PNC Bank 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

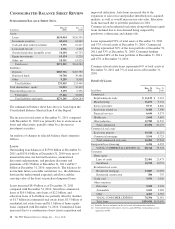

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

S

UMMARIZED

B

ALANCE

S

HEET

D

ATA

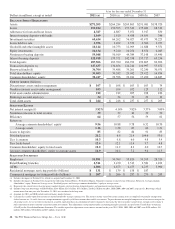

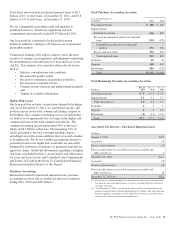

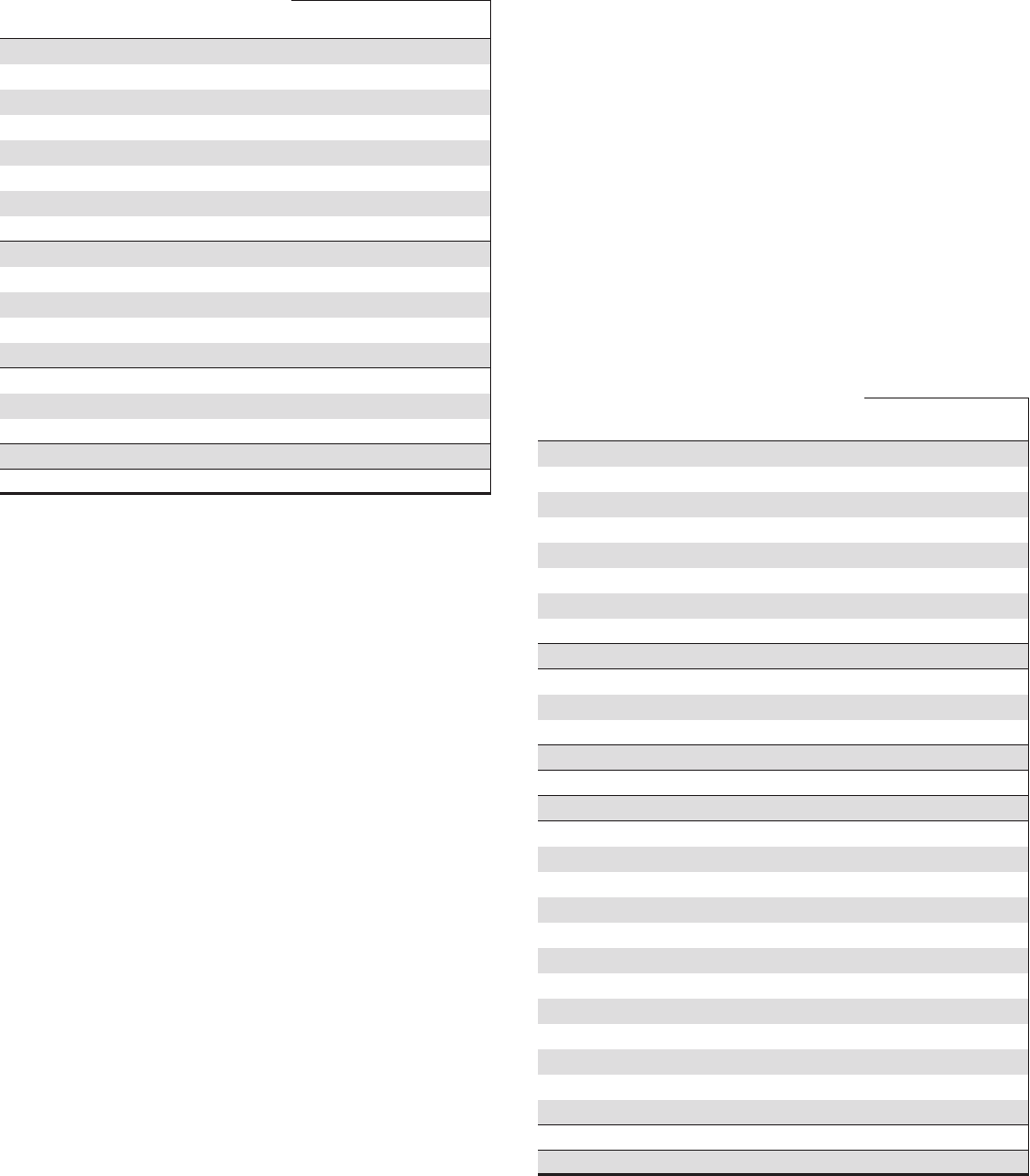

In millions

Dec. 31

2011

Dec. 31

2010

Assets

Loans $159,014 $150,595

Investment securities 60,634 64,262

Cash and short-term investments 9,992 10,437

Loans held for sale 2,936 3,492

Goodwill and other intangible assets 10,144 10,753

Equity investments 10,134 9,220

Other, net 18,351 15,525

Total assets $271,205 $264,284

Liabilities

Deposits $187,966 $183,390

Borrowed funds 36,704 39,488

Other 9,289 8,568

Total liabilities 233,959 231,446

Total shareholders’ equity 34,053 30,242

Noncontrolling interests 3,193 2,596

Total equity 37,246 32,838

Total liabilities and equity $271,205 $264,284

The summarized balance sheet data above is based upon the

Consolidated Balance Sheet in Item 8 of this Report.

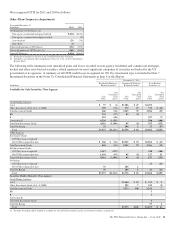

The increase in total assets at December 31, 2011 compared

with December 31, 2010 was primarily due to an increase in

loans and other assets, partially offset by a decrease in

investment securities.

An analysis of changes in selected balance sheet categories

follows.

L

OANS

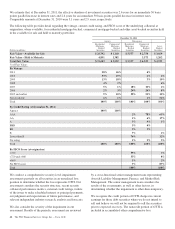

Outstanding loan balances of $159.0 billion at December 31,

2011 and $150.6 billion at December 31, 2010 were net of

unearned income, net deferred loan fees, unamortized

discounts and premiums, and purchase discounts and

premiums of $2.3 billion at December 31, 2011 and $2.7

billion at December 31, 2010, respectively. The balances do

not include future accretable net interest (i.e., the difference

between the undiscounted expected cash flows and the

carrying value of the loan) on purchased impaired loans.

Loans increased $8.4 billion as of December 31, 2011

compared with December 31, 2010. Growth in commercial

loans of $10.5 billion, auto loans of $2.2 billion, and

education loans of $.4 billion was partially offset by declines

of $1.7 billion in commercial real estate loans, $1.5 billion of

residential real estate loans and $1.1 billion of home equity

loans compared with December 31, 2010. Commercial loans

increased due to a combination of new client acquisition and

improved utilization. Auto loans increased due to the

expansion of sales force and product introduction to acquired

markets, as well as overall increases in auto sales. Education

loans increased due to portfolio purchases in 2011.

Commercial and residential real estate along with home equity

loans declined due to loan demand being outpaced by

paydowns, refinancing, and charge-offs.

Loans represented 59% of total assets at December 31, 2011

and 57% of total assets at December 31, 2010. Commercial

lending represented 56% of the loan portfolio at December 31,

2011 and 53% at December 31, 2010. Consumer lending

represented 44% of the loan portfolio at December 31, 2011

and 47% at December 31, 2010.

Commercial real estate loans represented 6% of total assets at

December 31, 2011 and 7% of total assets at December 31,

2010.

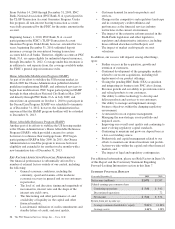

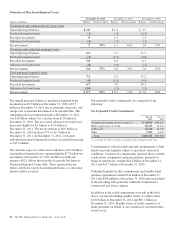

Details Of Loans

In millions

Dec. 31

2011

Dec. 31

2010

Commercial

Retail/wholesale trade $ 11,539 $ 9,901

Manufacturing 11,453 9,334

Service providers 9,717 8,866

Real estate related (a) 8,488 7,500

Financial services 6,646 4,573

Health care 5,068 3,481

Other industries 12,783 11,522

Total commercial 65,694 55,177

Commercial real estate

Real estate projects 10,640 12,211

Commercial mortgage 5,564 5,723

Total commercial real estate 16,204 17,934

Equipment lease financing 6,416 6,393

TOTAL COMMERCIAL LENDING (b) 88,314 79,504

Consumer

Home equity

Lines of credit 22,491 23,473

Installment 10,598 10,753

Residential real estate

Residential mortgage 13,885 15,292

Residential construction 584 707

Credit card 3,976 3,920

Other consumer

Education 9,582 9,196

Automobile 5,181 2,983

Other 4,403 4,767

TOTAL CONSUMER LENDING 70,700 71,091

Total loans $159,014 $150,595

(a) Includes loans to customers in the real estate and construction industries.

(b) Construction loans with interest reserves, and A/B Note restructurings are not

significant to PNC.

38 The PNC Financial Services Group, Inc. – Form 10-K