PNC Bank 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

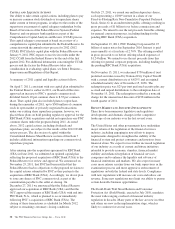

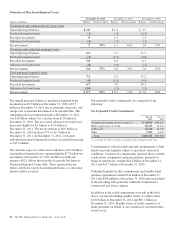

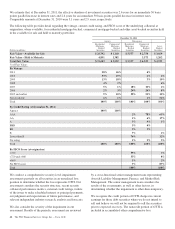

Valuation of Purchased Impaired Loans

December 31, 2011 December 31, 2010 December 31, 2009

Dollars in billions Balance Net Investment Balance Net Investment Balance Net Investment

Commercial and commercial real estate loans:

Unpaid principal balance $ 1.0 $ 1.8 $ 3.5

Purchased impaired mark (.1) (.4) (1.3)

Recorded investment .9 1.4 2.2

Allowance for loan losses (.2) (.3) (.2)

Net investment .7 70% 1.1 61% 2.0 57%

Consumer and residential mortgage loans:

Unpaid principal balance 6.5 7.9 11.7

Purchased impaired mark (.7) (1.5) (3.6)

Recorded investment 5.8 6.4 8.1

Allowance for loan losses (.8) (.6) (.3)

Net investment 5.0 77% 5.8 73% 7.8 67%

Total purchased impaired loans:

Unpaid principal balance 7.5 9.7 15.2

Purchased impaired mark (.8) (1.9) (4.9)

Recorded investment 6.7 7.8 10.3

Allowance for loan losses (1.0) (.9) (.5)

Net investment $ 5.7 76% $ 6.9 71% $ 9.8 64%

The unpaid principal balance of purchased impaired loans

declined from $9.7 billion at December 31, 2010 to $7.5

billion at December 31, 2011 due to payments, disposals, and

charge-offs of amounts determined to be uncollectible. The

remaining purchased impaired mark at December 31, 2011

was $.8 billion, which was a decline from $1.9 billion at

December 31, 2010. The associated allowance for loan losses

increased slightly by $.1 billion to $1.0 billion at

December 31, 2011. The net investment of $6.9 billion at

December 31, 2010 declined 17% to $5.7 billion at

December 31, 2011. At December 31, 2011, our largest

individual purchased impaired loan had a recorded investment

of $25.2 million.

We currently expect to collect total cash flows of $7.8 billion

on purchased impaired loans, representing the $5.7 billion net

investment at December 31, 2011 and the accretable net

interest of $2.1 billion shown in the Accretable Net Interest-

Purchased Impaired Loans table. These represent the net

future cash flows on purchased impaired loans, as contractual

interest will be reversed.

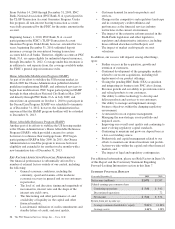

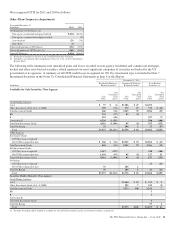

Net unfunded credit commitments are comprised of the

following:

Net Unfunded Credit Commitments

Dec. 31

2011

Dec. 31

2010

Commercial/commercial real estate (a) $ 64,955 $59,256

Home equity lines of credit 18,317 19,172

Credit card 16,216 14,725

Other 3,783 2,652

Total $103,271 $95,805

(a) Less than 4% of these amounts at each date relate to commercial real estate.

Commitments to extend credit represent arrangements to lend

funds or provide liquidity subject to specified contractual

conditions. Commercial commitments reported above exclude

syndications, assignments and participations, primarily to

financial institutions, totaling $20.2 billion at December 31,

2011 and $16.7 billion at December 31, 2010.

Unfunded liquidity facility commitments and standby bond

purchase agreements totaled $742 million at December 31,

2011 and $458 million at December 31, 2010 and are included

in the preceding table primarily within the Commercial /

commercial real estate category.

In addition to the credit commitments set forth in the table

above, our net outstanding standby letters of credit totaled

$10.8 billion at December 31, 2011 and $10.1 billion at

December 31, 2010. Standby letters of credit commit us to

make payments on behalf of our customers if specified future

events occur.

40 The PNC Financial Services Group, Inc. – Form 10-K