PNC Bank 2011 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

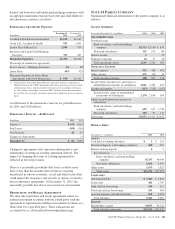

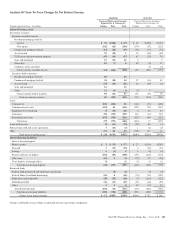

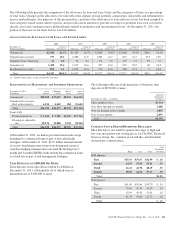

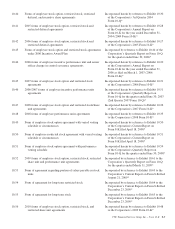

The following table presents the assignment of the allowance for loan and lease losses and the categories of loans as a percentage

of total loans. Changes in the allocation over time reflect the changes in loan portfolio composition, risk profile and refinements to

reserve methodologies. For purposes of this presentation, a portion of the allowance for loan and lease losses has been assigned to

loan categories based on the relative specific and pool allocation amounts to provide coverage for probable losses not covered in

specific, pool and consumer reserve methodologies related to qualitative and measurement factors. At December 31, 2011, the

portion of the reserves for these factors was $16 million.

A

LLOCATION OF

A

LLOWANCE FOR

L

OAN AND

L

EASE

L

OSSES

2011 2010 2009 2008 2007

December 31

Dollars in millions Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans

Commercial $1,180 41.3% $1,387 36.7% $1,869 34.8% $1,668 39.4% $564 42.4%

Commercial real estate 753 10.2 1,086 11.9 1,305 14.7 833 14.7 153 13.0

Equipment lease financing 62 4.0 94 4.2 171 3.9 179 3.7 36 3.7

Consumer (a) 1,458 35.4 1,227 36.6 957 34.0 929 29.9 68 26.9

Residential real estate 894 9.1 1,093 10.6 770 12.6 308 12.3 9 14.0

Total $4,347 100.0% $4,887 100.0% $5,072 100.0% $3,917 100.0% $830 100.0%

(a) Includes home equity, credit card and other consumer.

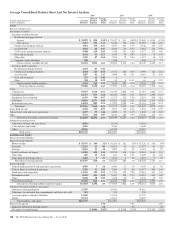

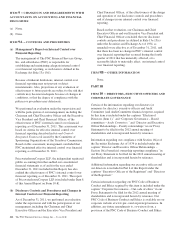

S

ELECTED

L

OAN

M

ATURITIES AND

I

NTEREST

S

ENSITIVITY

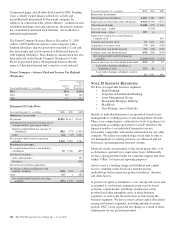

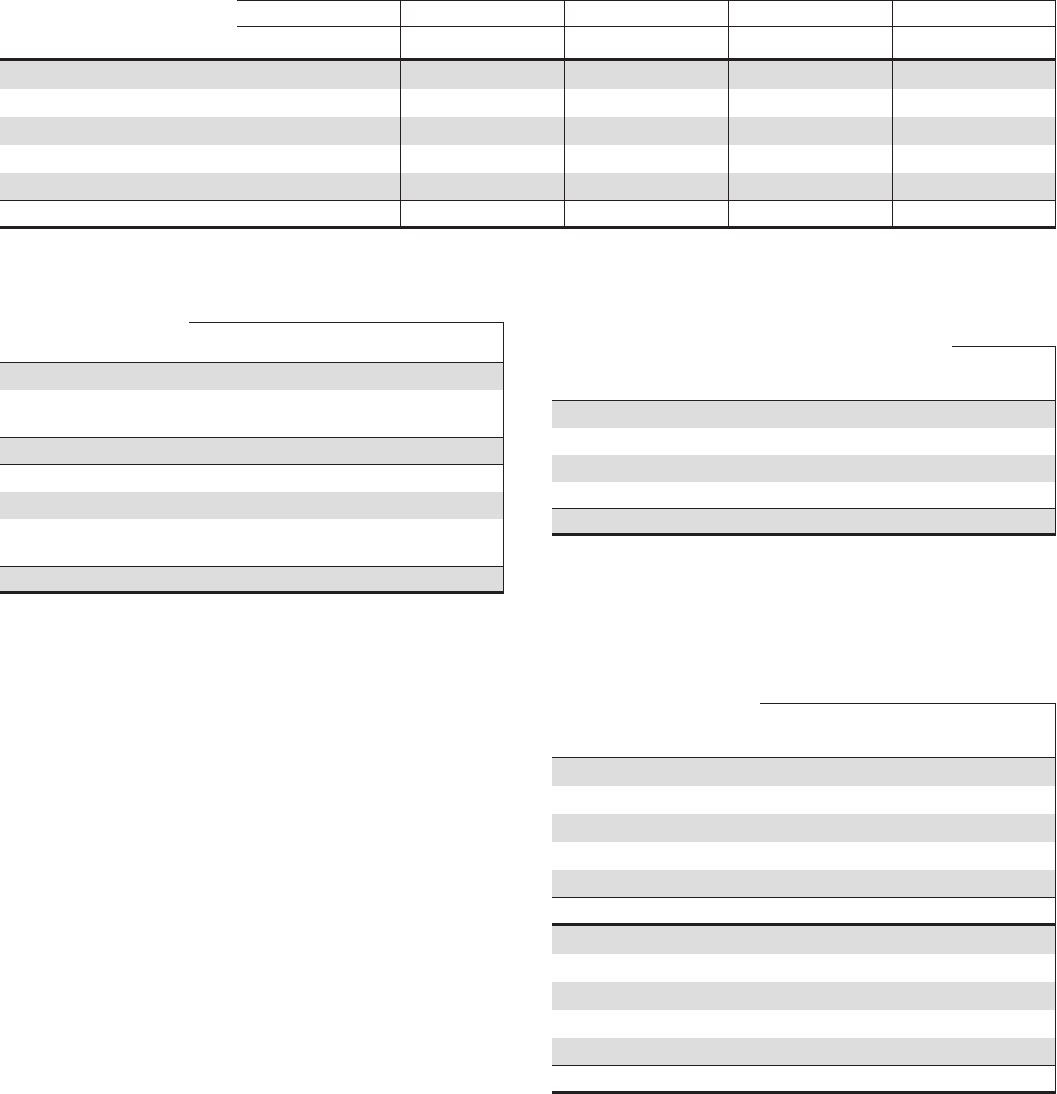

December 31, 2011

In millions

1 Year

or Less

1 Through

5 Years

After 5

Years

Gross

Loans

Commercial $20,508 $37,031 $8,155 $65,694

Commercial real estate -

Real estate projects 6,014 4,442 184 10,640

Total $26,522 $41,473 $8,339 $76,334

Loans with:

Predetermined rate $ 5,546 $ 9,585 $2,635 $17,766

Floating or adjustable

rate 20,976 31,888 5,704 58,568

Total $26,522 $41,473 $8,339 $76,334

At December 31, 2011, we had no pay-fixed interest rate swaps

designated to commercial loans as part of fair value hedge

strategies. At December 31, 2011, $13.9 billion notional amount

of receive-fixed interest rate swaps were designated as part of

cash flow hedging strategies that converted the floating rate (1

month and 3 month LIBOR) on the underlying commercial loans

to a fixed rate as part of risk management strategies.

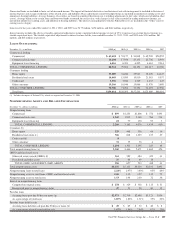

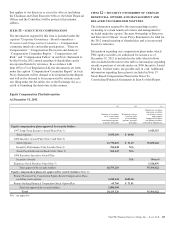

T

IME

D

EPOSITS OF

$100,000 O

R

M

ORE

Time deposits in foreign offices totaled $1.8 billion at

December 31, 2011, substantially all of which were in

denominations of $100,000 or more.

The following table sets forth maturities of domestic time

deposits of $100,000 or more:

December 31, 2011 – in millions

Domestic

Certificates

of Deposit

Three months or less $3,534

Over three through six months 1,908

Over six through twelve months 1,835

Over twelve months 2,093

Total $9,370

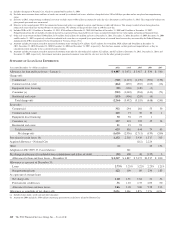

C

OMMON

S

TOCK

P

RICES

/D

IVIDENDS

D

ECLARED

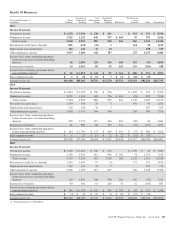

The table below sets forth by quarter the range of high and

low sale and quarter-end closing prices for The PNC Financial

Services Group, Inc. common stock and the cash dividends

declared per common share.

High Low Close

Cash

Dividends

Declared

2011 Quarter

First $65.19 $59.67 $62.99 $ .10

Second 64.37 55.56 59.61 .35

Third 61.21 42.70 48.19 .35

Fourth 58.70 44.74 57.67 .35

Total $1.15

2010 Quarter

First $61.80 $50.46 $59.70 $ .10

Second 70.45 56.30 56.50 .10

Third 62.99 49.43 51.91 .10

Fourth 61.79 50.69 60.72 .10

Total $ .40

The PNC Financial Services Group, Inc. – Form 10-K 211