PNC Bank 2011 Annual Report Download - page 45

Download and view the complete annual report

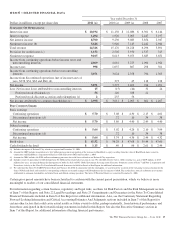

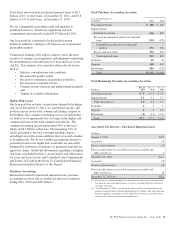

Please find page 45 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The net interest margin was 3.92% for 2011 and 4.14% for

2010. The following factors impacted the comparison:

• A 41 basis point decrease in the yield on interest-

earning assets. The yield on loans, the largest portion

of our earning assets, decreased 38 basis points.

• These factors were partially offset by a 20 basis point

decline in the rate accrued on interest-bearing

liabilities. The rate accrued on interest-bearing

deposits, the largest component, decreased 19 basis

points primarily in retail certificates of deposit.

We expect our 2012 net interest income, including the results

of our pending RBC Bank (USA) acquisition following

closing, to increase in percentage terms by mid-to-high single

digits compared to 2011 as core net interest income should

continue to grow offset by the expected decline in purchase

accounting accretion, assuming the economic outlook for

2012 will be a continuation of the 2011 environment.

N

ONINTEREST

I

NCOME

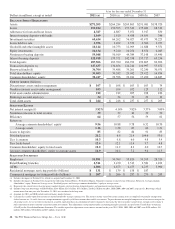

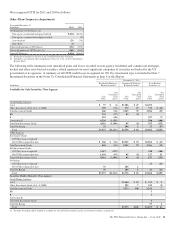

Noninterest income totaled $5.6 billion for 2011 and $5.9

billion for 2010. Noninterest income for 2011 reflected higher

asset management fees and other income, higher residential

mortgage banking revenue, and lower net other-than-

temporary impairments (OTTI), that were offset by a decrease

in corporate service fees primarily due to a reduction in the

value of commercial mortgage servicing rights, lower service

charges on deposits from the impact of Regulation E rules

pertaining to overdraft fees, a decrease in net gains on sales of

securities and lower consumer services fees due, in part, to a

decline in interchange fees on individual debit card

transactions in the fourth quarter partially offset by higher

transaction volumes throughout 2011.

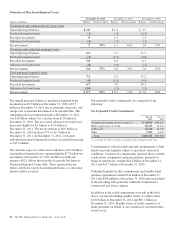

Asset management revenue, including BlackRock, increased

$34 million to $1.1 billion in 2011 compared with 2010. The

increase was driven by strong sales performance by our Asset

Management Group and somewhat higher equity earnings

from our BlackRock investment. Discretionary assets under

management at December 31, 2011 totaled $107 billion

compared with $108 billion at December 31, 2010.

For 2011, consumer services fees totaled $1.2 billion

compared with $1.3 billion in 2010. The decrease was due to

lower interchange rates on debit card transactions, lower

brokerage related revenue, and lower ATM related fees,

partially offset by higher volumes of customer-initiated

transactions including debit and credit cards. As further

discussed in the Retail Banking section of the Business

Segments Review portion of this Item 7, the Dodd-Frank

limits on interchange rates were effective October 1, 2011 and

had a negative impact on revenues of approximately $75

million in the fourth quarter of 2011, and are expected to have

an additional incremental reduction on 2012 annual revenue of

approximately $175 million, based on 2011 transaction

volumes.

Corporate services revenue totaled $.9 billion in 2011 and

$1.1 billion in 2010. Lower values of commercial mortgage

servicing rights, largely driven by lower interest rates and

higher loan prepayment rates, and lower special servicing fees

drove the decline.

Residential mortgage revenue totaled $713 million in 2011

and $699 million in 2010. Higher loans sales revenue drove

the comparison, largely offset by lower net hedging gains on

mortgage servicing rights and lower servicing fees.

Service charges on deposits totaled $534 million for 2011 and

$705 million for 2010. The decline resulted primarily from the

impact of Regulation E rules pertaining to overdraft fees. As

further discussed in the Retail Banking section of the Business

Segments Review portion of this Item 7, the new Regulation E

rules related to overdraft charges negatively impacted our

2011 revenue by approximately $200 million compared with

2010.

Net gains on sales of securities totaled $249 million for 2011

and $426 million for 2010. The net credit component of OTTI

of securities recognized in earnings was a loss of $152 million

in 2011, compared with a loss of $325 million in 2010.

Gains on BlackRock related transactions included a fourth

quarter 2010 pretax gain of $160 million from our sale of

7.5 million BlackRock common shares as part of a BlackRock

secondary common stock offering.

Other noninterest income totaled $1.1 billion for 2011

compared with $.9 billion for 2010.

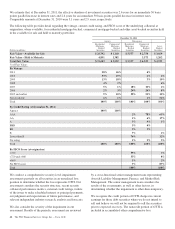

The diversity of our revenue streams should enable us to

achieve a solid performance in an environment that will

continue to be affected by regulatory reform headwinds and

implementation challenges. Looking to 2012, we see

opportunities for growth as a result of our larger franchise and

the pending acquisition, our ability to cross-sell our products

and services to existing clients and our progress in adding new

clients. We expect noninterest income to increase in

percentage terms by the mid-single digits despite further

regulatory impacts on debit card interchange fees, assuming

the economic outlook for 2012 will be a continuation of the

2011 environment.

P

RODUCT

R

EVENUE

In addition to credit and deposit products for commercial

customers, Corporate & Institutional Banking offers other

services, including treasury management, capital markets-

related products and services, and commercial mortgage

banking activities for customers in all business segments. A

portion of the revenue and expense related to these products is

reflected in Corporate & Institutional Banking and the

remainder is reflected in the results of other businesses. The

Other Information section in the Corporate & Institutional

Banking table in the Business Segments Review section of

36 The PNC Financial Services Group, Inc. – Form 10-K