PNC Bank 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

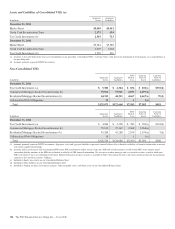

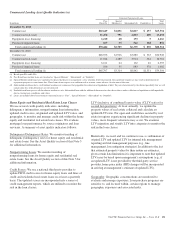

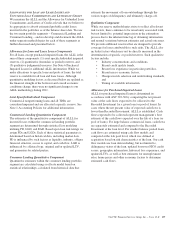

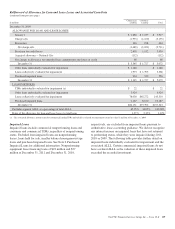

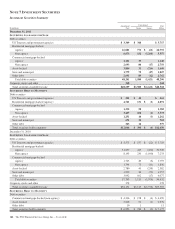

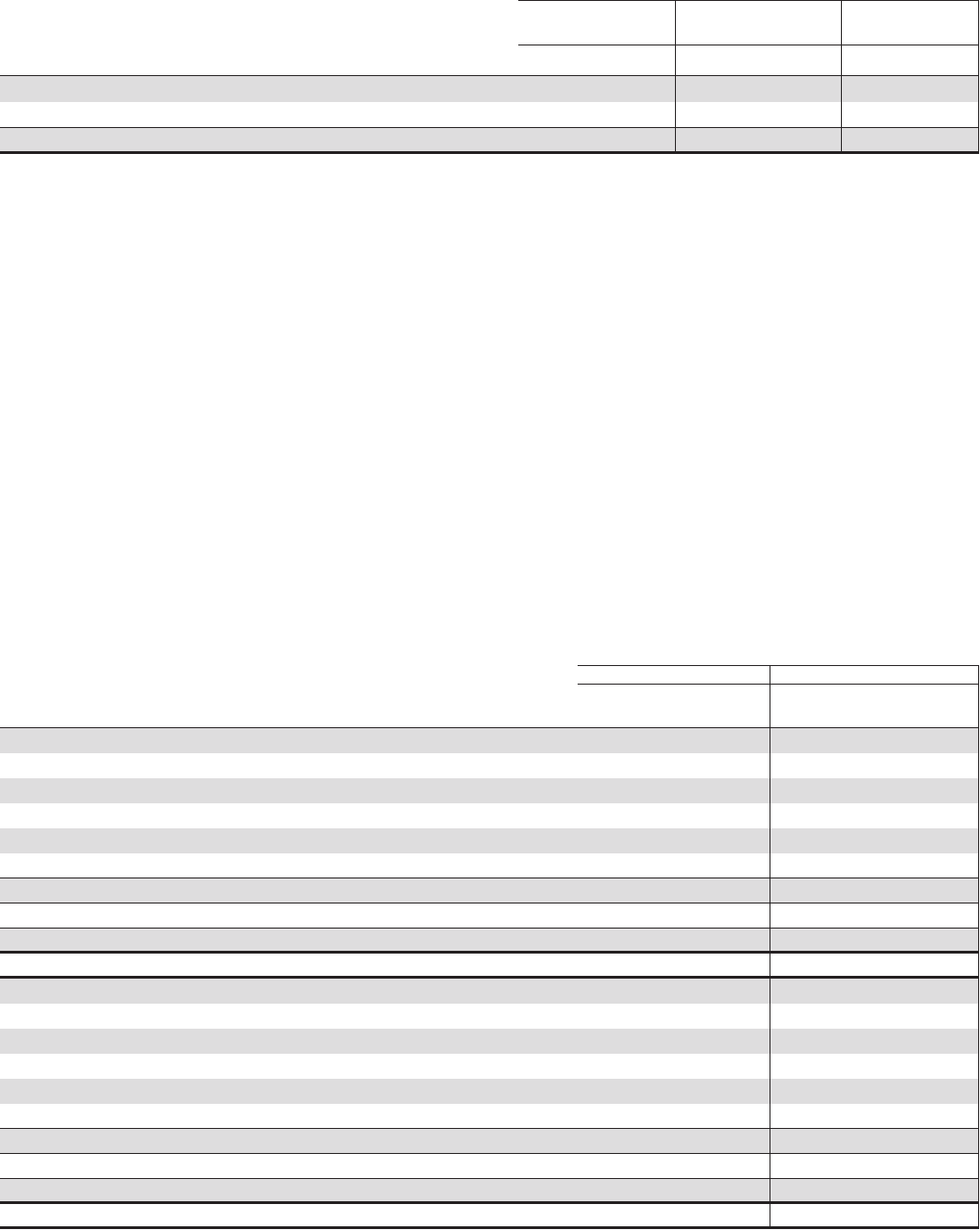

Consumer Real Estate Secured Asset Quality Indicators

Higher Risk Loans (a) All Other Loans

Home Equity and

Residential Real

Estate Loans

December 31, 2010 – dollars in millions Amount

% of Total

Loans Amount

% of Total

Loans

Recorded Investment

Amount

Home equity (b) $1,203 4% $33,023 96% $34,226

Residential real estate (c) 671 4% 15,328 96% 15,999

Total (d) $1,874 4% $48,351 96% $50,225

(a) At December 31, 2010, higher risk home equity loans are based upon updated FICO and original LTV while residential real estate higher risk loans are based upon updated FICO and

a combination of original and updated LTV. Higher risk loans exclude loans held for sale and government insured or guaranteed loans.

(b) We consider loans to be higher risk with an updated FICO of less than or equal to 660 and an original or updated LTV greater than or equal to 90%. The majority of the December 31,

2010 balance related to higher risk home equity loans is geographically distributed throughout the following areas: Pennsylvania 28%, Ohio 13%, New Jersey 11%, Illinois 7%,

Michigan 6%, and Kentucky 5%. All other states, none of which comprise more than 4%, make up the remainder of the balance.

(c) We consider loans to be higher risk with an updated FICO of less than or equal to 660 and an original or updated LTV greater than or equal to 90%. The majority of the December 31,

2010 balance related to higher risk residential real estate loans is geographically distributed throughout the following areas: California 23%, Florida 11%, Illinois 11%, and Maryland

8%. All other states, none of which comprise more than 5%, make up the remainder of the balance.

(d) Total loans include purchased impaired loans of $6.4 billion at December 31, 2010.

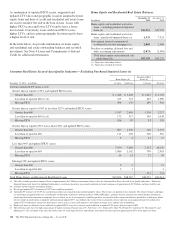

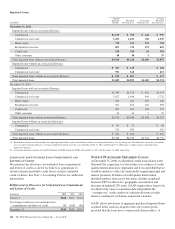

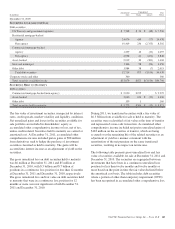

Credit Card and Other Consumer Loan Classes

We monitor a variety of asset quality information in the

management of the credit card and other consumer loan

classes. Other consumer loan classes include education,

automobile, and other secured and unsecured lines and loans.

Along with the trending of delinquencies and losses for each

class, FICO credit score updates are generally obtained on a

monthly basis, as well as a variety of credit bureau attributes.

Loans with high FICO scores tend to have a lower likelihood

of loss. Conversely, loans with low FICO scores tend to have

a higher likelihood of loss.

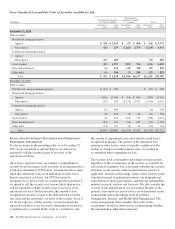

Consumer Purchased Impaired Loans Class

Estimates of the expected cash flows primarily determine the

credit impacts of consumer purchased impaired loans.

Consumer cash flow estimates are influenced by a number of

credit related items, which include, but are not limited to:

estimated real estate values, payment patterns, updated FICO

scores, the current economic environment, updated LTV ratios

and the date of origination. These key factors are monitored to

help ensure that concentrations of risk are mitigated and cash

flows are maximized.

See Note 6 Purchased Impaired Loans for additional information.

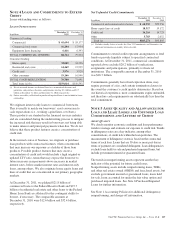

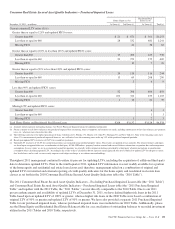

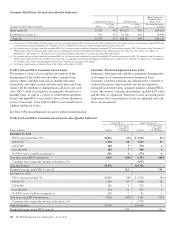

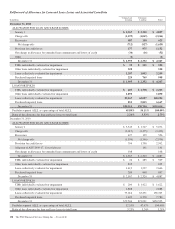

Credit Card and Other Consumer Loan Classes Asset Quality Indicators

Credit Card (a) Other Consumer (b)

Dollars in millions Amount

% of Total Loans

Using FICO

Credit Metric Amount

% of Total Loans

Using FICO

Credit Metric

December 31, 2011

FICO score greater than 719 $2,016 51% $ 5,556 61%

650 to 719 1,100 28 2,125 23

620 to 649 184 5 370 4

Less than 620 284 7 548 6

No FICO score available or required (c) 392 9 574 6

Total loans using FICO credit metric 3,976 100% 9,173 100%

Consumer loans using other internal credit metrics (b) 9,993

Total loan balance $3,976 $19,166

Weighted-average current FICO score (d) 723 739

December 31, 2010

FICO score greater than 719 $1,895 48% $ 4,135 58%

650 to 719 1,149 29 1,984 28

620 to 649 183 5 295 4

Less than 620 424 11 652 9

No FICO score available or required (c) 269 7 81 1

Total loans using FICO credit metric 3,920 100% 7,147 100%

Consumer loans using other internal credit metrics (b) 9,799

Total loan balance $3,920 $16,946

Weighted-average current FICO score (d) 709 713

134 The PNC Financial Services Group, Inc. – Form 10-K