PNC Bank 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

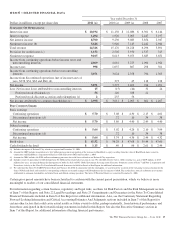

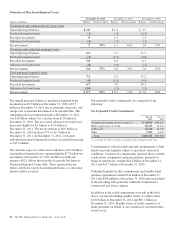

billion decrease in average total loans partially offset by a $1.7

billion increase in average total investment securities. The

overall decline in average loans reflected lower loan demand,

loan repayments, dispositions and net charge-offs. The

increase in total investment securities reflected net

investments of excess liquidity primarily in agency residential

mortgage-backed securities.

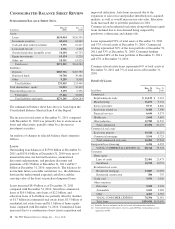

Total loans at December 31, 2011 increased $8.4 billion to

$159.0 billion compared with $150.6 billion at December 31,

2010. Average total loans decreased $1.8 billion or 1%, to

$152.0 billion, in 2011 compared with 2010 primarily as loan

growth during the second half of 2011 was offset by loan

decreases during the first half of 2011. The decrease in

average total loans primarily reflected declines in commercial

real estate of $3.7 billion and residential real estate of $2.8

billion, partially offset by a $5.1 billion increase in

commercial loans. Commercial real estate loans declined due

to loan sales, paydowns, and charge-offs. The decrease in

residential real estate was impacted by portfolio management

activities, paydowns and net charge-offs. Commercial loans

increased due to a combination of new client acquisition and

improved utilization. Loans represented 68% of average

interest-earning assets for 2011 and for 2010.

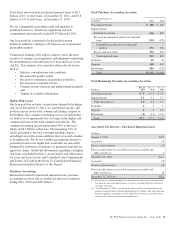

Average investment securities increased $1.7 billion, to $59.7

billion, in 2011 compared with 2010. Average securities held

to maturity increased $2.3 billion, to $9.4 billion, in 2011

compared with 2010. This increase was partially offset by the

decrease in average securities available for sale of $.6 billion,

to $50.3 billion, in 2011 compared with 2010. The increase in

average securities held to maturity was primarily a result of

transfers totalling $6.3 billion from securities available for

sale to securities held to maturity during the second and third

quarters of 2011.

Total investment securities comprised 27% of average

interest-earning assets for 2011 and 26% for 2010.

Average noninterest-earning assets totaled $41.0 billion in

2011 compared with $40.2 billion 2010.

Average total deposits were $183.0 billion for 2011 compared

with $181.9 billion for 2010. Average deposits remained

essentially flat from the prior year period primarily as a result

of decreases of $8.9 billion in average retail certificates of

deposit, $.4 billion in average other time deposits, and $.4

billion in average time deposits in foreign offices, which were

offset by increases of $6.6 billion in average noninterest-

bearing deposits, $2.5 billion in average interest-bearing

demand deposits and $1.2 billion in average savings deposits.

Total deposits at December 31, 2011 were $188.0 billion

compared with $183.4 billion at December 31, 2010 and are

further discussed within the Consolidated Balance Sheet

Review section of this Report.

Average total deposits represented 69% of average total assets

for 2011 and 2010.

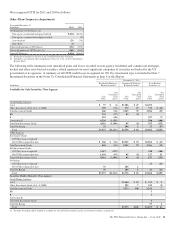

Average transaction deposits were $138.0 billion for 2011

compared with $128.4 billion for 2010. The continued

execution of the retail deposit strategy and customer

preference for liquidity contributed to the year-over-year

increase in average balances. In addition, commercial and

corporate deposit growth was very strong in 2011.

Average borrowed funds were $35.7 billion for 2011

compared with $40.2 billion for 2010. Maturities of Federal

Home Loan Bank (FHLB) borrowings drove the decline

compared to 2010. Total borrowed funds at December 31,

2011 were $36.7 billion compared with $39.5 billion at

December 31, 2010 and are further discussed within the

Consolidated Balance Sheet Review section of this Item 7. In

addition, the Liquidity Risk Management portion of the Risk

Management section of this Item 7 includes additional

information regarding our sources and uses of borrowed

funds.

B

USINESS

S

EGMENT

H

IGHLIGHTS

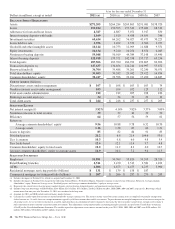

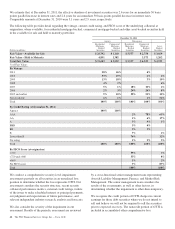

Highlights of results for 2011 and 2010 are included below.

As a result of its sale, GIS is no longer a reportable business

segment.

We refer you to Item 1 of this Report under the captions

Business Overview and Review of Business Segments for an

overview of our business segments and to the Business

Segments Review section of this Item 7 for a Results Of

Businesses – Summary table and further analysis of business

segment results for 2011 and 2010, including presentation

differences from Note 25 Segment Reporting in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

We provide a reconciliation of total business segment earnings

to PNC consolidated income from continuing operations

before noncontrolling interests as reported according to

accounting principles generally accepted in the United States

of America (GAAP) in Note 25 Segment Reporting in our

Notes To Consolidated Financial Statements of Item 8 of this

Report.

Retail Banking

Retail Banking earned $31 million for 2011 compared with

earnings of $144 million in 2010. Earnings declined from the

prior year as lower revenues from the impact of Regulation E

rules related to overdraft fees, a low interest rate environment,

and the regulatory impact of lower interchange fees on debit

card transactions, were partially offset by a lower provision

for credit losses and higher volumes of customer-initiated

transactions. Retail Banking continued to maintain its focus on

growing core customers, selectively investing in the business

for future growth, and disciplined expense management.

34 The PNC Financial Services Group, Inc. – Form 10-K