PNC Bank 2011 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

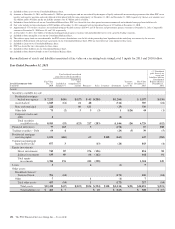

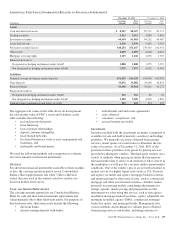

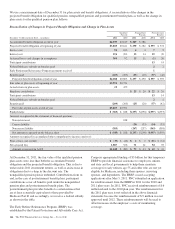

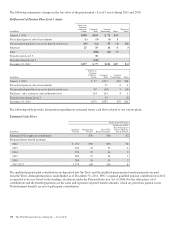

Depreciation expense on premises, equipment and leasehold

improvements and amortization expense, primarily for

capitalized internally developed software, was as follows:

Depreciation and Amortization Expense

Year ended December 31

in millions 2011 2010 2009

Continuing operations:

Depreciation $474 $455 $466

Amortization 22 45 79

Discontinued operations:

Depreciation 12 29

Amortization 11 26

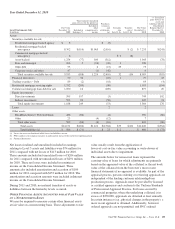

We lease certain facilities and equipment under agreements

expiring at various dates through the year 2067. We account

for these as operating leases. Rental expense on such leases

was as follows:

Lease Rental Expense

Year ended December 31

in millions 2011 2010 2009

Continuing operations: $357 $379 $372

Discontinued operations: 10 16

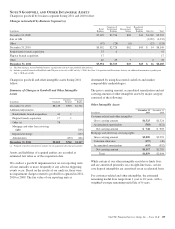

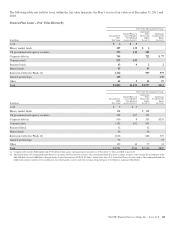

Required minimum annual rentals that we owe on

noncancelable leases having initial or remaining terms in

excess of one year totaled $2.5 billion at December 31, 2011.

Future minimum annual rentals are as follows:

• 2012: $342 million,

• 2013: $312 million,

• 2014: $274 million,

• 2015: $221 million,

• 2016: $188 million, and

• 2017 and thereafter: $1.2 billion.

N

OTE

11 T

IME

D

EPOSITS

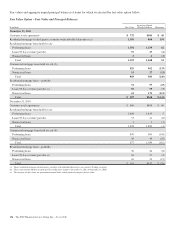

The aggregate amount of time deposits with a denomination of

$100,000 or more was $11.2 billion at December 31, 2011 and

$15.5 billion at December 31, 2010.

Total time deposits of $31.6 billion at December 31, 2011

have future contractual maturities, including related purchase

accounting adjustments, as follows:

• 2012: $25.0 billion,

• 2013: $3.0 billion,

• 2014: $1.2 billion,

• 2015: $0.9 billion,

• 2016: $0.3 billion, and

• 2017 and thereafter: $1.2 billion.

N

OTE

12 B

ORROWED

F

UNDS

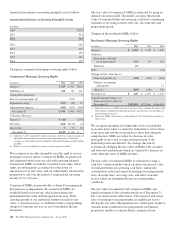

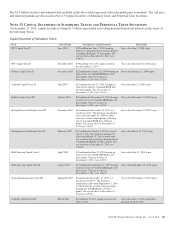

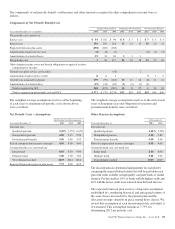

Bank notes along with senior and subordinated notes consisted

of the following:

Bank Notes, Senior Debt and Subordinated Debt

December 31, 2011

Dollars in millions Outstanding Stated Rate Maturity

Bank notes $ 510 zero – 4.66% 2013-2043

Senior debt 11,283 .57% – 6.70% 2012-2020

Bank notes and senior

debt $11,793

Subordinated debt

Junior $ 2,377 1.10% – 10.18% 2028-2068

Other 5,944 .90% – 8.11% 2013-2019

Subordinated debt $ 8,321

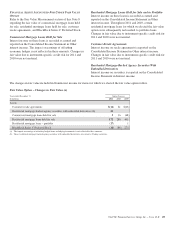

Included in outstandings for the senior and subordinated notes

in the table above are basis adjustments of $434 million and

$591 million, respectively, related to fair value accounting

hedges as of December 31, 2011.

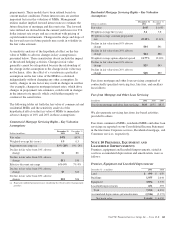

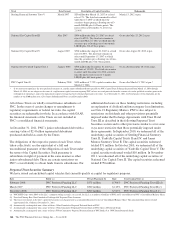

Total borrowed funds of $36.7 billion at December 31, 2011

have contractually scheduled repayments, including related

purchase accounting adjustments, as follows:

• 2012: $15.8 billion,

• 2013: $3.4 billion,

• 2014: $2.7 billion,

• 2015: $2.8 billion,

• 2016: $1.9 billion, and

• 2017 and thereafter: $10.1 billion.

Included in borrowed funds are FHLB borrowings of $7.0

billion at December 31, 2011, which are collateralized by a

blanket lien on residential mortgage and other real estate-

related loans. FHLB advances of $3.0 billion have scheduled

maturities of less than one year. The remainder of the FHLB

borrowings have balances that will mature from 2012 – 2030,

with interest rates ranging from zero to 7.33%.

As part of the National City acquisition, PNC assumed a

liability for the payment at maturity or earlier of $1.4 billion

of convertible senior notes with a fixed interest rate of 4.0%

payable semiannually. The notes matured and were paid off on

February 1, 2011 except for notes that were converted prior to

the maturity date. Prior to November 15, 2010, holders were

entitled to convert the notes, at their option, under certain

circumstances, none of which were satisfied. After

November 15, 2010, the holders were entitled to convert their

notes at any time through the third scheduled trading date

preceding the maturity date, and certain holders did elect to

convert a de minimis amount of notes. Upon conversion, PNC

paid cash related to the principal amount of such notes. PNC

was not required to issue any shares of its common stock for

any conversion value.

162 The PNC Financial Services Group, Inc. – Form 10-K