PNC Bank 2011 Annual Report Download - page 80

Download and view the complete annual report

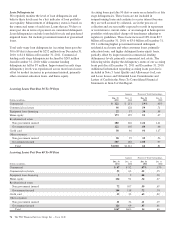

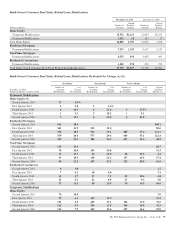

Please find page 80 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2011 and 2010, unresolved and settled investor

indemnification and repurchase claims were primarily related to

one of the following alleged breaches in representations and

warranties: 1) misrepresentation of income, assets or

employment; 2) property evaluation or status issues (e.g.,

appraisal, title, etc.); 3) underwriting guideline violations; or 4)

mortgage insurance rescissions. During 2011, the volume of

residential mortgage indemnification and repurchase claims

increased reflecting the prolonged weak residential housing

sector and the continuing industry trend of Agency investors

pursuing strategies to aggressively reduce their exposure to

losses on purchased loans. This increase, along with an increase

in the average time to resolve investor claims, has contributed

to the higher balances of unresolved claims for residential

mortgages at December 31, 2011. The extended period of time

to resolve these investor claims coupled with higher claim

rescission rates drove the decline in residential mortgage

indemnification and repurchase settlement activity in 2011. As

the level of residential mortgage claims increased over the past

couple of years, management focused its efforts on improving

its process to review and respond to these claims. The lower

balance of unresolved indemnification and repurchase claims

for home equity loans/lines at December 31, 2011 was

primarily attributed to pooled settlement activity and higher

claim rescission rates during 2011. Management also

implemented enhancements to its process of reviewing and

responding to investor claims for this sold portfolio. The pooled

settlement activity also drove the year-over-year increase in

home equity indemnification and repurchase settlements. As a

result, certain investor indemnification and repurchase requests

received in 2010 were not resolved until the pooled settlement

activity occurred in 2011.

For the first and second-lien mortgage balances of unresolved

and settled claims contained in the tables above, a significant

amount of these claims were associated with sold loans

originated through correspondent lender and broker

origination channels. For the home equity loans/lines sold

portfolio, all unresolved and settled claims relate to loans

originated through the broker origination channel. In certain

instances when indemnification or repurchase claims are

settled for these types of sold loans, we have recourse back to

the correspondent lenders, brokers and other third-parties

(e.g., contract underwriting companies, closing agents,

appraisers, etc.). Depending on the underlying reason for the

investor claim, we determine our ability to pursue recourse

with these parties and file claims with them accordingly. Our

historical recourse recovery rate has been insignificant as our

efforts have been impacted by the inability of such parties to

reimburse us for their recourse obligations (e.g., their capital

availability or whether they remain in business) or contractual

limitations that limit our ability to pursue recourse with these

parties (e.g., loss caps, statutes of limitations, etc.). Broker

recourse activities, to the extent material, as well as the trends

in unresolved claim and indemnification and repurchase

activity described above are considered in the determination

of our estimated indemnification and repurchase liability

detailed below.

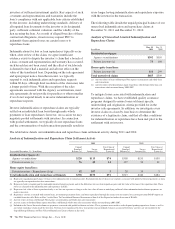

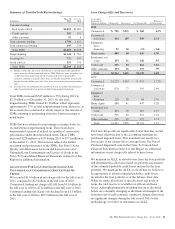

Origination and sale of residential mortgages is an ongoing

business activity and, accordingly, management continually

assesses the need to recognize indemnification and repurchase

liabilities pursuant to the associated investor sale agreements.

We establish indemnification and repurchase liabilities for

estimated losses on sold first and second-lien mortgages and

home equity loans/lines for which indemnification is expected

to be provided or for loans that are expected to be

repurchased. For the first and second-lien mortgage sold

portfolio, we have established an indemnification and

repurchase liability pursuant to investor sale agreements based

on claims made and our estimate of future claims on a loan by

loan basis. These relate primarily to loans originated during

2006-2008. For the home equity loans/lines sold portfolio, we

have established indemnification and repurchase liabilities

based upon this same methodology for loans sold during

2005-2007.

Indemnification and repurchase liabilities, which are included

in Other liabilities on the Consolidated Balance Sheet, are

initially recognized when loans are sold to investors and are

subsequently evaluated by management. Initial recognition

and subsequent adjustments to the indemnification and

repurchase liability for the sold residential mortgage portfolio

are recognized in Residential mortgage revenue on the

Consolidated Income Statement. Since PNC is no longer

engaged in the brokered home equity lending business, only

subsequent adjustments are recognized to the home equity

loans/lines indemnification and repurchase liability. These

adjustments are recognized in Other noninterest income on the

Consolidated Income Statement.

Management’s subsequent evaluation of these indemnification

and repurchase liabilities is based upon trends in

indemnification and repurchase requests, actual loss

experience, risks in the underlying serviced loan portfolios,

and current economic conditions. As part of its evaluation,

management considers estimated loss projections over the life

of the subject loan portfolio. We believe our indemnification

and repurchase liabilities appropriately reflect the estimated

probable losses on investor indemnification and repurchase

claims at December 31, 2011 and December 31, 2010.

At December 31, 2011 and December 31, 2010, the liability

for estimated losses on indemnification and repurchase claims

for residential mortgages totaled $83 million and $144

million, respectively. The year-over-year decline in this

liability reflects lower estimated losses driven primarily by the

seasoning of the sold portfolio and higher claim rescission

rates as described above. This decrease resulted despite higher

levels of investor indemnification and repurchase claim

activity. The indemnification and repurchase liability for

home equity loans/lines was $47 million and $150 million at

The PNC Financial Services Group, Inc. – Form 10-K 71