PNC Bank 2011 Annual Report Download - page 185

Download and view the complete annual report

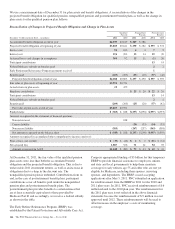

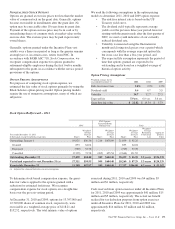

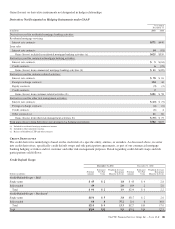

Please find page 185 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Derivatives represent contracts between parties that usually

require little or no initial net investment and result in one party

delivering cash or another type of asset to the other party

based on a notional amount and an underlying as specified in

the contract. Derivative transactions are often measured in

terms of notional amount, but this amount is generally not

exchanged and it is not recorded on the balance sheet. The

notional amount is the basis to which the underlying is applied

to determine required payments under the derivative contract.

The underlying is a referenced interest rate (commonly

LIBOR), security price, credit spread or other index.

Residential and commercial real estate loan commitments

associated with loans to be sold also qualify as derivative

instruments.

All derivatives are carried on our Consolidated Balance Sheet

at fair value. Derivative balances are presented on a net basis

taking into consideration the effects of legally enforceable

master netting agreements. Cash collateral exchanged with

counterparties is also netted against the applicable derivative

fair values.

Further discussion on how derivatives are accounted for is

included in Note 1 Accounting Policies.

D

ERIVATIVES

D

ESIGNATED IN

H

EDGE

R

ELATIONSHIPS

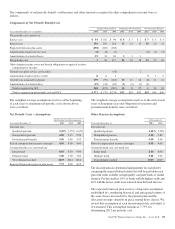

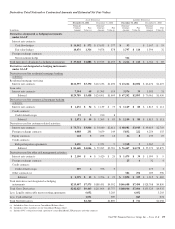

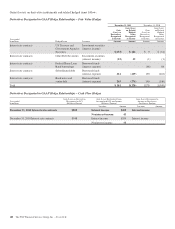

Certain derivatives used to manage interest rate risk as part of

our asset and liability risk management activities are

designated as accounting hedges under GAAP. Derivatives

hedging the risks associated with changes in the fair value of

assets or liabilities are considered fair value hedges,

derivatives hedging the variability of expected future cash

flows are considered cash flow hedges, and derivatives

hedging a net investment in a foreign subsidiary are

considered net investment hedges. Designating derivatives as

accounting hedges allows for gains and losses on those

derivatives, to the extent effective, to be recognized in the

income statement in the same period the hedged items affect

earnings.

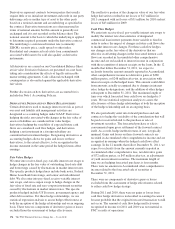

Fair Value Hedges

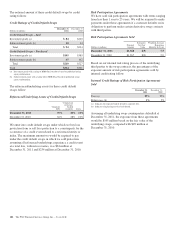

We enter into receive-fixed, pay-variable interest rate swaps to

hedge changes in the fair value of outstanding fixed-rate debt

and borrowings caused by fluctuations in market interest rates.

The specific products hedged may include bank notes, Federal

Home Loan Bank borrowings, and senior and subordinated

debt. We also enter into pay-fixed, receive-variable interest

rate swaps, and zero-coupon swaps to hedge changes in the

fair value of fixed rate and zero-coupon investment securities

caused by fluctuations in market interest rates. The specific

products hedged include US Treasury, government agency and

other debt securities. For these hedge relationships, we use

statistical regression analysis to assess hedge effectiveness at

both the inception of the hedge relationship and on an ongoing

basis. There were no components of derivative gains or losses

excluded from the assessment of hedge effectiveness.

The ineffective portion of the change in value of our fair value

hedge derivatives resulted in net losses of $17 million for

2011 compared with net losses of $31 million for 2010 and net

losses of $43 million for 2009.

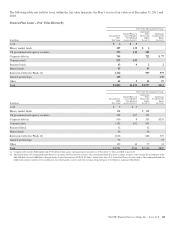

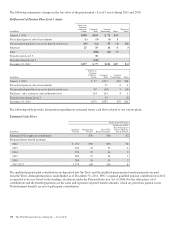

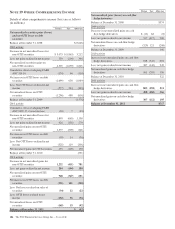

Cash Flow Hedges

We enter into receive-fixed, pay-variable interest rate swaps to

modify the interest rate characteristics of designated

commercial loan interest payments from variable to fixed in

order to reduce the impact of changes in future cash flows due

to market interest rate changes. For these cash flow hedges,

any changes in the fair value of the derivatives that are

effective in offsetting changes in the forecasted interest cash

flows are recorded in Accumulated other comprehensive

income and are reclassified to interest income in conjunction

with the recognition of interest receipts on the loans. In the 12

months that follow December 31, 2011, we expect to

reclassify from the amount currently reported in Accumulated

other comprehensive income net derivative gains of $382

million pretax, or $248 million after-tax, in association with

interest receipts on the hedged loans. This amount could differ

from amounts actually recognized due to changes in interest

rates, hedge de-designations, and the addition of other hedges

subsequent to December 31, 2011. The maximum length of

time over which forecasted loan cash flows are hedged is 9

years. We use statistical regression analysis to assess the

effectiveness of these hedge relationships at both the inception

of the hedge relationship and on an ongoing basis.

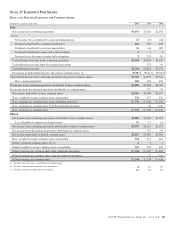

We also periodically enter into forward purchase and sale

contracts to hedge the variability of the consideration that will

be paid or received related to the purchase or sale of

investment securities. The forecasted purchase or sale is

consummated upon gross settlement of the forward contract

itself. As a result, hedge ineffectiveness, if any, is typically

minimal. Gains and losses on these forward contracts are

recorded in Accumulated other comprehensive income and are

recognized in earnings when the hedged cash flows affect

earnings. In the 12 months that follow December 31, 2011, we

expect to reclassify from the amount currently reported in

Accumulated other comprehensive loss, net derivative gains

of $72 million pretax, or $47 million after-tax, as adjustments

of yield on investment securities. The maximum length of

time we are hedging forecasted purchases is four months.

There were no amounts in Accumulated other comprehensive

income related to the forecasted sale of securities at

December 31, 2011.

There were no components of derivative gains or losses

excluded from the assessment of hedge effectiveness related

to either cash flow hedge strategy.

During 2011 and 2010, there were no gains or losses from

cash flow hedge derivatives reclassified to earnings because it

became probable that the original forecasted transaction would

not occur. The amount of cash flow hedge ineffectiveness

recognized in income for 2011 and 2010 was not material to

PNC’s results of operations.

176 The PNC Financial Services Group, Inc. – Form 10-K