PNC Bank 2011 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

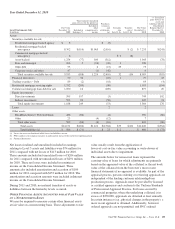

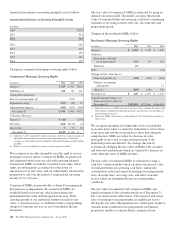

prepayments. These models have been refined based on

current market conditions. Future interest rates are another

important factor in the valuation of MSRs. Management

utilizes market implied forward interest rates to estimate the

future direction of mortgage and discount rates. The forward

rates utilized are derived from the current yield curve for U.S.

dollar interest rate swaps and are consistent with pricing of

capital markets instruments. Changes in the shape and slope of

the forward curve in future periods may result in volatility in

the fair value estimate.

A sensitivity analysis of the hypothetical effect on the fair

value of MSRs to adverse changes in key assumptions is

presented below. These sensitivities do not include the impact

of the related hedging activities. Changes in fair value

generally cannot be extrapolated because the relationship of

the change in the assumption to the change in fair value may

not be linear. Also, the effect of a variation in a particular

assumption on the fair value of the MSRs is calculated

independently without changing any other assumption. In

reality, changes in one factor may result in changes in another

(for example, changes in mortgage interest rates, which drive

changes in prepayment rate estimates, could result in changes

in the interest rate spread), which could either magnify or

counteract the sensitivities.

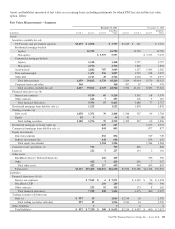

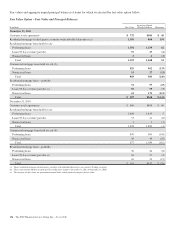

The following tables set forth the fair value of commercial and

residential MSRs and the sensitivity analysis of the

hypothetical effect on the fair value of MSRs to immediate

adverse changes of 10% and 20% in those assumptions:

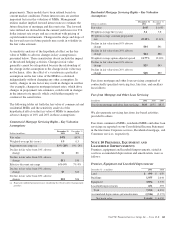

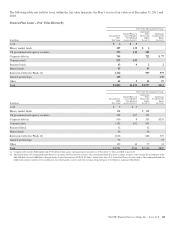

Commercial Mortgage Servicing Rights – Key Valuation

Assumptions

Dollars in millions

December 31

2011

December 31

2010

Fair value $471 $674

Weighted-average life (years) 5.9 6.3

Prepayment rate range (a) 13%-28% 10%-24%

Decline in fair value from 10% adverse

change $6 $8

Decline in fair value from 20% adverse

change $11 $16

Effective discount rate range 6%-9% 7%-9%

Decline in fair value from 10% adverse

change $9 $13

Decline in fair value from 20% adverse

change $18 $26

(a) Represents modeled prepayment rates considering the effective dates of prepayment

penalties.

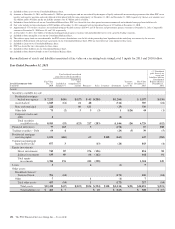

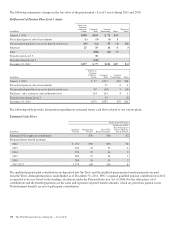

Residential Mortgage Servicing Rights – Key Valuation

Assumptions

Dollars in millions

December 31

2011

December 31

2010

Fair value $647 $1,033

Weighted-average life (years) 3.6 5.8

Weighted-average constant prepayment

rate 22.10% 12.61%

Decline in fair value from 10% adverse

change $44 $41

Decline in fair value from 20% adverse

change $84 $86

Weighted-average option adjusted spread 11.77% 12.18%

Decline in fair value from 10% adverse

change $25 $43

Decline in fair value from 20% adverse

change $48 $83

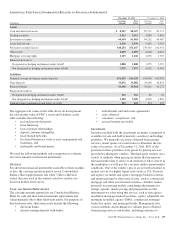

Fees from mortgage and other loan servicing comprised of

contractually specified servicing fees, late fees, and ancillary

fees follows:

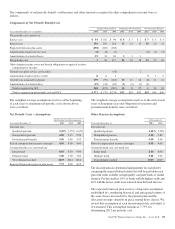

Fees from Mortgage and Other Loan Servicing

In millions 2011 2010 2009

Fees from mortgage and other loan servicing $641 $692 $825

We also generate servicing fees from fee-based activities

provided to others.

Fees from commercial MSRs, residential MSRs and other loan

servicing are reported on our Consolidated Income Statement

in the line items Corporate services, Residential mortgage, and

Consumer services, respectively.

N

OTE

10 P

REMISES

,E

QUIPMENT AND

L

EASEHOLD

I

MPROVEMENTS

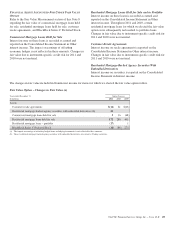

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

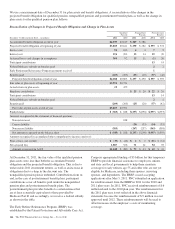

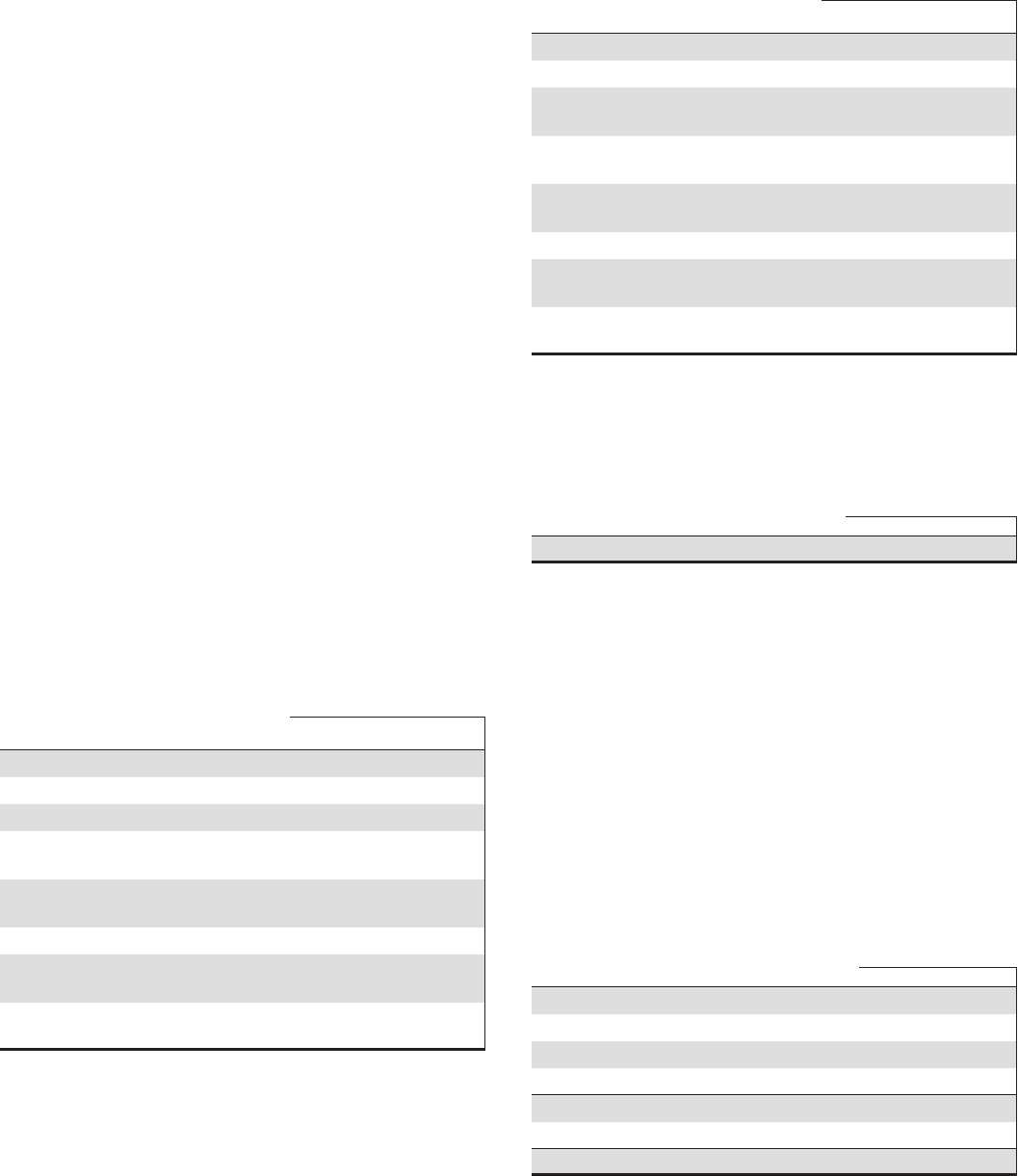

Premises, Equipment and Leasehold Improvements

December 31 - in millions 2011 2010

Land $ 690 $ 659

Buildings 1,955 1,644

Equipment 3,894 3,335

Leasehold improvements 651 593

Total 7,190 6,231

Accumulated depreciation and amortization (2,546) (2,172)

Net book value $ 4,644 $ 4,059

The PNC Financial Services Group, Inc. – Form 10-K 161