PNC Bank 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For debt securities, a critical component of the evaluation for

OTTI is the identification of credit-impaired securities, where

management does not expect to receive cash flows sufficient

to recover the entire amortized cost basis of the security. The

paragraphs below describe our process for identifying credit

impairment for our most significant categories of securities

not backed by the US government or its agencies.

Non-Agency Residential Mortgage-Backed Securities and

Asset-Backed Securities Collateralized by First-Lien and

Second-Lien Residential Mortgage Loans

Potential credit losses on these securities are evaluated on a

security by security basis. Collateral performance assumptions

are developed for each security after reviewing collateral

composition and collateral performance statistics. This

includes analyzing recent delinquency roll rates, loss

severities, voluntary prepayments, and various other collateral

and performance metrics. This information is then combined

with general expectations on the housing market and other

economic factors to develop estimates of future performance.

Security level assumptions for prepayments, loan defaults, and

loss given default are applied to every security using a third-

party cash flow model. The third-party cash flow model then

generates projected cash flows according to the structure of

each security. Based on the results of the cash flow analysis,

we determine whether we will recover the amortized cost

basis of our security.

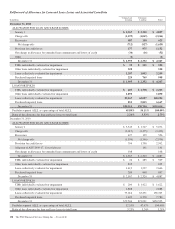

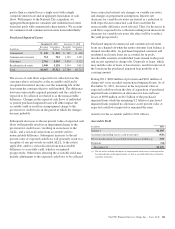

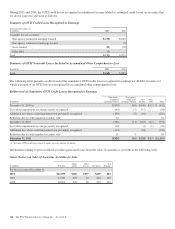

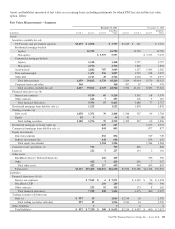

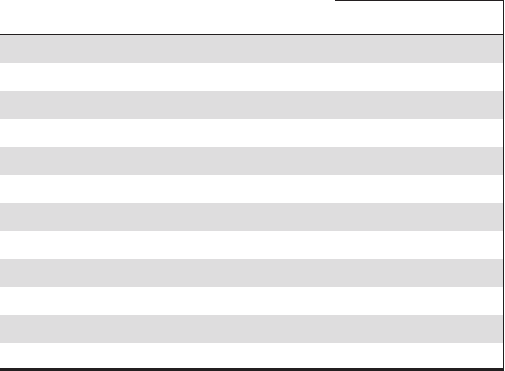

The following table provides detail on the significant

assumptions used to determine credit impairment for

non-agency residential mortgage-backed and asset-backed

securities:

Credit Impairment Assessment Assumptions – Non-Agency

Residential Mortgage-Backed and Asset-Backed

Securities (a)

December 31, 2011 Range

Weighted-

average (b)

Long-term prepayment rate (annual CPR)

Prime 7-20% 14%

Alt-A 5-12 6

Option ARM 3-6 3

Remaining collateral expected to default

Prime 1-49% 19%

Alt-A 1-59 34

Option ARM 16-81 61

Loss severity

Prime 5-70% 46%

Alt-A 18-82 57

Option ARM 41-69 58

(a) Collateralized by first and second-lien non-agency residential mortgage loans.

(b) Calculated by weighting the relevant assumption for each individual security by the

current outstanding cost basis of the security.

Non-Agency Commercial Mortgage-Backed Securities

Credit losses on these securities are measured using property-

level cash flow projections and forward-looking property

valuations. Cash flows are projected using a detailed analysis

of net operating income (NOI) by property type which, in turn,

is based on the analysis of NOI performance over the past

several business cycles combined with PNC’s economic

outlook. Loss severities are based on property price

projections, which are calculated using capitalization rate

projections. The capitalization rate projections are based on a

combination of historical capitalization rates and expected

capitalization rates implied by current market activity, our

outlook and relevant independent industry research, analysis

and forecasts. Securities exhibiting weaker performance

within the model are subject to further analysis. This analysis

is performed at the loan level, and includes assessing local

market conditions, reserves, occupancy, rent rolls and master/

special servicer details.

The PNC Financial Services Group, Inc. – Form 10-K 145