PNC Bank 2011 Annual Report Download - page 92

Download and view the complete annual report

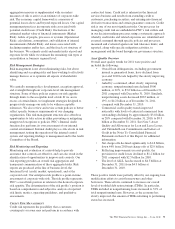

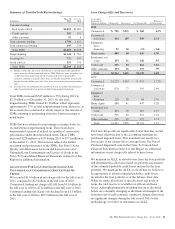

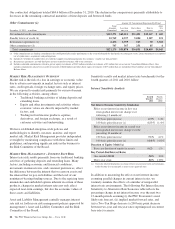

Please find page 92 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2011, total ALLL to total nonperforming

loans was 122%. The comparable amount for December 31,

2010 was 109%. The allowance allocated to consumer loans

and lines of credit not secured by residential real estate and

purchased impaired loans, which are both excluded from

nonperforming loans, totaled $1.4 billion at both

December 31, 2011, and 2010. See the Nonperforming Assets

By Type table within this Credit Risk Management section for

additional information. Excluding these balances, the

allowance as a percent of nonperforming loans was 84% and

77% as of December 31, 2011 and December 31, 2010,

respectively.

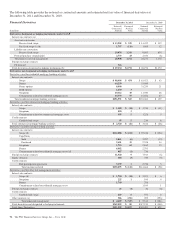

See Note 5 Asset Quality and Allowances for Loan and Lease

Losses and Unfunded Loan Commitments and Letters of

Credit and Note 6 Purchased Impaired Loans in the Notes To

Consolidated Financial Statements in Item 8 of this Report

regarding changes in the ALLL and in the allowance for

unfunded loan commitments and letters of credit.

C

REDIT

D

EFAULT

S

WAPS

From a credit risk management perspective, we use credit

default swaps (CDS) as a tool to manage risk concentrations

in the credit portfolio. That risk management could come from

protection purchased or sold in the form of single name or

index products. When we buy loss protection by purchasing a

CDS, we pay a fee to the seller, or CDS counterparty, in return

for the right to receive a payment if a specified credit event

occurs for a particular obligor or reference entity.

When we sell protection, we receive a CDS premium from the

buyer in return for PNC’s obligation to pay the buyer if a

specified credit event occurs for a particular obligor or

reference entity.

We evaluate the counterparty credit worthiness for all our

CDS activities. Counterparty credit lines are approved based

on a review of credit quality in accordance with our traditional

credit quality standards and credit policies. The credit risk of

our counterparties is monitored in the normal course of

business. In addition, all counterparty credit lines are subject

to collateral thresholds and exposures above these thresholds

are secured.

CDSs are included in the “Derivatives not designated as

hedging instruments under GAAP” table in the Financial

Derivatives section of this Risk Management discussion.

O

PERATIONAL

R

ISK

M

ANAGEMENT

Operational risk is the risk of loss resulting from inadequate or

failed internal processes or systems, human factors, or

external events. This includes losses that may arise as a result

of non-compliance with laws or regulations, failure to fulfill

fiduciary responsibilities, as well as litigation or other legal

actions. Operational risk may occur in any of our business

activities and manifests itself in various ways, including but

not limited to:

• Transaction processing errors,

• Unauthorized transactions and fraud by employees or

third parties,

• Material disruption in business activities,

• System breaches and misuse of sensitive information,

• Regulatory or governmental actions, fines or

penalties, and

• Significant legal expenses, judgments or settlements.

Operational Risk Management focuses on balancing business

needs, regulatory expectations and risk management priorities

through a balanced, adaptive and proactive program that is

designed to provide a strong governance model, sound and

consistent management processes and transparent operational

risk reporting across the enterprise.

We manage operational risk based upon a comprehensive

framework that enables the company to determine the

enterprise and individual business unit’s operational risk

profile in comparison to the established risk appetite and

identify operational risks that may require further mitigation.

This framework is established around a set of enterprise-wide

policies and a system of internal controls that are designed to

manage risk and to provide management with timely and

accurate information about the operations of PNC. This

framework employs a number of techniques to manage

operational risk, including:

• Risk and Control Self-Assessments (RCSAs) are

performed at least annually across PNC’s businesses,

processes, systems and products. RCSA methodology

is a standard process for management to self assess

operational risks, evaluate control effectiveness, and

determine if risk exposure is within established

tolerances;

• Scenario Analysis is leveraged to proactively

evaluate operational loss events with the potential for

severe business, financial, operational or regulatory

impact on the company or a major business unit. This

methodology leverages standard processes and tools

to evaluate a wide range of business and operational

risks encompassing both external and internal events

relevant to the company. Based upon scenario

analysis conclusions, management may implement

additional controls or risk management activities to

reduce exposure to an acceptable level;

• A Key Risk Indicator (KRI) framework allows

management to assess actual operational risk results

compared to expectations and thresholds, as well as

proactively identify unexpected shifts in operational

risk exposure or control effectiveness. Enterprise-

level KRIs are designed to monitor exposure across

the different inherent operational risk types.

Business-specific KRIs are established in support of

the individual risk and control self assessments; and

• Operational loss events across the enterprise are

continuously captured and maintained in a central

repository. This information is analyzed and used to

help determine the root causes of these events and to

identify trends that could indicate changes in the

company’s risk exposure or control effectiveness.

The PNC Financial Services Group, Inc. – Form 10-K 83