PNC Bank 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

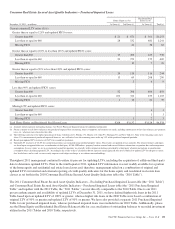

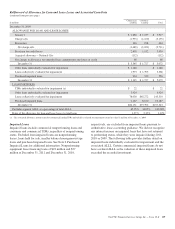

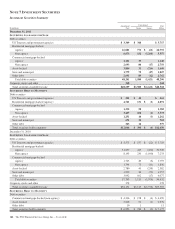

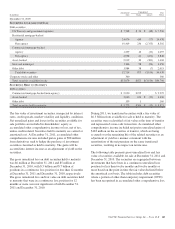

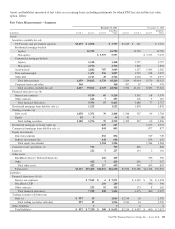

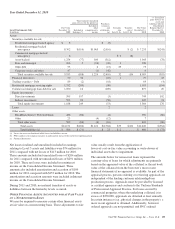

In millions

Amortized

Cost

Unrealized Fair

ValueGains Losses

December 31, 2009

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

US Treasury and government agencies $ 7,548 $ 20 $ (48) $ 7,520

Residential mortgage-backed

Agency 24,076 439 (77) 24,438

Non-agency 10,419 236 (2,353) 8,302

Commercial mortgage-backed

Agency 1,299 10 (12) 1,297

Non-agency 4,028 42 (222) 3,848

Asset-backed 2,019 30 (381) 1,668

State and municipal 1,346 58 (54) 1,350

Other debt 1,984 38 (7) 2,015

Total debt securities 52,719 873 (3,154) 50,438

Corporate stocks and other 360 360

Total securities available for sale $53,079 $873 $(3,154) $50,798

S

ECURITIES

H

ELD TO

M

ATURITY

Debt securities

Commercial mortgage-backed (non-agency) $ 2,030 $195 $ 2,225

Asset-backed 3,040 109 $ (13) 3,136

Other debt 159 1 160

Total securities held to maturity $ 5,229 $305 $ (13) $ 5,521

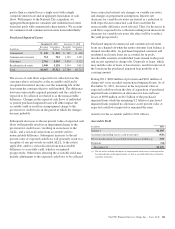

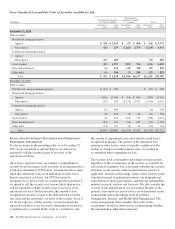

The fair value of investment securities is impacted by interest

rates, credit spreads, market volatility and liquidity conditions.

Net unrealized gains and losses in the securities available for

sale portfolio are included in shareholders’ equity as

accumulated other comprehensive income or loss, net of tax,

unless credit-related. Securities held to maturity are carried at

amortized cost. At December 31, 2011, accumulated other

comprehensive income included pretax gains of $98 million

from derivatives used to hedge the purchase of investment

securities classified as held to maturity. The gains will be

accreted into interest income as an adjustment of yield on the

securities.

The gross unrealized loss on debt securities held to maturity

was $6 million at December 31, 2011 and $5 million at

December 31, 2010, with $.5 billion and $.7 billion of

positions in a continuous loss position for less than 12 months

at December 31, 2011 and December 31, 2010, respectively.

The gross unrealized loss and fair value on debt securities held

to maturity that were in a continuous loss position for 12

months or more were not significant at both December 31,

2011 and December 31, 2010.

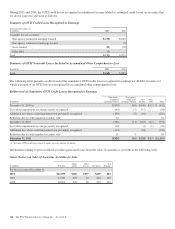

During 2011, we transferred securities with a fair value of

$6.3 billion from available for sale to held to maturity. The

securities were reclassified at fair value at the time of transfer

and represented a non-cash transaction. Accumulated other

comprehensive income included net pretax unrealized gains of

$183 million on the securities at transfer, which are being

accreted over the remaining life of the related securities as an

adjustment of yield in a manner consistent with the

amortization of the net premium on the same transferred

securities, resulting in no impact on net income.

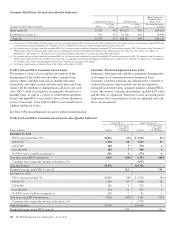

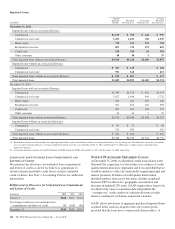

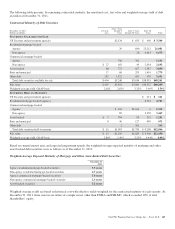

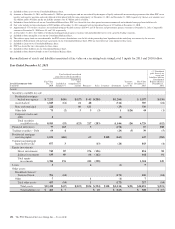

The following table presents gross unrealized loss and fair

value of securities available for sale at December 31, 2011 and

December 31, 2010. The securities are segregated between

investments that have been in a continuous unrealized loss

position for less than twelve months and twelve months or

more based on the point in time the fair value declined below

the amortized cost basis. The table includes debt securities

where a portion of other-than-temporary impairment (OTTI)

has been recognized in accumulated other comprehensive loss.

The PNC Financial Services Group, Inc. – Form 10-K 143