PNC Bank 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

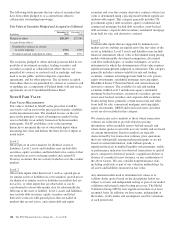

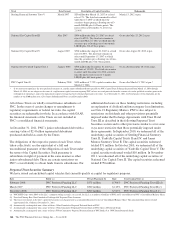

appraisals are regularly reviewed. We have a real estate

valuation services group whose sole function is to manage the

real estate appraisal solicitation and evaluation process for

commercial loans. All third-party appraisals are reviewed by

this group, including consideration of comments/questions on

the appraisal by the reviewer, customer relationship manager,

credit officer, and underwriter. Upon resolving these

comments/questions through discussions with the third-party

appraiser, adjustments to the initial appraisal may occur and

be incorporated into the final issued appraisal report.

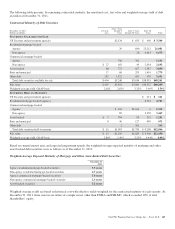

For loans secured by commercial properties where the

underlying collateral is $250,000 and less, there is no

requirement to obtain an appraisal. In instances where an

appraisal is not obtained, the collateral value is determined

consistent with external third-party appraisal standards, by an

internal person independent of the lending customer

relationship/loan production process. If an appraisal is

outdated due to changed project or market conditions, or if the

net book value is utilized, management uses a Loss Given

Default (LGD) percentage which represents the exposure PNC

expects to lose in the event a borrower defaults on an

obligation. Accordingly, LGD is a function of collateral

recovery rates and loan-to-value. Collateral recovery rates

vary based upon collateral type and represent the expected

recovery amount on defaulted loans from the collateral after

workout costs. Those rates are established based upon actual

PNC loss experience and external market data.

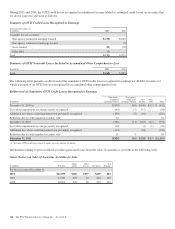

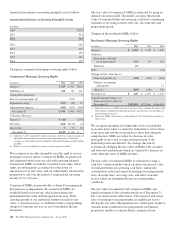

The amounts below for loans held for sale represent the

carrying value of loans for which adjustments are primarily

based on observable market data, management’s internal

assumptions or the appraised value of collateral. The fair

value determination of the equity investment resulting in an

impairment loss included below was based on observable

market data for other comparable entities as adjusted for

internal assumptions and unobservable inputs. The amounts

below for commercial mortgage servicing rights reflect an

impairment of three strata at both December 31, 2011 and

December 31, 2010, respectively. The fair value of

commercial mortgage servicing rights is estimated by using an

internal valuation model. The model calculates the present

value of estimated future net servicing cash flows considering

estimates of servicing revenue and costs, discount rates and

prepayment speeds. The amounts below for OREO and

foreclosed assets are primarily based on appraised values or

sales price less costs to sell. The amounts below for long-lived

assets held for sale represent the carrying value of the asset

(lower of recorded net book value or sales price less estimated

cost to sell) based upon a recent appraisal, a recent sales offer,

or management assumptions which take into consideration

changes in the market environment or changes in property

conditions.

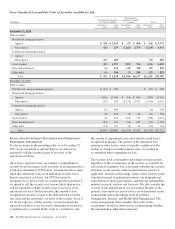

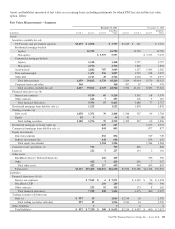

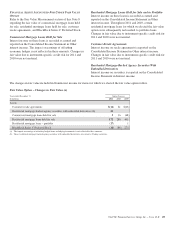

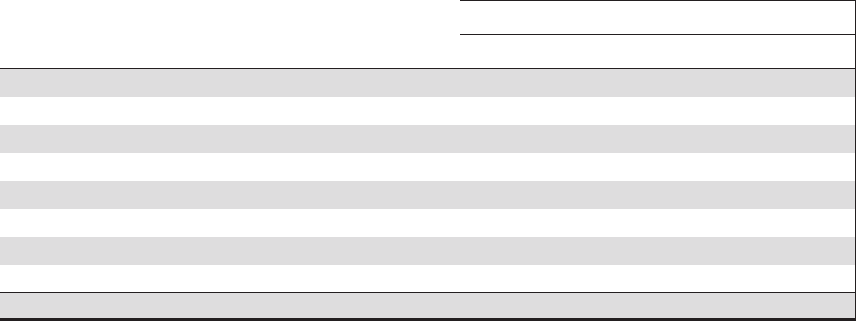

Fair Value Measurements – Nonrecurring (a)

Fair Value

Gains (Losses)

Year ended

In millions

December 31

2011

December 31

2010

December 31

2011

December 31

2010

Assets

Nonaccrual loans $ 253 $ 429 $ (49) $81

Loans held for sale 130 350 (2) (93)

Equity investments 13(2) (3)

Commercial mortgage servicing rights 457 644 (157) (40)

Other intangible assets 1

OREO and foreclosed assets 223 245 (71) (103)

Long-lived assets held for sale 17 25 (5) (30)

Total assets $1,081 $1,697 $(286) $(188)

(a) All Level 3.

154 The PNC Financial Services Group, Inc. – Form 10-K