PNC Bank 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

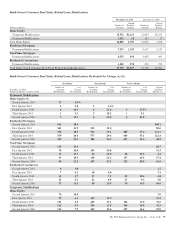

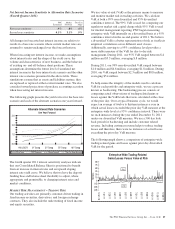

Net Interest Income Sensitivity to Alternative Rate Scenarios

(Fourth Quarter 2011)

PNC

Economist

Market

Forward

Two-Ten

Slope

First year sensitivity .9% .8% .4%

Second year sensitivity 4.1% 3.1% .9%

All changes in forecasted net interest income are relative to

results in a base rate scenario where current market rates are

assumed to remain unchanged over the forecast horizon.

When forecasting net interest income, we make assumptions

about interest rates and the shape of the yield curve, the

volume and characteristics of new business, and the behavior

of existing on- and off-balance sheet positions. These

assumptions determine the future level of simulated net

interest income in the base interest rate scenario and the other

interest rate scenarios presented in the above table. These

simulations assume that as assets and liabilities mature, they

are replaced or repriced at then current market rates. We also

consider forward projections of purchase accounting accretion

when forecasting net interest income.

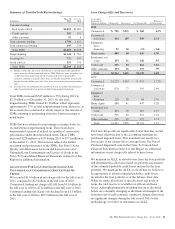

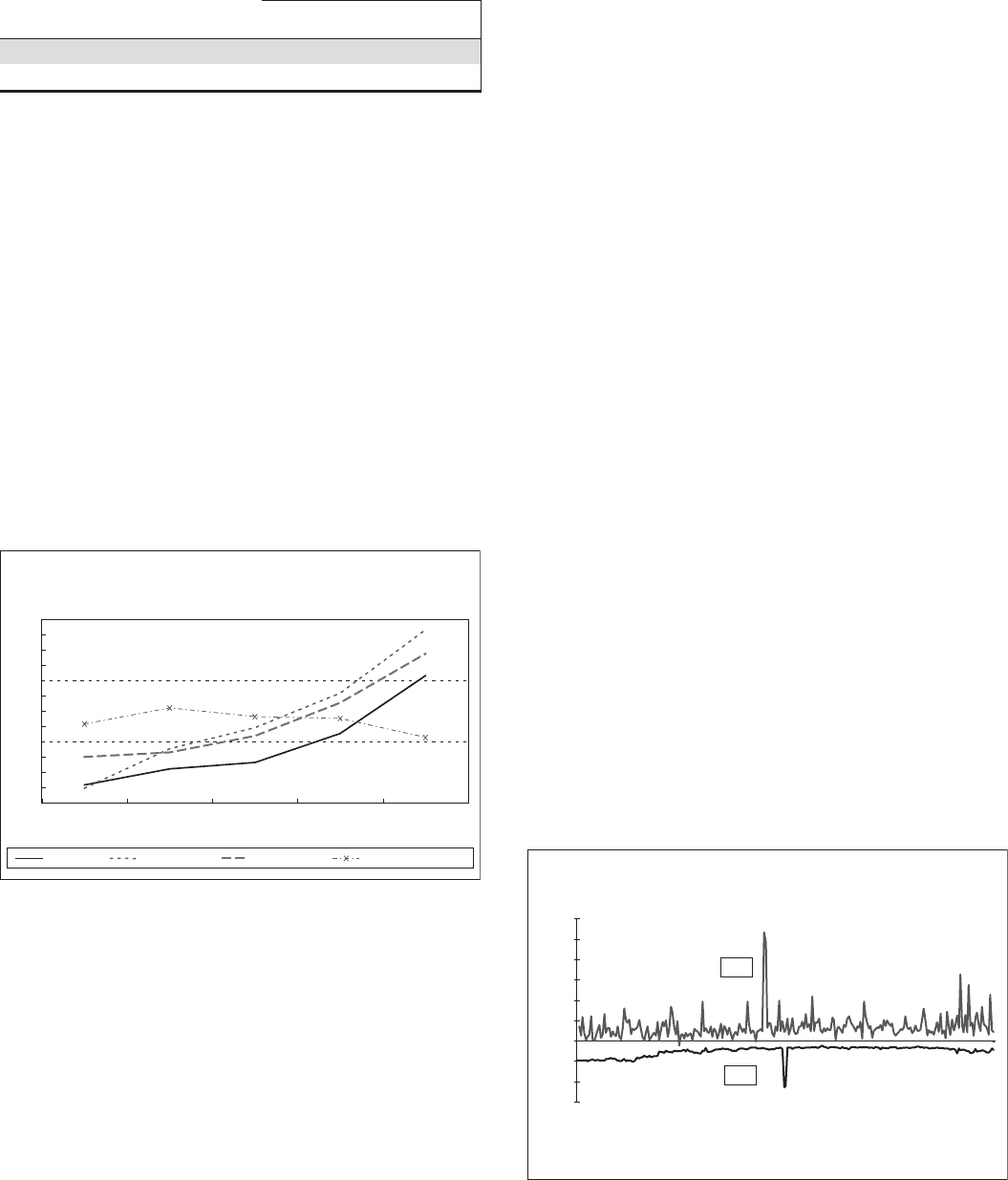

The following graph presents the yield curves for the base rate

scenario and each of the alternate scenarios one year forward.

Alternate Interest Rate Scenarios

One Year Forward

0.0

1.0

2.0

3.0

1M LIBOR 2Y Swap 3Y Swap 5Y Swap 10Y Swap

Base Rates PNC Economist Market Forward Two-Ten Slope decrease

The fourth quarter 2011 interest sensitivity analyses indicate

that our Consolidated Balance Sheet is positioned to benefit

from an increase in interest rates and an upward sloping

interest rate yield curve. We believe that we have the deposit

funding base and balance sheet flexibility to adjust, where

appropriate and permissible, to changing interest rates and

market conditions.

M

ARKET

R

ISK

M

ANAGEMENT

–T

RADING

R

ISK

Our trading activities are primarily customer-driven trading in

fixed income securities, derivatives, and foreign exchange

contracts. They also include the underwriting of fixed income

and equity securities.

We use value-at-risk (VaR) as the primary means to measure

and monitor market risk in trading activities. We calculate

VaR at both a 99% non diversified and 95% diversified

confidence interval. The 99% VaR is used for computing our

regulatory market risk capital charge while 95% VaR is used

for internal management reporting. PNC began measuring

enterprise wide VaR internally on a diversified basis at a 95%

confidence interval in the second quarter of 2011. We believe

a diversified VaR is a better representation of risk as it reflects

empirical correlations across different asset classes.

Additionally, moving to a 95% confidence level provides a

more stable measure of the VaR for day-to-day risk

management. During 2011, our 95% VaR ranged between $.4

million and $3.5 million, averaging $.8 million.

During 2011, our 99% non-diversified VaR ranged between

$1.0 million and $6.8 million, averaging $1.8 million. During

2010, our VaR ranged between $2.3 million and $8.8 million,

averaging $5.4 million.

To help ensure the integrity of the models used to calculate

VaR for each portfolio and enterprise-wide, we use a process

known as backtesting. The backtesting process consists of

comparing actual observations of trading-related gains or

losses against the VaR levels that were calculated at the close

of the prior day. Over a typical business cycle, we would

expect an average of twelve to thirteen instances a year in

which actual losses exceeded the prior day VaR measure at the

enterprise-wide level at a 95% confidence interval. There were

no such instances during the year ended December 31, 2011

under our diversified VaR measure. We use a 500 day look

back period for backtesting and include customer related

revenue. Including customer revenue helps to reduce trading

losses and therefore, there were no instances of actual losses

exceeding the prior day VaR measure.

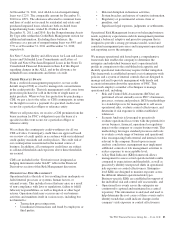

The following graph shows a comparison of enterprise-wide

trading-related gains and losses against prior day diversified

VaR for the period.

Enterprise-Wide Trading-Related

Gains/Losses Versus Value at Risk

(45)

(30)

(15)

0

15

30

45

60

90

75

12/31/10

1/31/11

2/28/11

3/31/11

4/30/11

5/31/11

6/30/11

7/31/11

8/31/11

9/30/11

10/31/11

11/30/11

12/30/11

Millions

VaR

P&L

The PNC Financial Services Group, Inc. – Form 10-K 89