PNC Bank 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

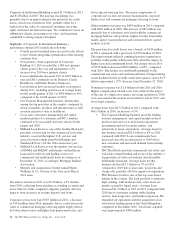

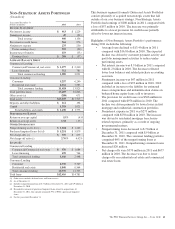

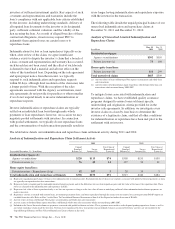

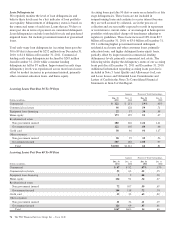

Commercial Mortgage Servicing Rights

Dollars in millions

December 31

2011

December 31

2010

Fair value $ 471 $ 674

Weighted-average life (in years) (a) 5.9 6.3

Prepayment rate range (a) (b) 13% – 28% 10% – 24%

Effective discount rate range 6%–9% 7% – 9%

(a) Changes in weighted-average life and prepayment rate reflect the cumulative impact

of changes in rates, prepayment expectations and model changes.

(b) Represents modeled prepayment rates considering the effective dates of prepayment

penalties.

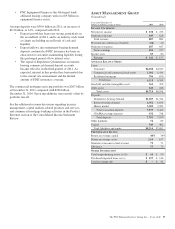

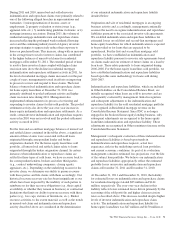

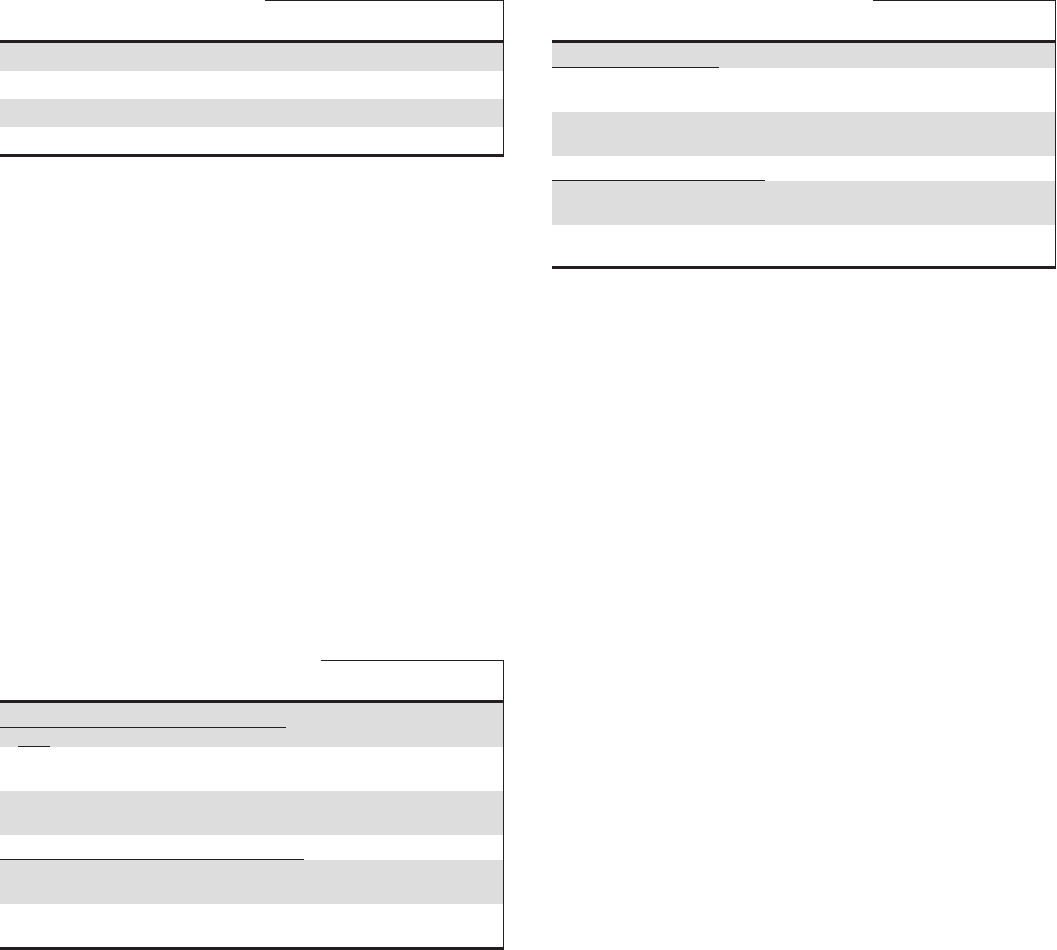

A sensitivity analysis of the hypothetical effect on the fair

value of MSRs to adverse changes in key assumptions is

presented below. These sensitivities do not include the impact

of the related hedging activities. Changes in fair value

generally cannot be extrapolated because the relationship of

the change in the assumption to the change in fair value may

not be linear. Also, the effect of a variation in a particular

assumption on the fair value of the MSRs is calculated

independently without changing any other assumption. In

reality, changes in one factor may result in changes in another

(for example, changes in mortgage interest rates, which drive

changes in prepayment rate estimates, could result in changes

in the interest rate spread), which could either magnify or

counteract the sensitivities.

Residential Mortgage Servicing Rights

Dollars in millions

December 31

2011

December 31

2010

Weighted-average constant prepayment

rate:

Decline in fair value from 10% adverse

change $44 $41

Decline in fair value from 20% adverse

change $84 $86

Weighted-average option adjusted spread:

Decline in fair value from 10% adverse

change $25 $43

Decline in fair value from 20% adverse

change $48 $83

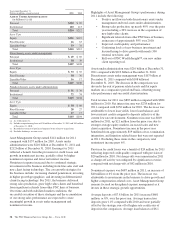

Commercial Mortgage Servicing Rights

Dollars in millions

December 31

2011

December 31

2010

Prepayment rate range:

Decline in fair value from 10% adverse

change $6 $8

Decline in fair value from 20% adverse

change $11 $16

Effective discount rate range:

Decline in fair value from 10% adverse

change $9 $13

Decline in fair value from 20% adverse

change $18 $26

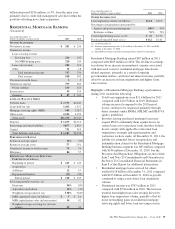

Income Taxes

In the normal course of business, we and our subsidiaries enter

into transactions for which the tax treatment is unclear or

subject to varying interpretations. In addition, filing

requirements, methods of filing and the calculation of taxable

income in various state and local jurisdictions are subject to

differing interpretations.

We evaluate and assess the relative risks and merits of the

appropriate tax treatment of transactions, filing positions,

filing methods and taxable income calculations after

considering statutes, regulations, judicial precedent, and other

information, and maintain tax accruals consistent with our

evaluation of these relative risks and merits. The result of our

evaluation and assessment is by its nature an estimate. We and

our subsidiaries are routinely subject to audit and challenges

from taxing authorities. In the event we resolve a challenge for

an amount different than amounts previously accrued, we will

account for the difference in the period in which we resolve

the matter.

Proposed Accounting Standards

The Financial Accounting Standards Board (FASB) issued

several Exposure Drafts for comment during 2011 as well as

the beginning of 2012.

66 The PNC Financial Services Group, Inc. – Form 10-K