PNC Bank 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F

INANCIAL

I

NSTRUMENTS

A

CCOUNTED

F

OR AT

F

AIR

V

ALUE

ON A

R

ECURRING

B

ASIS

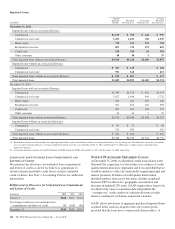

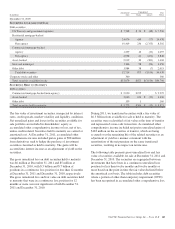

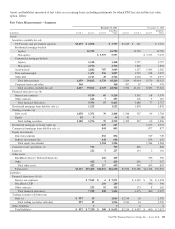

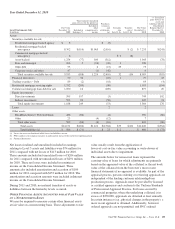

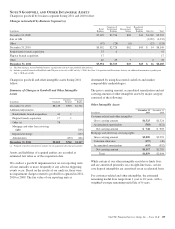

Securities Available for Sale and Trading Securities

Securities accounted for at fair value include both the

available for sale and trading portfolios. We primarily use

prices obtained from pricing services, dealer quotes, or recent

trades to determine the fair value of securities. As of

December 31, 2011, 86% of the positions in these portfolios

were priced by pricing services provided by third-party

vendors. The third-party vendors use a variety of methods

when pricing securities that incorporate relevant market data

to arrive at an estimate of what a buyer in the marketplace

would pay for a security under current market conditions. One

of the vendor’s prices are set with reference to market activity

for highly liquid assets such as U.S. Treasury and agency

securities and agency residential mortgage-backed securities,

and matrix pricing for other asset classes, such as commercial

mortgage and other asset-backed securities. Another vendor

primarily uses pricing models considering adjustments for

ratings, spreads, matrix pricing and prepayments for the

instruments we value using this service, such as non-agency

residential mortgage-backed securities, agency adjustable rate

mortgage securities, agency collateralized mortgage

obligations (CMOs), commercial mortgage-backed securities

and municipal bonds. The vendors we use provide pricing

services on a global basis and have quality management

processes in place to monitor the integrity of the valuation

inputs and the prices provided to users, including procedures

to consider and incorporate information received from pricing

servicer users who may challenge a price. We monitor and

validate the reliability of vendor pricing on an ongoing basis

through periodic pricing methodology reviews, by performing

detailed reviews of the assumptions and inputs used by the

vendor to price individual securities, and through price

validation testing. Price validation testing is performed

independent of the risk-taking function and involves

corroborating the prices received from third-party vendors

with prices from another third-party source, by reviewing

valuations of comparable instruments, or by comparison to

internal valuations. Securities not priced by one of our pricing

vendors may be valued using a dealer quote. Dealer quotes

received are typically non-binding. Securities priced using a

dealer quote are subject to corroboration either with another

dealer quote, by comparison to similar securities priced by

another third-party source, or through internal valuation in

order to validate that the quote is representative of the market.

Security prices are also validated through actual cash

settlement upon sale of a security.

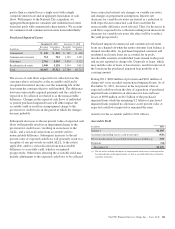

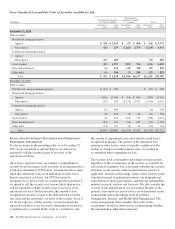

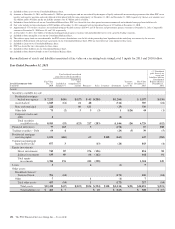

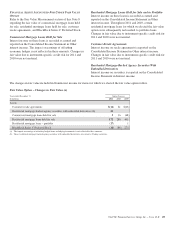

Securities are classified within the fair value hierarchy after

giving consideration to the nature and complexity of the

security, the activity level in the market for the security type,

and the observability of the inputs used to determine the fair

value. In circumstances where relevant market prices are

limited or unavailable, valuations may require significant

judgments or adjustments to determine fair value. In these

cases, the securities are classified as Level 3. As of

December 31, 2011 and 2010, securities classified as Level 3

consisted primarily of non-agency residential mortgage-

backed and asset-backed securities collateralized by first- and

second-lien residential mortgage loans. Fair value for these

securities is estimated primarily using pricing obtained from

third-party vendors. In some cases, fair value is estimated

using a dealer quote or by reference to prices of securities of a

similar vintage and collateral type. Market activity for these

security types is limited with little price transparency. As a

result, these securities are generally valued by the third-party

vendor using a discounted cash flow approach that

incorporates observable market activity where available.

Significant inputs to the valuation include prepayment

projections, credit loss assumptions, and discount rates that

are deemed representative of current market conditions.

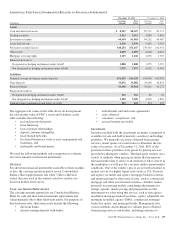

A cross-functional team comprised of representatives from

Asset & Liability Management, Finance, and Market Risk

Management oversees the governance of the processes and

methodologies used to estimate the fair value of securities and

the price validation testing that is performed. Management

meets on a regular basis to review pricing sources and trends

and the results of validation testing.

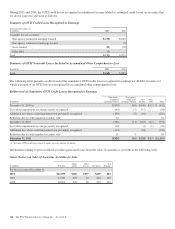

Financial Derivatives

Exchange-traded derivatives are valued using quoted market

prices and are classified as Level 1. However, the majority of

derivatives that we enter into are executed over-the-counter

and are valued using internal models. Readily observable

market inputs to these models can be validated to external

sources, including industry pricing services, or corroborated

through recent trades, dealer quotes, yield curves, implied

volatility or other market-related data. Certain derivatives,

such as total rate of return swaps, are corroborated to the

CMBX index. These derivatives are classified as Level 2.

Derivatives priced using significant management judgment or

assumptions are classified as Level 3.

The fair values of our derivatives are adjusted for

nonperformance risk including credit risk as appropriate. Our

nonperformance risk adjustment is computed using new loan

pricing and considers externally available bond spreads, in

conjunction with internal historical recovery observations.

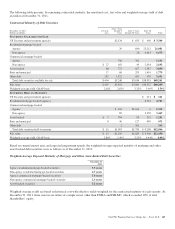

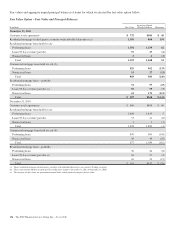

Residential Mortgage Loans Held for Sale

We have elected to account for certain residential mortgage

loans originated for sale on a recurring basis at fair value.

Residential mortgage loans are valued based on quoted market

prices, where available, prices for other traded mortgage loans

with similar characteristics, and purchase commitments and

bid information received from market participants. These

loans are regularly traded in active markets and observable

pricing information is available from market participants. The

prices are adjusted as necessary to include the embedded

servicing value in the loans and to take into consideration the

specific characteristics of certain loans that are priced based

The PNC Financial Services Group, Inc. – Form 10-K 149