PNC Bank 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.B

USINESS

S

EGMENTS

R

EVIEW

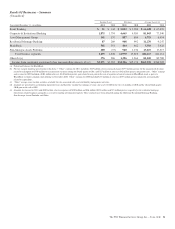

We have six reportable business segments:

• Retail Banking

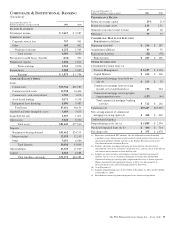

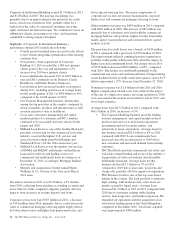

• Corporate & Institutional Banking

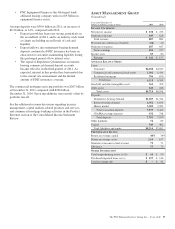

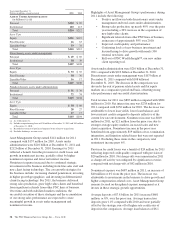

• Asset Management Group

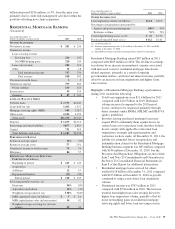

• Residential Mortgage Banking

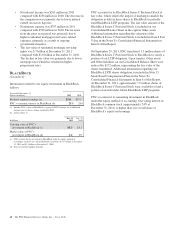

• BlackRock

• Non-Strategic Assets Portfolio

Once we entered into an agreement to sell GIS, it was no

longer a reportable business segment. We sold GIS on July 1,

2010.

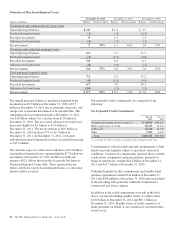

Business segment results, including inter-segment revenues,

and a description of each business are included in Note 25

Segment Reporting included in the Notes To Consolidated

Financial Statements in Item 8 of this Report. Certain amounts

included in this Item 7 differ from those amounts shown in

Note 25 primarily due to the presentation in this Item 7 of

business net interest revenue on a taxable-equivalent basis.

Results of individual businesses are presented based on our

management accounting practices and management structure.

There is no comprehensive, authoritative body of guidance for

management accounting equivalent to GAAP; therefore, the

financial results of our individual businesses are not

necessarily comparable with similar information for any other

company. We refine our methodologies from time to time as

our management accounting practices are enhanced and our

businesses and management structure change. Certain prior

period amounts have been reclassified to reflect current

methodologies and our current business and management

structure. Financial results are presented, to the extent

practicable, as if each business operated on a stand-alone

basis. Additionally, we have aggregated the results for

corporate support functions within “Other” for financial

reporting purposes.

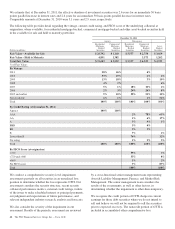

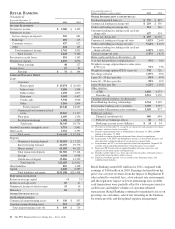

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors.

A portion of capital is intended to cover unexpected losses and

is assigned to our business segments using our risk-based

economic capital model, including consideration of the

goodwill and other intangible assets at those business

segments, as well as the diversification of risk among the

business segments. We have revised certain capital allocations

among our business segments, including amounts for prior

periods. PNC’s total capital did not change as a result of these

adjustments for any periods presented. However, capital

allocations to the segments were lower in the year-over-year

comparisons primarily due to improving credit quality.

We have allocated the allowances for loan and lease losses

and for unfunded loan commitments and letters of credit based

on our assessment of risk in the business segment loan

portfolios. Our allocation of the costs incurred by operations

and other shared support areas not directly aligned with the

businesses is primarily based on the use of services.

Total business segment financial results differ from total

consolidated results from continuing operations before

noncontrolling interests, which itself excludes the earnings

and revenue attributable to GIS through June 30, 2010 and the

related third quarter 2010 after-tax gain on the sale of GIS that

are reflected in discontinued operations. The impact of these

differences is reflected in the “Other” category. “Other” for

purposes of this Business Segments Review and the Business

Segment Highlights in the Executive Summary includes

residual activities that do not meet the criteria for disclosure as

a separate reportable business, such as gains or losses related

to BlackRock transactions, integration costs, asset and liability

management activities including net securities gains or losses,

other-than-temporary impairment of investment securities and

certain trading activities, exited businesses, alternative

investments, including private equity, intercompany

eliminations, most corporate overhead, tax adjustments that

are not allocated to business segments, and differences

between business segment performance reporting and

financial statement reporting (GAAP), including the

presentation of net income attributable to noncontrolling

interests, as the segments’ results exclude their portion of net

income attributable to noncontrolling interests.

50 The PNC Financial Services Group, Inc. – Form 10-K