PNC Bank 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Robert Q. Reilly has served as the head of PNC’s Asset

Management Group since 2005. Previously, he held numerous

management roles in both Corporate Banking and Asset

Management. He was appointed Executive Vice President in

February 2009.

Gregory H. Kozich joined PNC as Senior Vice President of

PNC Bank, N.A. in October 2010. He has served as Senior

Vice President of PNC since February 2011 and Corporate

Controller for PNC since March 2011. Prior to joining PNC,

he was with Fannie Mae as its corporate controller and

PricewaterhouseCoopers LLP as a partner in its National

Banking Group.

DIRECTORS OF THE REGISTRANT

The name, age and principal occupation of each of our

directors as of February 17, 2012, and the year he or she first

became a director is set forth below:

• Richard O. Berndt, 69, Managing Partner of

Gallagher, Evelius & Jones LLP (law firm) (2007)

• Charles E. Bunch, 62, Chairman and Chief Executive

Officer of PPG Industries, Inc. (coatings, sealants

and glass products) (2007)

• Paul W. Chellgren, 69, Operating Partner, Snow

Phipps Group, LLC (private equity) (1995)

• Kay Coles James, 62, President and Founder of The

Gloucester Institute (non-profit) (2006)

• Richard B. Kelson, 65, President and Chief Executive

Officer, ServCo, LLC (strategic sourcing, supply

chain management) (2002)

• Bruce C. Lindsay, 70, Chairman and Managing

Member of 2117 Associates, LLC (business

consulting firm) (1995)

• Anthony A. Massaro, 67, Retired Chairman and

Chief Executive Officer of Lincoln Electric

Holdings, Inc. (manufacturer of welding and cutting

products) (2002)

• Jane G. Pepper, 66, Retired President of the

Pennsylvania Horticultural Society (non-profit)

(1997)

• James E. Rohr, 63, Chairman and Chief Executive

Officer of PNC (1990)

• Donald J. Shepard, 65, Retired Chairman of the

Executive Board and Chief Executive Officer of

AEGON N.V. (insurance) (2007)

• Lorene K. Steffes, 66, Independent Business Advisor

(technology and technical services) (2000)

• Dennis F. Strigl, 65, Retired President and Chief

Operating Officer of Verizon Communications Inc.

(telecommunications) (2001)

• Thomas J. Usher, 69, Non-executive Chairman of

Marathon Petroleum Corporation (oil and gas

industry) (1992)

• George H. Walls, Jr., 69, former Chief Deputy

Auditor for the State of North Carolina (2006)

• Helge H. Wehmeier, 69, Retired Vice Chairman of

Bayer Corporation (healthcare, crop protection, and

chemicals) (1992)

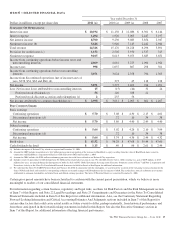

PART II

ITEM

5–

MARKET FOR REGISTRANT

’

SCOMMON

EQUITY

,

RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

(a) (1) Our common stock is listed on the New York Stock

Exchange and is traded under the symbol “PNC.” At the close

of business on February 17, 2012, there were 77,045 common

shareholders of record.

Holders of PNC common stock are entitled to receive dividends

when declared by the Board of Directors out of funds legally

available for this purpose. Our Board of Directors may not pay

or set apart dividends on the common stock until dividends for

all past dividend periods on any series of outstanding preferred

stock have been paid or declared and set apart for payment. The

Board presently intends to continue the policy of paying

quarterly cash dividends. The amount of any future dividends

will depend on economic and market conditions, our financial

condition and operating results, and other factors, including

contractual restrictions and applicable government regulations

and policies (such as those relating to the ability of bank and

non-bank subsidiaries to pay dividends to the parent company

and regulatory capital limitations). Our ability to increase our

dividend is currently subject to the results of the Federal

Reserve’s 2012 Comprehensive Capital Analysis and Review

(CCAR) as part of its supervisory assessment of capital

adequacy described under “Supervision and Regulation” in

Item 1 of this Report.

The Federal Reserve has the power to prohibit us from paying

dividends without its approval. For further information

concerning dividend restrictions and restrictions on loans,

dividends or advances from bank subsidiaries to the parent

company, you may review “Supervision and Regulation” in

Item 1 of this Report, “Funding and Capital Sources” in the

Consolidated Balance Sheet Review section, “Liquidity Risk

Management” in the Risk Management section, and “Trust

Preferred Securities” in the Off-Balance Sheet Arrangements

and VIEs section of Item 7 of this Report, and Note 13 Capital

Securities of Subsidiary Trusts and Perpetual Trust Securities

and Note 21 Regulatory Matters in the Notes To Consolidated

Financial Statements in Item 8 of this Report, which we

include here by reference.

We include here by reference additional information relating

to PNC common stock under the caption “Common Stock

Prices/Dividends Declared” in the Statistical Information

(Unaudited) section of Item 8 of this Report.

The PNC Financial Services Group, Inc. – Form 10-K 25