PNC Bank 2011 Annual Report Download - page 205

Download and view the complete annual report

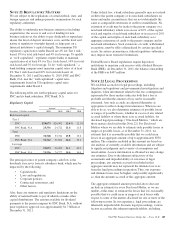

Please find page 205 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As a result of the number and range of authorities

conducting the investigations and inquiries, as well as

the nature of these types of investigations and

inquiries, among other factors, PNC cannot at this

time predict the ultimate overall cost to or effect on

PNC from potential governmental, legislative or

regulatory actions arising out of these investigations

and inquiries.

• In April 2011, as a result of a publicly-

disclosed interagency horizontal review of

residential mortgage servicing operations at

fourteen federally regulated mortgage

servicers, PNC entered into a consent order

with the Board of Governors of the Federal

Reserve System and PNC Bank entered into a

consent order with the Office of the

Comptroller of the Currency. Collectively,

these consent orders describe certain

foreclosure-related practices and controls that

the regulators found to be deficient and require

PNC and PNC Bank to, among other things,

develop and implement plans and programs to

enhance PNC’s residential mortgage servicing

and foreclosure processes, retain an

independent consultant to review certain

residential mortgage foreclosure actions, take

certain remedial actions, and oversee

compliance with the orders and the new plans

and programs. The two orders do not foreclose

the potential for civil money penalties from

either of these regulators.

In connection with these orders, PNC has

established a Compliance Committee of the

Boards of PNC and PNC Bank to monitor and

coordinate PNC’s and PNC Bank’s

implementation of the commitments under the

orders. PNC and PNC Bank are executing

Action Plans designed to meet the requirements

of the orders. Consistent with the orders, PNC

has also engaged an independent consultant to

conduct a review of certain residential

foreclosure actions, including those identified

through borrower complaints, and identify

whether any remedial actions for borrowers are

necessary. The consultant’s review is

underway. PNC expects to take any required

remedial actions coming out of this review,

although the full scope and nature of any such

remedial actions is not currently known.

• On February 9, 2012, the Department of

Justice, other federal regulators and 49 state

attorneys general announced agreements with

the five largest mortgage servicers. Under these

agreements, which remain subject to, among

other things, definitive documentation and

court approval, the mortgage servicers will

make cash payments to federal and state

governments, provide various forms of

financial relief to borrowers, and implement

new mortgage servicing standards. These

governmental authorities are continuing their

review of, and have engaged in discussions

with, other mortgage servicers, including PNC,

that were subject to the interagency horizontal

review, which could result in the imposition of

substantial payments and other forms of relief

(similar to that agreed to by the five largest

servicers) on some or all of these mortgage

servicers, including PNC. Whether and to what

extent any such relief may be imposed on PNC

and other smaller servicers is not yet known.

• PNC has received subpoenas from the U.S.

Attorney’s Office for the Southern District of

New York concerning National City Bank’s

lending practices in connection with loans

insured by the Federal Housing Administration

(FHA) as well as certain non-FHA-insured loan

origination, sale and securitization practices.

The U.S. Attorney’s Office inquiry is in its

early stage and PNC is cooperating with the

investigation.

• The SEC previously commenced investigations of

activities of National City prior to its acquisition by

PNC. The SEC has requested, and we have provided

to the SEC, documents concerning, among other

things, National City’s capital-raising activities, loan

underwriting experience, allowance for loan losses,

marketing practices, dividends, bank regulatory

matters and the sale of First Franklin Financial

Corporation.

• The SEC has been conducting an investigation into

events at Equipment Finance LLC (EFI), a subsidiary

of Sterling Financial Corporation, which PNC

acquired in April 2008. The United States Attorney’s

Office for the Eastern District of Pennsylvania has

also been investigating the EFI situation.

Our practice is to cooperate fully with regulatory and

governmental investigations, audits and other inquiries,

including those described in this Note 22.

Other

In addition to the proceedings or other matters described

above, PNC and persons to whom we may have

indemnification obligations, in the normal course of business,

are subject to various other pending and threatened legal

proceedings in which claims for monetary damages and other

relief are asserted. We do not anticipate, at the present time,

that the ultimate aggregate liability, if any, arising out of such

other legal proceedings will have a material adverse effect on

our financial position. However, we cannot now determine

196 The PNC Financial Services Group, Inc. – Form 10-K