PNC Bank 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

ONPERFORMING

A

SSETS AND

L

OAN

D

ELINQUENCIES

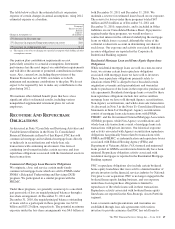

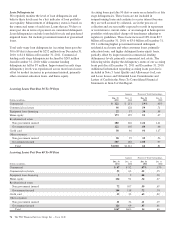

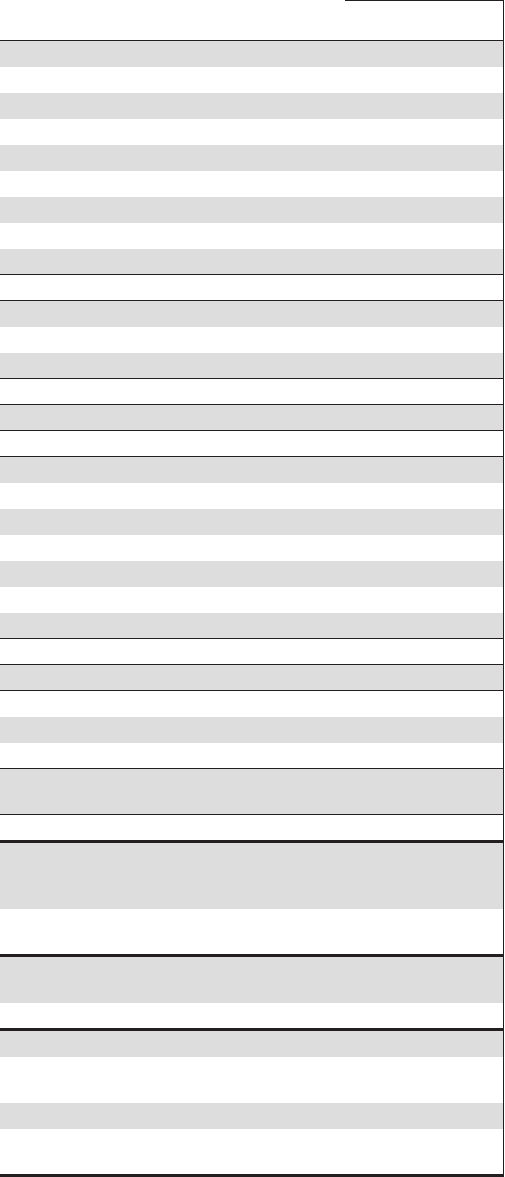

Nonperforming Assets, including OREO and Foreclosed

Assets

Nonperforming assets include nonaccrual loans and leases for

which ultimate collectability of the full amount of contractual

principal and interest is not probable and include TDRs,

OREO and foreclosed assets. Loans held for sale, government

insured or guaranteed loans, purchased impaired loans and

loans accounted for under the fair value option are excluded

from nonperforming loans. Additional information regarding

our nonaccrual policies is included in Note 1 Accounting

Policies in the Notes To Consolidated Financial Statements in

Item 8 of this Report. A summary of nonperforming assets is

presented in the table below.

Nonperforming assets decreased $967 million from

December 31, 2010, to $4.2 billion at December 31, 2011.

Nonperforming loans decreased $906 million to $3.6 billion

while OREO and foreclosed assets decreased $61 million to

$596 million. The ratio of nonperforming assets to total loans

and OREO and foreclosed assets was 2.60% at December 31,

2011 and 3.39% at December 31, 2010. The ratio of

nonperforming loans to total loans declined to 2.24% at

December 31, 2011, compared to 2.97% at December 31,

2010. The decrease in nonperforming loans from

December 31, 2010 occurred across all loan classes except for

home equity and credit card. Home equity nonperforming

loans continued to increase as a result of the extended period

of time to exit problem loans from the portfolio and the

additions of modifications which result in TDRs. Total

nonperforming assets have declined $2.3 billion, or 35%, from

their peak of $6.4 billion at March 31, 2010.

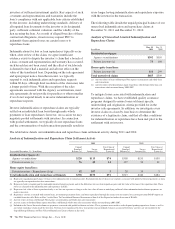

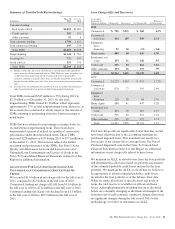

At December 31, 2011, TDRs included in nonperforming

loans increased to $1.1 billion or 32% of total nonperforming

loans compared to $784 million or 18% of nonperforming

loans as of December 31, 2010. Within consumer

nonperforming loans, residential real estate TDRs comprise

51% of total residential real estate nonperforming loans at

December 31, 2011, up from 30% at December 31, 2010.

Similarly, home equity TDRs comprise 77% of home equity

nonperforming loans at December 31, 2011, up slightly from

75% at December 31, 2010. The level of TDRs in these

portfolios is expected to result in elevated nonperforming loan

levels for longer periods because TDRs remain in

nonperforming status until a borrower has made at least six

consecutive months of payments under the modified terms or

ultimate resolution occurs.

At December 31, 2011, our largest nonperforming asset was

$28 million in the Accommodation and Food Services

Industry and our average nonperforming loan associated with

commercial lending was under $1 million. Our ten largest

outstanding nonperforming assets are all from the commercial

lending portfolio and represent 9% and 5% of total

commercial lending nonperforming loans and total

nonperforming assets, respectively, as of December 31, 2011.

Nonperforming Assets By Type

In millions

Dec. 31

2011

Dec. 31

2010

Nonperforming loans

Commercial

Retail/wholesale trade $ 109 $ 197

Manufacturing 117 250

Service providers 147 218

Real estate related (a) 252 233

Financial services 36 16

Health care 29 50

Other industries 209 289

Total commercial 899 1,253

Commercial real estate

Real estate projects 1,051 1,422

Commercial mortgage 294 413

Total commercial real estate 1,345 1,835

Equipment lease financing 22 77

TOTAL COMMERCIAL LENDING 2,266 3,165

Consumer (b)

Home equity 529 448

Residential real estate

Residential mortgage (c) 685 764

Residential construction 41 54

Credit card (d) 8

Other consumer 31 35

TOTAL CONSUMER LENDING 1,294 1,301

Total nonperforming loans (e) 3,560 4,466

OREO and foreclosed assets

Other real estate owned (OREO) (f) 561 589

Foreclosed and other assets 35 68

TOTAL OREO AND FORECLOSED

ASSETS 596 657

Total nonperforming assets $4,156 $5,123

Amount of commercial lending

nonperforming loans contractually current

as to remaining principal and interest $ 632 $ 988

Percentage of total commercial lending

nonperforming loans 28% 31%

Amount of TDRs included in nonperforming

loans $1,141 $ 784

Percentage of total nonperforming loans 32% 18%

Nonperforming loans to total loans 2.24% 2.97%

Nonperforming assets to total loans, OREO

and foreclosed assets 2.60 3.39

Nonperforming assets to total assets 1.53 1.94

Allowance for loan and lease losses to total

nonperforming loans (e) (g) 122 109

(a) Includes loans related to customers in the real estate and construction industries.

(b) Excludes most consumer loans and lines of credit, not secured by residential real

estate, which are charged off after 120 to 180 days past due and are not placed on

nonperforming status.

(c) Effective in 2011, nonperforming residential mortgage excludes loans of $61 million

accounted for under the fair value option as of December 31, 2011. The comparable

balance at December 31, 2010 was not material.

74 The PNC Financial Services Group, Inc. – Form 10-K