PNC Bank 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

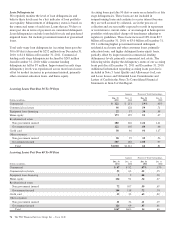

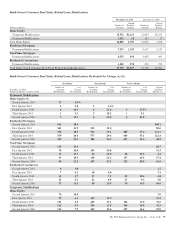

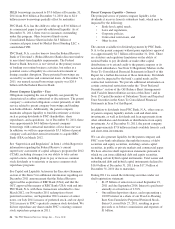

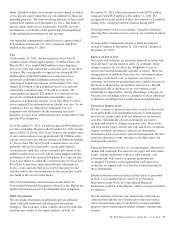

Summary of Troubled Debt Restructurings

In millions

Dec. 31

2011

Dec. 31

2010

Consumer lending:

Real estate-related $1,492 $1,087

Credit card (a) 291 331

Other consumer 15 4

Total consumer lending 1,798 1,422

Total commercial lending 405 236

Total TDRs $2,203 $1,658

Nonperforming $1,141 $ 784

Accruing (b) 771 543

Credit card (a) 291 331

Total TDRs $2,203 $1,658

(a) Includes credit cards and certain small business and consumer credit agreements

whose terms have been restructured and are TDRs. However, since our policy is to

exempt these loans from being placed on nonaccrual status as permitted by

regulatory guidance as generally these loans are directly charged off in the period

that they become 180 days past due, these loans are excluded from nonperforming

loans.

(b) Accruing loans have demonstrated a period of at least six months of performance

under the restructured terms and are excluded from nonperforming loans.

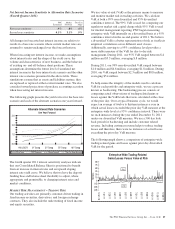

Total TDRs increased $545 million or 33% during 2011 to

$2.2 billion as of December 31, 2011. Of this total,

nonperforming TDRs totaled $1.1 billion, which represents

approximately 32% of total nonperforming loans. However, as

the economy has continued to slowly improve, the amount of

TDRs returning to performing status has been increasing as

noted below.

TDRs that have returned to performing (accruing) status are

excluded from nonperforming loans. These loans have

demonstrated a period of at least six months of consecutive

performance under the restructured terms. These TDRs

increased $228 million or 42% during 2011 to $771 million as

of December 31, 2011. This increase reflects the further

seasoning and performance of the TDRs. See Note 5 Asset

Quality and Allowances for Loan and Lease Losses and

Unfunded Loan Commitments and Letters of Credit in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for additional information.

A

LLOWANCES

F

OR

L

OAN

A

ND

L

EASE

L

OSSES

A

ND

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

We recorded $1.6 billion in net charge-offs for the full year of

2011, compared to $2.9 billion in the full year of 2010.

Commercial lending net charge-offs fell from $1.6 billion in

the full year of 2010 to $712 million in the full year of 2011.

Consumer lending net charge-offs declined from $1.3 billion

in the full year of 2010 to $927 million in the full year of

2011.

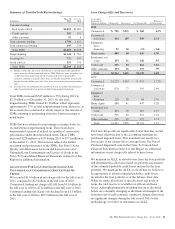

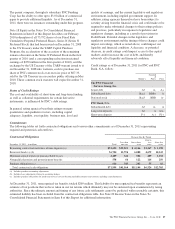

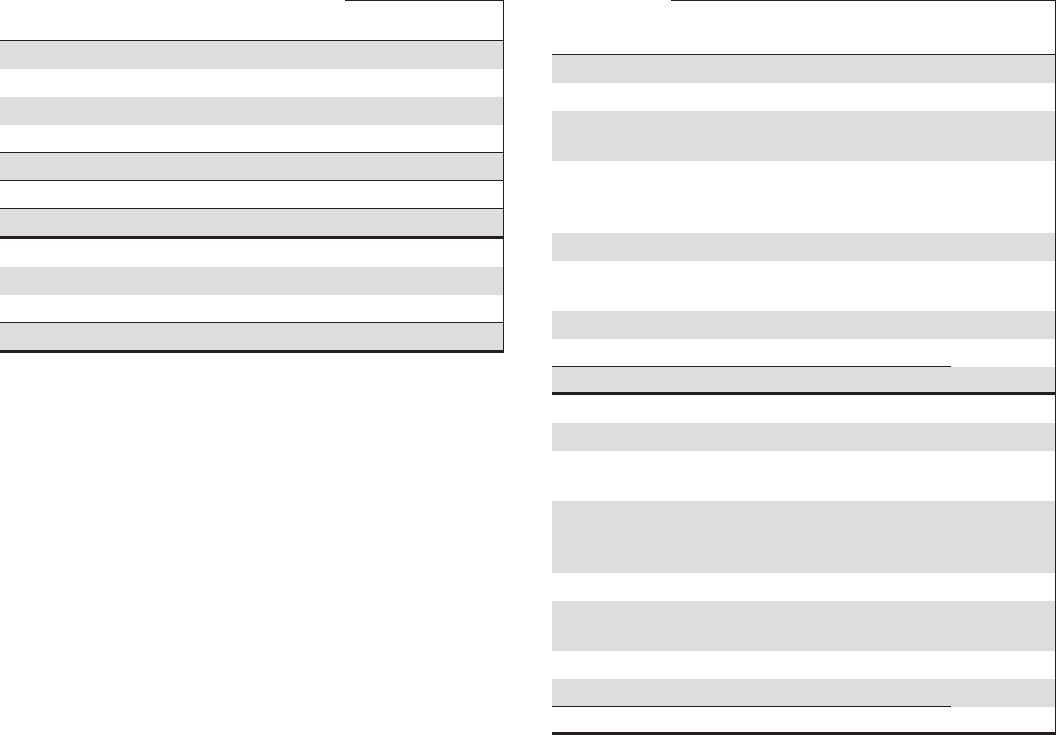

Loan Charge-Offs And Recoveries

Year ended

December 31

Dollars in millions Charge-offs Recoveries Net Charge-offs

Percent of

Average Loans

2011

Commercial $ 700 $332 $ 368 .62%

Commercial

real estate 464 105 359 2.14

Equipment

lease

financing 35 50 (15) (.24)

Home equity 484 48 436 1.30

Residential real

estate 153 11 142 .95

Credit card 235 23 212 5.62

Other consumer 193 56 137 .79

Total $2,264 $625 $1,639 1.08

2010

Commercial $1,227 $294 $ 933 1.72%

Commercial

real estate 670 77 593 2.90

Equipment

lease

financing 120 56 64 1.02

Home equity 488 41 447 1.28

Residential real

estate 406 19 387 2.19

Credit card 335 20 315 7.94

Other consumer 246 49 197 1.74

Total $3,492 $556 $2,936 1.91

Total net charge-offs are significantly lower than they would

have been otherwise due to the accounting treatment for

purchased impaired loans. This treatment also results in a

lower ratio of net charge-offs to average loans. See Note 6

Purchased Impaired Loans in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information on net charge-offs related to these loans.

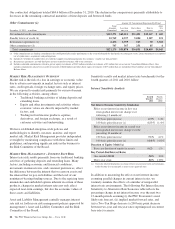

We maintain an ALLL to absorb losses from the loan portfolio

and determine this allowance based on quarterly assessments

of the estimated probable credit losses incurred in the loan

portfolio. We maintain the ALLL at a level that we believe to

be appropriate to absorb estimated probable credit losses

incurred in the loan portfolio as of the balance sheet date.

While we make allocations to specific loans and pools of

loans, the total reserve is available for all loan and lease

losses. Although quantitative modeling factors as discussed

below are constantly changing as the financial strength of the

borrower and overall economic conditions change, there were

no significant changes during the full year of 2011 to the

methodology we follow to determine our ALLL.

The PNC Financial Services Group, Inc. – Form 10-K 81