PNC Bank 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our modeling methods and data are reviewed by independent

model reviewers not involved in the development of the model

to identify possible errors or areas where the soundness of the

model could be in question. Issues identified by the

independent reviewer are tracked and reported using our

existing governance structure until the issue has been fully

remediated. It is important that models operate in a controlled

environment where access to code or the ability to make

changes is limited to those so authorized. Additionally, proper

back-up and recovery mechanisms are needed for the ongoing

functioning of models. Our use of independent model control

reviewers aids in the evaluation of the existing control

mechanisms to help ensure that controls are appropriate and

are functioning properly.

L

IQUIDITY

R

ISK

M

ANAGEMENT

Liquidity risk has two fundamental components. The first is

potential loss assuming we were unable to meet our funding

requirements at a reasonable cost. The second is the potential

inability to operate our businesses because adequate

contingent liquidity is not available in a stressed environment.

We manage liquidity risk at the consolidated company level

(bank, parent company, and nonbank subsidiaries combined)

to help ensure that we can obtain cost-effective funding to

meet current and future obligations under both normal

“business as usual” and stressful circumstances, and to help

ensure that we maintain an appropriate level of contingent

liquidity.

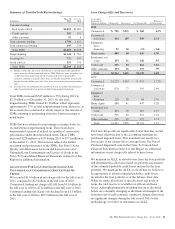

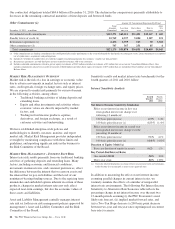

Spot and forward funding gap analyses are used to measure

and monitor consolidated liquidity risk. Funding gaps

represent the difference in projected sources of liquidity

available to offset projected uses. We calculate funding gaps

for the overnight, thirty-day, ninety-day, one hundred

eighty-day and one-year time intervals. Management also

monitors liquidity through a series of early warning indicators

that may indicate a potential market, or PNC-specific,

liquidity stress event. Finally, management performs a set of

liquidity stress tests and maintains a contingency funding plan

to address a potential liquidity crisis. In the most severe

liquidity stress simulation, we assume that PNC’s liquidity

position is under pressure, while the market in general is under

systemic pressure. The simulation considers, among other

things, the impact of restricted access to both secured and

unsecured external sources of funding, accelerated run-off of

customer deposits, valuation pressure on assets, and heavy

demand to fund contingent obligations. Risk limits are

established within our Liquidity Risk Policy. Management’s

Asset and Liability Committee regularly reviews compliance

with the established limits.

Parent company liquidity guidelines are designed to help

ensure that sufficient liquidity is available to meet our parent

company obligations over the succeeding 24-month period.

Risk limits for parent company liquidity are established within

our Enterprise Capital and Liquidity Management Policy. The

Board of Directors’ Risk Committee regularly reviews

compliance with the established limits.

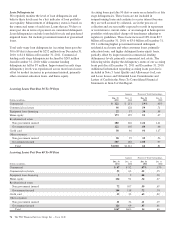

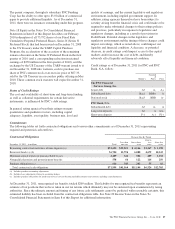

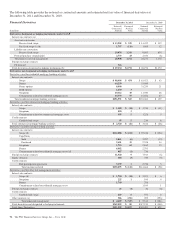

Bank Level Liquidity – Uses

Obligations requiring the use of liquidity can generally be

characterized as either contractual or discretionary. At the

bank level, primary contractual obligations include funding

loan commitments, satisfying deposit withdrawal requests and

maturities and debt service related to bank borrowings. We

also maintain adequate bank liquidity to meet future potential

loan demand and provide for other business needs, as

necessary. As of December 31, 2011, there were

approximately $7.3 billion of bank borrowings with

contractual maturities of less than one year.

Bank Level Liquidity – Sources

Our largest source of bank liquidity on a consolidated basis is

the deposit base that comes from our retail and commercial

businesses. Liquid assets and unused borrowing capacity from

a number of sources are also available to maintain our

liquidity position. Borrowed funds come from a diverse mix

of short and long-term funding sources.

At December 31, 2011, our liquid assets consisted of short-

term investments (Federal funds sold, resale agreements,

trading securities, and interest-earning deposits with banks)

totaling $5.9 billion and securities available for sale totaling

$48.6 billion. Of our total liquid assets of $54.5 billion, we

had $20.1 billion pledged as collateral for borrowings, trust,

and other commitments. The level of liquid assets fluctuates

over time based on many factors, including market conditions,

loan and deposit growth and active balance sheet

management.

In addition to the customer deposit base, which has

historically provided the single largest source of relatively

stable and low-cost funding and liquid assets, the bank also

obtains liquidity through the issuance of traditional forms of

funding including long-term debt (senior notes and

subordinated debt and FHLB advances) and short-term

borrowings (Federal funds purchased, securities sold under

repurchase agreements, commercial paper issuances, and other

short-term borrowings).

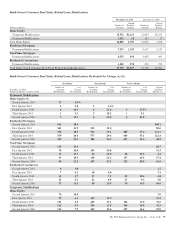

PNC Bank, N.A. has the ability to offer up to $20 billion in

senior and subordinated unsecured debt obligations with

maturities of more than nine months. Through December 31,

2011, PNC Bank, N.A. had issued $6.9 billion of debt under

this program. Total senior and subordinated debt declined to

$4.1 billion at December 31, 2011 from $5.5 billion at

December 31, 2010 due to contractual maturities.

PNC Bank, N.A. is a member of the FHLB-Pittsburgh and as

such has access to advances from FHLB-Pittsburgh secured

generally by residential mortgage and other mortgage-related

loans. At December 31, 2011, our unused secured borrowing

capacity was $10.6 billion with FHLB-Pittsburgh. Total

The PNC Financial Services Group, Inc. – Form 10-K 85