PNC Bank 2011 Annual Report Download - page 212

Download and view the complete annual report

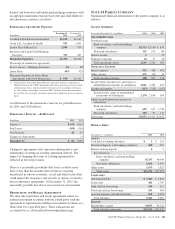

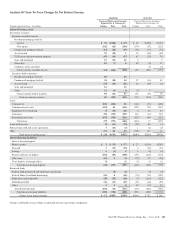

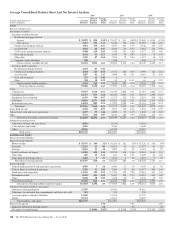

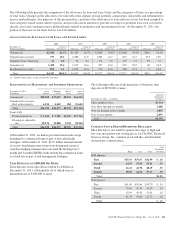

Please find page 212 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have allocated the allowances for loan and lease losses

and for unfunded loan commitments and letters of credit based

on our assessment of risk in each business segment’s loan

portfolio. Our allocation of the costs incurred by operations

and other shared support areas not directly aligned with the

businesses is primarily based on the use of services.

Total business segment financial results differ from

consolidated income from continuing operations before

noncontrolling interests, which itself excludes the earnings

and revenue attributable to GIS through June 30, 2010 and the

related third quarter 2010 after-tax gain on the sale of GIS that

are reflected in discontinued operations. The impact of these

differences is reflected in the “Other” category in the business

segment tables. “Other” includes residual activities that do not

meet the criteria for disclosure as a separate reportable

business, such as gains or losses related to BlackRock

transactions, integration costs, asset and liability management

activities including net securities gains or losses, other-than-

temporary impairment of investment securities and certain

trading activities, exited businesses, alternative investments,

including private equity, intercompany eliminations, most

corporate overhead, tax adjustments that are not allocated to

business segments, and differences between business segment

performance reporting and financial statement reporting

(GAAP), including the presentation of net income attributable

to noncontrolling interests as the segments’ results exclude

their portion of net income attributable to noncontrolling

interests. Assets, revenue and earnings attributable to foreign

activities were not material in the periods presented for

comparative purposes.

B

USINESS

S

EGMENT

P

RODUCTS

A

ND

S

ERVICES

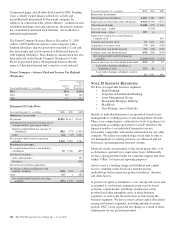

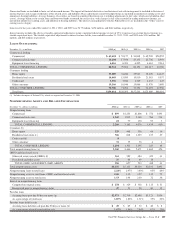

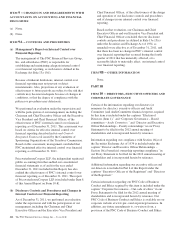

Retail Banking provides deposit, lending, brokerage,

investment management, and cash management services to

consumer and small business customers within our primary

geographic markets. Our customers are serviced through our

branch network, call centers and online banking channels. The

branch network is located primarily in Pennsylvania, Ohio,

New Jersey, Michigan, Illinois, Maryland, Indiana, Kentucky,

Florida, Washington, D.C., Delaware, Virginia, Missouri,

Wisconsin and Georgia.

Corporate & Institutional Banking provides lending, treasury

management, and capital markets-related products and

services to mid-sized corporations, government and

not-for-profit entities, and selectively to large corporations.

Lending products include secured and unsecured loans, letters

of credit and equipment leases. Treasury management services

include cash and investment management, receivables

management, disbursement services, funds transfer services,

information reporting, and global trade services. Capital

markets-related products and services include foreign

exchange, derivatives, loan syndications, mergers and

acquisitions advisory and related services to middle-market

companies, our multi-seller conduit, securities underwriting,

and securities sales and trading. Corporate & Institutional

Banking also provides commercial loan servicing, and real

estate advisory and technology solutions for the commercial

real estate finance industry. Corporate & Institutional Banking

provides products and services generally within our primary

geographic markets, with certain products and services offered

nationally and internationally.

Asset Management Group includes personal wealth

management for high net worth and ultra high net worth

clients and institutional asset management. Wealth

management products and services include financial and

retirement planning, customized investment management,

private banking, tailored credit solutions and trust

management and administration for individuals and their

families. Institutional asset management provides investment

management, custody, and retirement planning services. The

institutional clients include corporations, unions,

municipalities, non-profits, foundations and endowments

located primarily in our geographic footprint.

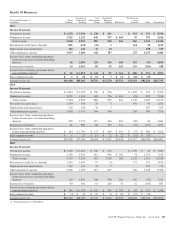

Residential Mortgage Banking directly originates primarily

first lien residential mortgage loans on a nationwide basis with

a significant presence within the retail banking footprint, and

also originates loans through majority owned affiliates.

Mortgage loans represent loans collateralized by one-to-four-

family residential real estate. These loans are typically

underwritten to government agency and/or third-party

standards, and sold, servicing retained, to secondary mortgage

conduits FNMA, FHLMC, Federal Home Loan Banks and

third-party investors, or are securitized and issued under the

GNMA program. The mortgage servicing operation performs

all functions related to servicing mortgage loans – primarily

those in first lien position – for various investors and for loans

owned by PNC. Certain loans originated through majority

owned affiliates are sold to others.

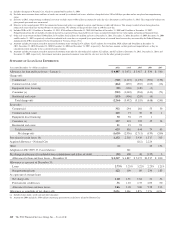

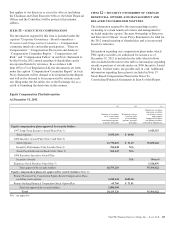

BlackRock is a leader in investment management, risk

management and advisory services for institutional and retail

clients worldwide. BlackRock provides diversified investment

management services to institutional clients, intermediary and

individual investors through various investment vehicles.

Investment management services primarily consist of the

management of equity, fixed income, multi-asset class,

alternative investment and cash management products.

BlackRock offers its investment products in a variety of

vehicles, including open-end and closed-end mutual funds,

iShares®exchange-traded funds (“ETFs”), collective

investment trusts and separate accounts. In addition,

BlackRock provides market risk management, financial

markets advisory and enterprise investment system services to

a broad base of clients. Financial markets advisory services

include valuation services relating to illiquid securities,

dispositions and workout assignments (including long-term

portfolio liquidation assignments), risk management and

strategic planning and execution. At December 31, 2011, our

economic interest in BlackRock was 21%.

The PNC Financial Services Group, Inc. – Form 10-K 203