PNC Bank 2011 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

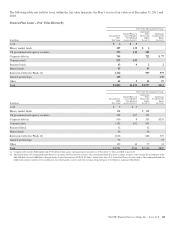

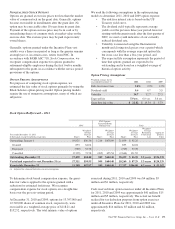

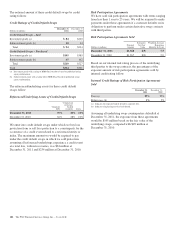

There were no options granted in excess of market value in

2011, 2010 or 2009. Shares of common stock available during

the next year for the granting of options and other awards

under the Incentive Plans were 33,775,543 at December 31,

2011. Total shares of PNC common stock authorized for

future issuance under equity compensation plans totaled

35,304,422 shares at December 31, 2011, which includes

shares available for issuance under the Incentive Plans and the

Employee Stock Purchase Plan (ESPP) as described below.

During 2011, we issued 731,336 shares from treasury stock in

connection with stock option exercise activity. As with past

exercise activity, we currently intend to utilize primarily

treasury stock for any future stock option exercises.

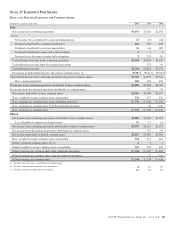

Awards granted to non-employee directors in 2011, 2010 and

2009 include 27,090, 29,040, and 39,552 deferred stock units,

respectively, awarded under the Outside Directors Deferred

Stock Unit Plan. A deferred stock unit is a phantom share of

our common stock, which requires liability accounting

treatment until such awards are paid to the participants as

cash. As there are no vesting or service requirements on these

awards, total compensation expense is recognized in full on

awarded deferred stock units on the date of grant.

I

NCENTIVE

/P

ERFORMANCE

U

NIT

S

HARE

A

WARDS

A

ND

R

ESTRICTED

S

TOCK

/U

NIT

A

WARDS

The fair value of nonvested incentive/performance unit share

awards and restricted stock/unit awards is initially determined

based on prices not less than the market value of our common

stock price on the date of grant. The value of certain incentive/

performance unit share awards is subsequently remeasured

based on the achievement of one or more financial and other

performance goals generally over a three-year period. The

Personnel and Compensation Committee of the Board of

Directors approves the final award payout with respect to

incentive/performance unit share awards. Restricted stock/unit

awards have various vesting periods generally ranging from

36 months to 60 months.

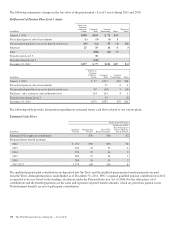

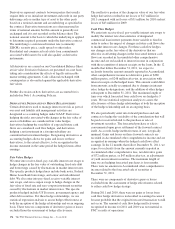

Beginning in 2011, we incorporated two changes to certain

awards under our existing long-term incentive compensation

programs. First, for certain grants of incentive performance

units, the future payout amount will be subject to a negative

annual adjustment if PNC fails to meet certain risk-related

performance metrics. This adjustment is in addition to the

existing financial performance metrics relative to our peers.

These grants have a three-year performance period and are

payable in either stock or a combination of stock and cash.

Second, performance-based restricted share units

(performance RSUs) were granted in 2011 to certain of our

executives in lieu of stock options. These performance RSUs

(which are payable solely in stock) have a service condition,

an internal risk-related performance condition, and an external

market condition. Satisfaction of the performance condition is

based on four independent one-year performance periods.

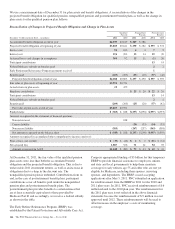

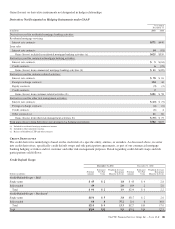

The weighted-average grant-date fair value of incentive/

performance unit share awards and restricted stock/unit

awards granted in 2011, 2010 and 2009 was $63.25, $54.59

and $41.16 per share, respectively. We recognize

compensation expense for such awards ratably over the

corresponding vesting and/or performance periods for each

type of program.

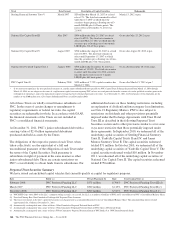

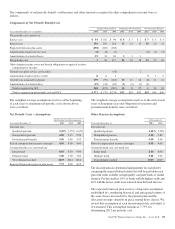

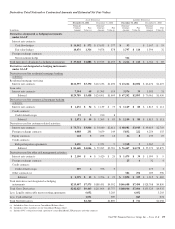

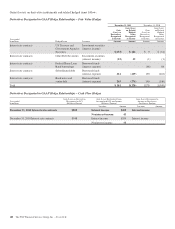

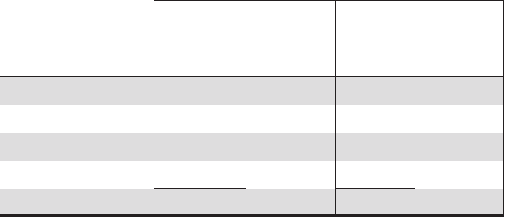

Nonvested Incentive/Performance Unit Share Awards and

Restricted Stock/Unit Awards – Rollforward

Shares in thousands

Nonvested

Incentive/

Performance

Unit Shares

Weighted-

Average

Grant

Date Fair

Value

Nonvested

Restricted

Stock/

Unit

Shares

Weighted-

Average

Grant

Date Fair

Value

December 31, 2010 363 $56.40 2,250 $49.95

Granted 623 64.21 1,059 62.68

Vested (156) 59.54 (706) 51.27

Forfeited (91) 52.24

December 31, 2011 830 $61.68 2,512 $54.87

In the chart above, the unit shares and related weighted-

average grant-date fair value of the incentive/performance

awards exclude the effect of dividends on the underlying

shares, as those dividends will be paid in cash.

At December 31, 2011, there was $61 million of unrecognized

deferred compensation expense related to nonvested share-

based compensation arrangements granted under the Incentive

Plans. This cost is expected to be recognized as expense over a

period of no longer than five years. The total fair value of

incentive/performance unit share and restricted stock/unit

awards vested during 2011, 2010 and 2009 was approximately

$52 million, $39 million and $47 million, respectively.

L

IABILITY

A

WARDS

We grant annually cash-payable restricted share units to

certain executives. The grants were made primarily as part of

an annual bonus incentive deferral plan. While there are time-

based and service-related vesting criteria, there are no market

or performance criteria associated with these awards.

Compensation expense recognized related to these awards was

recorded in prior periods as part of annual cash bonus criteria.

As of December 31, 2011, there were 753,203 of these cash-

payable restricted share units outstanding.

174 The PNC Financial Services Group, Inc. – Form 10-K