PNC Bank 2011 Annual Report Download - page 71

Download and view the complete annual report

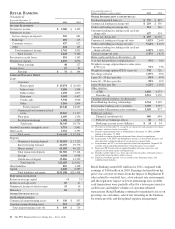

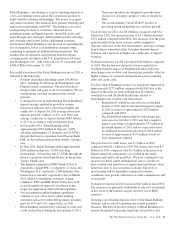

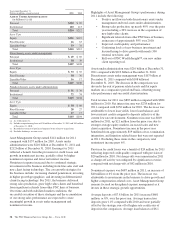

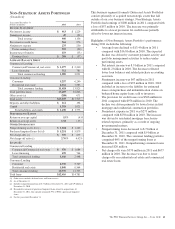

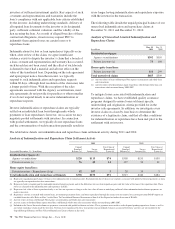

Please find page 71 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The majority of assets within this portfolio were obtained

through acquisitions and fall outside of our core business

strategy. Consequently, the business activity of this segment is

to manage the wind-down of the portfolio assigned to it while

maximizing the value and mitigating risk. The fair value

marks taken upon acquisition of the assets, the team we have

in place, and targeted asset resolution strategies help us to

manage these assets. Additionally, our capital and liquidity

positions provide us flexibility in a challenging environment

to optimize returns on this portfolio for our shareholders.

• The $12.4 billion of loans held in this portfolio at

December 31, 2011 are stated inclusive of a fair

value adjustment on purchased impaired loans at

acquisition. Taking the adjustment and the ALLL

into account, the net carrying basis of this loan

portfolio is 79% of customer outstandings.

• The Commercial Lending portfolio within this

segment is comprised of $1.0 billion in residential

development loans (i.e. condominiums, townhomes,

developed and undeveloped land) and $.7 billion of

performing cross-border leases. This portfolio has

been reduced by 33% since December 31, 2010

driven by the decline in residential development

loans. The cross-border lease portfolio has been

relatively stable. These assets are long-term and are

of high credit quality.

• The performance of the Consumer Lending portfolio

within this segment is dependent upon economic

growth, unemployment rates, the housing market

recovery and the interest rate environment. The

portfolio’s credit quality performance has stabilized

through actions taken by management over the last

three years. Approximately 76% of customers have

been current with principal and interest payments for

the past 12 months. Consumer Lending consists of

consumer loans, which are mainly brokered home

equity loans and lines of credit, and residential real

estate mortgages. The residential real estate mortgage

portfolio is composed of jumbo and ALT-A first lien

mortgages, non-prime first and second lien

mortgages and, to a lesser extent, residential

construction loans. Management has implemented

various refinance programs, line management

programs, and loss mitigation programs to mitigate

risks within these portfolios while assisting

borrowers to maintain homeownership when

possible.

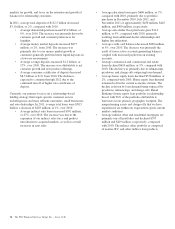

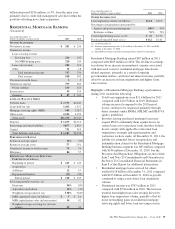

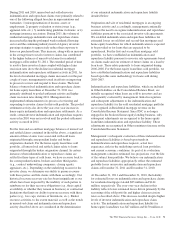

• When loans are sold, we may assume certain loan

repurchase obligations associated with those loans

primarily relating to situations where investors may

request PNC to indemnify them against losses or to

repurchase loans that they believe do not comply

with applicable contractual loan origination

covenants and representations and warranties we

have made. From 2005 to 2007, home equity loans

were sold with such contractual provisions. At

December 31, 2011, the liability for estimated losses

on repurchase and indemnification claims for the

Non-Strategic Assets Portfolio business segment was

$47 million. No substantial additional reserves were

recorded in 2011. See the Recourse And Repurchase

Obligations section of this Item 7 and Note 23

Commitments and Guarantees in the Notes To

Consolidated Financial Statements included in Item 8

of this Report for additional information.

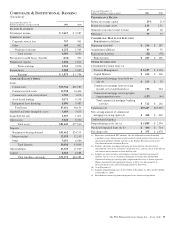

C

RITICAL

A

CCOUNTING

E

STIMATES

A

ND

J

UDGMENTS

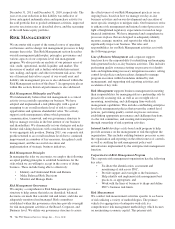

Our consolidated financial statements are prepared by

applying certain accounting policies. Note 1 Accounting

Policies in the Notes To Consolidated Financial Statements in

Item 8 of this Report describes the most significant accounting

policies that we use. Certain of these policies require us to

make estimates or economic assumptions that may vary under

different assumptions or conditions and such variations may

significantly affect our reported results and financial position

for the period or in future periods.

Fair Value Measurements

We must use estimates, assumptions, and judgments when

assets and liabilities are required to be recorded at, or adjusted

to reflect, fair value.

Assets and liabilities carried at fair value inherently result in a

higher degree of financial statement volatility. Fair values and

the information used to record valuation adjustments for

certain assets and liabilities are based on either quoted market

prices or are provided by independent third-party sources,

including appraisers and valuation specialists, when available.

When such third-party information is not available, we

estimate fair value primarily by using cash flow and other

financial modeling techniques. Changes in underlying factors,

assumptions, or estimates in any of these areas could

materially impact our future financial condition and results of

operations.

PNC applies Fair Value Measurements and Disclosures (ASC

820). This guidance defines fair value as the price that would

be received to sell a financial asset or paid to transfer a

financial liability in an orderly transaction between market

participants at the measurement date. This guidance requires a

three level hierarchy for disclosure of assets and liabilities

recorded at fair value. The classification of assets and

liabilities within the hierarchy is based on whether the inputs

to the valuation methodology used in the measurement are

observable or unobservable.

62 The PNC Financial Services Group, Inc. – Form 10-K