PNC Bank 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

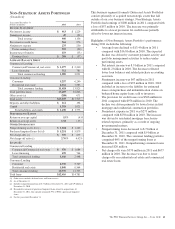

billion decreased $194 million, or 3%, from the prior year

primarily due to credit risk management activities within the

portfolio offsetting new client acquisition.

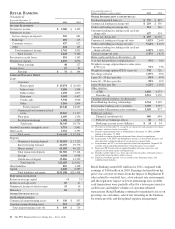

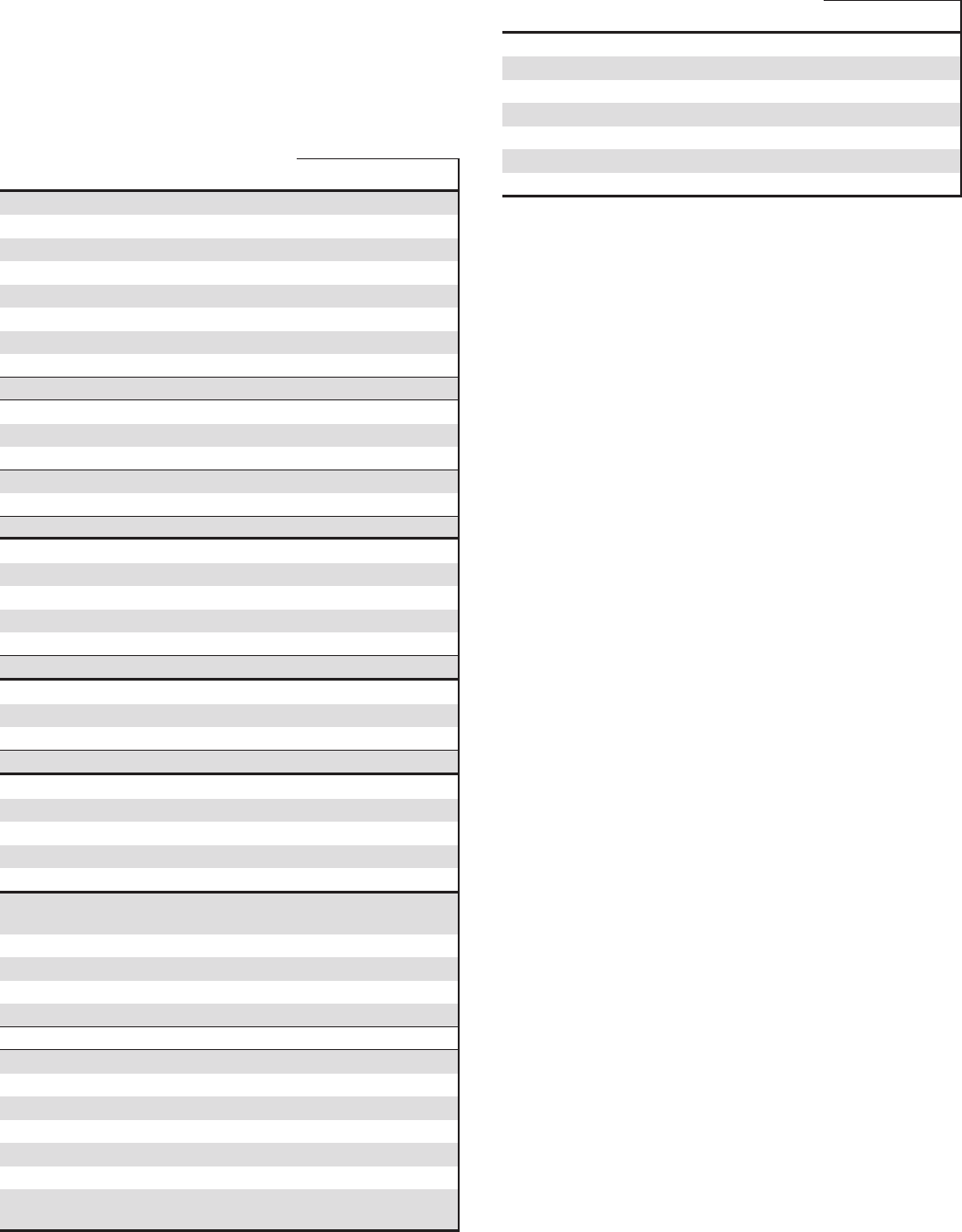

R

ESIDENTIAL

M

ORTGAGE

B

ANKING

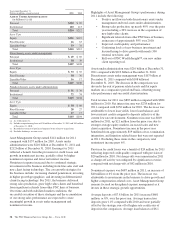

(Unaudited)

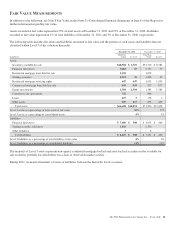

Year ended December 31

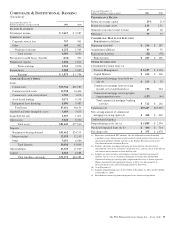

Dollars in millions, except as noted 2011 2010

I

NCOME

S

TATEMENT

Net interest income $ 201 $ 256

Noninterest income

Loan servicing revenue

Servicing fees 226 242

Net MSR hedging gains 220 245

Loan sales revenue 282 231

Other 19 18

Total noninterest income 747 736

Total revenue 948 992

Provision for credit losses 55

Noninterest expense 797 563

Pretax earnings 146 424

Income taxes 59 155

Earnings $87$ 269

A

VERAGE

B

ALANCE

S

HEET

Portfolio loans $ 2,771 $2,649

Loans held for sale 1,492 1,322

Mortgage servicing rights (MSR) 905 1,017

Other assets 6,102 4,259

Total assets $11,270 $9,247

Deposits $ 1,675 $2,716

Borrowings and other liabilities 3,877 2,823

Capital 731 919

Total liabilities and equity $ 6,283 $6,458

P

ERFORMANCE

R

ATIOS

Return on average capital 12% 29%

Return on average assets .77 2.91

Noninterest income to total revenue 79 74

Efficiency 84 57

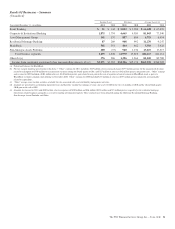

R

ESIDENTIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

(in billions)

Beginning of period $ 125 $ 145

Acquisitions 6

Additions 12 10

Repayments/transfers (25) (30)

End of period $ 118 $ 125

Servicing portfolio statistics: (a)

Fixed rate 90% 89%

Adjustable rate/balloon 10% 11%

Weighted-average interest rate 5.38% 5.62%

MSR capitalized value (in billions) $.7$ 1.0

MSR capitalization value (in basis points) 54 82

Weighted-average servicing fee (in basis

points) 29 30

Year ended December 31

Dollars in millions, except as noted 2011 2010

O

THER

I

NFORMATION

Loan origination volume (in billions) $11.4 $10.5

Percentage of originations represented by:

Agency and government programs 100% 99%

Refinance volume 76% 74%

Total nonperforming assets (a) (b) $76 $ 172

Purchased impaired loans (a) (c) $ 112 $ 161

(a) As of December 31.

(b) Includes nonperforming loans of $31 million at December 31, 2011 and $109

million at December 31, 2010.

(c) Recorded investment of purchased impaired loans related to acquisitions.

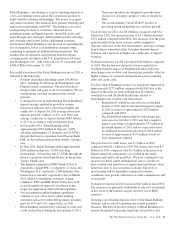

Residential Mortgage Banking earned $87 million in 2011

compared with $269 million in 2010. The decline in earnings

was driven by an increase in noninterest expense associated

with increased costs for residential mortgage foreclosure-

related expenses, primarily as a result of ongoing

governmental matters, and lower net interest income, partially

offset by an increase in loan originations and higher loans

sales revenue.

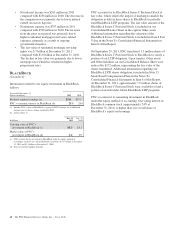

Highlights of Residential Mortgage Banking’s performance

during 2011 include the following:

• Total loan originations were $11.4 billion for 2011

compared with $10.5 billion in 2010. Refinance

volume increased compared to the 2010 period.

Loans continue to be originated primarily through

direct channels under FNMA, FHLMC and FHA/VA

agency guidelines.

• Investors having purchased mortgage loans may

request PNC to indemnify them against losses on

certain loans or to repurchase loans that they believe

do not comply with applicable contractual loan

origination covenants and representations and

warranties we have made. At December 31, 2011, the

liability for estimated losses on repurchase and

indemnification claims for the Residential Mortgage

Banking business segment was $83 million compared

with $144 million at December 31, 2010. See the

Recourse And Repurchase Obligations section of this

Item 7 and Note 23 Commitments and Guarantees in

the Notes To Consolidated Financial Statements in

Item 8 of this Report for additional information.

• Residential mortgage loans serviced for others

totalled $118 billion at December 31, 2011 compared

with $125 billion at December 31, 2010 as payoffs

continued to outpace new direct loan origination

volume.

• Noninterest income was $747 million in 2011

compared with $736 million in 2010. The increase

resulted from higher loan sales revenue driven by

higher loan origination volume, partially offset by

lower net hedging gains on residential mortgage

servicing rights and lower loan servicing revenue.

The PNC Financial Services Group, Inc. – Form 10-K 59