PNC Bank 2011 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

hazard, and borrower and lender paid mortgage insurance with

an aggregate maximum exposure up to the specified limits for

all reinsurance contracts as follows:

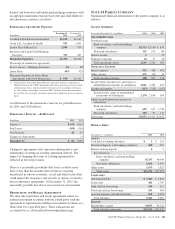

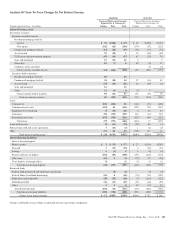

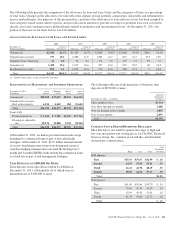

Reinsurance Agreements Exposure

In millions

December 31

2011

December 31

2010

Accidental Death & Dismemberment $2,255 $2,367

Credit Life, Accident & Health 951 1,003

Lender Placed Hazard (a) 2,899 709

Borrower and Lender Paid Mortgage

Insurance 327 463

Maximum Exposure $6,432 $4,542

Percentage of reinsurance agreements:

Excess of Loss – Mortgage Insurance 4% 8%

Quota Share 96% 92%

Maximum Exposure to Quota Share

Agreements with 100% Reinsurance $ 950 $1,001

(a) Transitioned to new Lender Placed Hazard reinsurance program in third quarter

2010 that lowered risk to PNC through the reduction in percentage of risk assumed

and the change from a stop loss feature to the purchase of catastrophe reinsurance.

As such, should a catastrophe event occur PNC will benefit from this reinsurance.

No credit for the catastrophe reinsurance protection is applied to the gross exposure

figure.

A rollforward of the reinsurance reserves for probable losses

for 2011 and 2010 follows:

Reinsurance Reserves – Rollforward

In millions 2011 2010

January 1 $ 150 $220

Paid Losses (109) (118)

Net Provision 41 51

Changes to Agreements (3)

December 31 $ 82 $150

Changes to agreements only represent entering into a new

relationship or exiting an existing agreement entirely. The

impact of changing the terms of existing agreements is

reflected in the net provision.

There is a reasonable possibility that losses could be more

than or less than the amount reserved due to on-going

uncertainty in various economic, social and other factors that

could impact the frequency and severity of claims covered by

these reinsurance agreements. At December 31, 2011, the

reasonably possible loss above our accrual was not material.

R

EPURCHASE AND

R

ESALE

A

GREEMENTS

We enter into repurchase and resale agreements where we

transfer investment securities to/from a third party with the

agreement to repurchase/resell those investment securities at a

future date for a specified price. These transactions are

accounted for as collateralized borrowings/financings.

N

OTE

24 P

ARENT

C

OMPANY

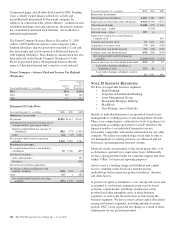

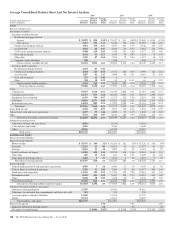

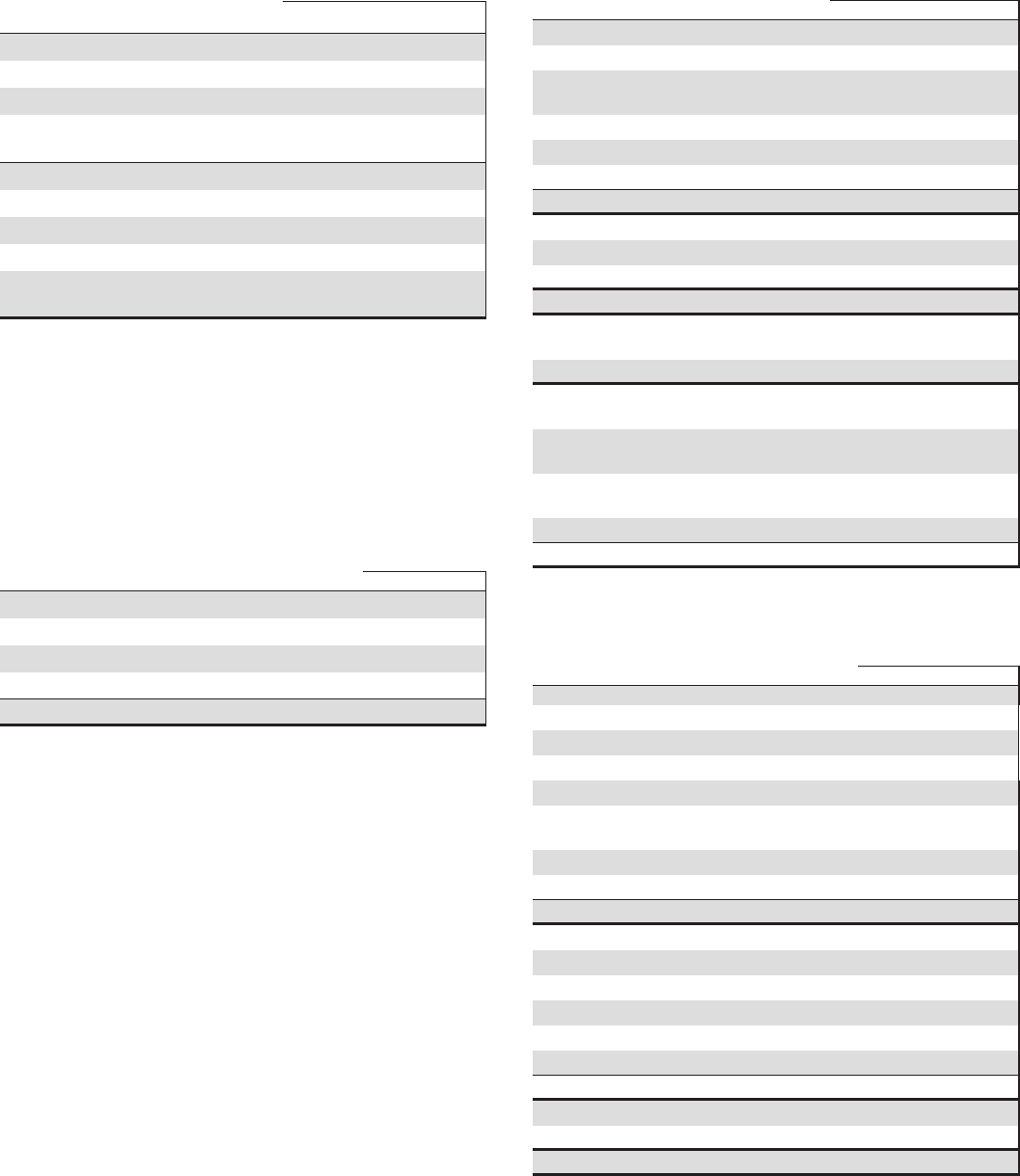

Summarized financial information of the parent company is as

follows:

Income Statement

Year ended December 31 - in millions 2011 2010 2009

Operating Revenue

Dividends from:

Bank subsidiaries and bank holding

company $2,513 $2,180 $ 839

Non-bank subsidiaries 131 575 84

Interest income 112

Noninterest income 24 27 28

Total operating revenue 2,669 2,782 963

O

PERATING

E

XPENSE

Interest expense 333 458 495

Other expense 275 (61) 21

Total operating expense 608 397 516

Income before income taxes and equity in

undistributed net income of subsidiaries 2,061 2,385 447

Income tax benefits (113) (253) (147)

Income before equity in undistributed

net income of subsidiaries 2,174 2,638 594

Equity in undistributed net income of

subsidiaries:

Bank subsidiaries and bank holding

company 699 677 1,736

Non-bank subsidiaries 183 97 117

Net income $3,056 $3,412 $2,447

Balance Sheet

December 31 - in millions 2011 2010

A

SSETS

Cash held at banking subsidiary $2$ 151

Restricted deposits with banking subsidiary 400 250

Interest-earning deposits 65

Investments in:

Bank subsidiaries and bank holding

company 35,355 34,049

Non-bank subsidiaries 2,036 1,951

Other assets 1,675 1,523

Total assets $39,474 $37,929

L

IABILITIES

Subordinated debt $ 3,303 $ 3,804

Senior debt 381 1,799

Bank affiliate borrowings 144 112

Non-bank affiliate borrowings 631 964

Accrued expenses and other liabilities 962 1,008

Total liabilities 5,421 7,687

E

QUITY

Shareholder’s equity 34,053 30,242

Total liabilities and equity $39,474 $37,929

The PNC Financial Services Group, Inc. – Form 10-K 201