reflected higher

equity earnings from our BlackRock investment, improved

equity markets and client growth. Discretionary assets under

management at December 31, 2010 totaled $108 billion

compared with $103 billion at December 31, 2009.

Consumer services fees totaled $1.3 billion in both 2010 and

2009. Consumer service fees for 2010 reflected higher

volume-related transaction fees offset by lower brokerage fees

and the impact of the January 1, 2010 consolidation of the

securitized credit card portfolio.

Corporate services revenue totaled $1.1 billion in 2010 and

$1.0 billion in 2009. The increase was largely the result of

higher merger and acquisition advisory and ancillary

commercial mortgage servicing fees partially offset by a

reduction in the value of commercial mortgage servicing

rights largely driven by lower interest rates. Corporate

services fees include the noninterest component of treasury

management fees, which continued to be a strong contributor

to revenue.

Residential mortgage revenue totaled $699 million in 2010

compared with $990 million in 2009. The decline in 2010

reflected reduced loan sales revenue following the strong loan

origination refinance volume in 2009 and lower net hedging

gains on mortgage servicing rights.

There were lower service charges on deposits of $245 million

in 2010 compared with 2009, partially resulting from the

negative impact of the new Regulation E rules.

Net securities gains increased by $128 million in 2010

compared with 2009 due to lower net credit related OTTI

partially offset by lower gains on sales of securities.

Gains on BlackRock related transactions included a fourth

quarter 2010 pretax gain of $160 million from our sale of

7.5 million BlackRock common shares as part of a BlackRock

secondary common stock offering. During the fourth quarter

of 2009, we recognized a $1.1 billion pretax gain on PNC’s

portion of the increase in BlackRock’s equity resulting from

the value of BlackRock shares issued by BlackRock in

connection with its acquisition of BGI.

Other noninterest income totaled $884 million for 2010

compared with $987 million for 2009. Other noninterest

income for 2009 included gains of $103 million primarily

related to our BlackRock LTIP shares obligation. Other

noninterest income for 2010 included net gains on alternative

investments, including private equity, of $258 million,

compared with net losses on alternative investments, including

private equity, of $93 million in 2009. Gains on sales of loans

were $73 million in 2010 and $220 million in 2009.

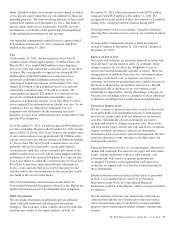

Provision For Credit Losses

The provision for credit losses totaled $2.5 billion for 2010

compared with $3.9 billion for 2009. The lower provision in

2010 reflected credit exposure reductions and overall

improved credit migration during 2010.

Noninterest Expense

Noninterest expense for 2010 declined 5%, to $8.6 billion,

compared with $9.1 billion for 2009. The impact of higher

cost savings related to the National City acquisition

integration and the reversal of certain accrued liabilities in

2010, including $73 million associated with a franchise tax

settlement and $123 million associated with an

indemnification liability for certain Visa litigation, were

reflected in the lower 2010 expenses. Lower expenses in the

comparison also reflected a special FDIC assessment,

intended to build the FDIC’s Deposit Insurance Fund, of $133

million in 2009. We also continued to invest in customer

growth and innovation initiatives.

The PNC Financial Services Group, Inc. – Form 10-K 93