PNC Bank 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

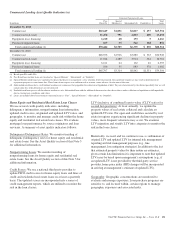

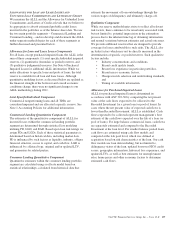

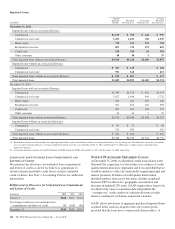

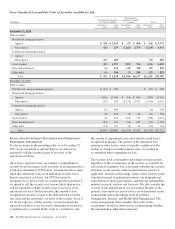

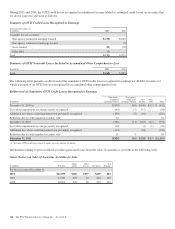

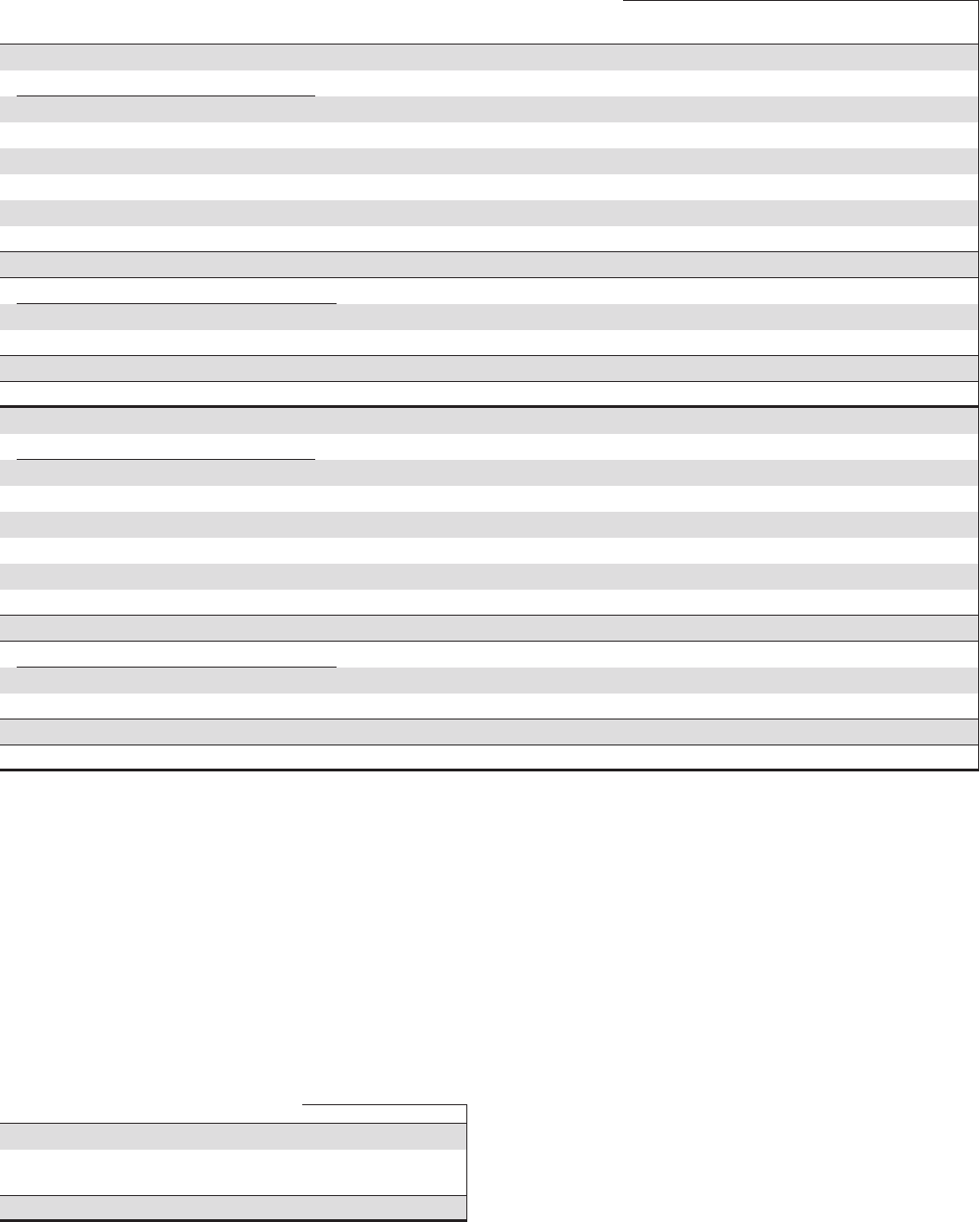

Impaired Loans

In millions

Unpaid

Principal

Balance

Recorded

Investment (a)

Associated

Allowance (b)

Average

Recorded

Investment (a)

December 31, 2011

Impaired loans with an associated allowance

Commercial $1,125 $ 785 $ 241 $ 979

Commercial real estate 1,452 1,043 318 1,247

Home equity 774 762 292 702

Residential real estate 853 730 193 609

Credit card 258 258 53 281

Other consumer 48 48 3 39

Total impaired loans with an associated allowance $4,510 $3,626 $1,100 $3,857

Impaired loans without an associated allowance

Commercial $ 347 $ 125 $ 104

Commercial real estate 592 342 413

Total impaired loans without an associated allowance $ 939 $ 467 $ 517

Total impaired loans $5,449 $4,093 $1,100 $4,374

December 31, 2010

Impaired loans with an associated allowance

Commercial $1,769 $1,178 $ 410 $1,533

Commercial real estate 1,927 1,446 449 1,732

Home equity 622 622 207 448

Residential real estate 521 465 122 309

Credit card 301 301 149 275

Other consumer 34 34 7 30

Total impaired loans with an associated allowance $5,174 $4,046 $1,344 $4,327

Impaired loans without an associated allowance

Commercial $ 87 $ 75 $ 90

Commercial real estate 525 389 320

Total impaired loans without an associated allowance $ 612 $ 464 $ 410

Total impaired loans $5,786 $4,510 $1,344 $4,737

(a) Recorded investment in a loan includes the unpaid principal balance plus accrued interest and net accounting adjustments, less any charge-offs. Recorded investment does not include

any associated valuation allowance. Average recorded investment is for the years ended December 31, 2011 and December 31, 2010 and is a simple average calculation using

quarter-end balances.

(b) Associated allowance amounts include $580 million and $509 million for TDRs at December 31, 2011 and December 31, 2010, respectively.

A

LLOWANCE FOR

U

NFUNDED

L

OAN

C

OMMITMENTS AND

L

ETTERS OF

C

REDIT

We maintain the allowance for unfunded loan commitments

and letters of credit at a level we believe is appropriate to

absorb estimated probable credit losses on these unfunded

credit facilities. See Note 1 Accounting Policies for additional

information.

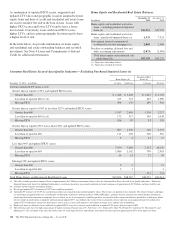

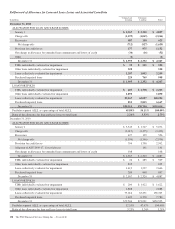

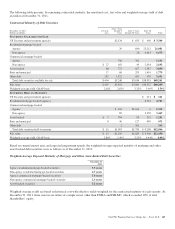

Rollforward of Allowance for Unfunded Loan Commitments

and Letters of Credit

In millions 2011 2010 2009

January 1 $188 $296 $344

Net change in allowance for unfunded loan

commitments and letters of credit 52 (108) (48)

December 31 $240 $188 $296

N

OTE

6P

URCHASED

I

MPAIRED

L

OANS

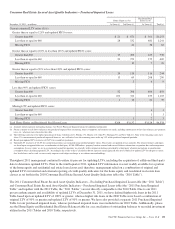

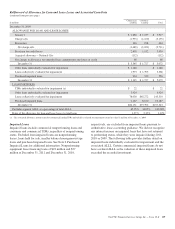

At December 31, 2008, we identified certain loans related to the

National City acquisition, for which there was evidence of credit

quality deterioration since origination and it was probable that we

would be unable to collect all contractually required principal and

interest payments. Evidence of credit quality deterioration

included statistics such as past due status, declines in updated

borrower FICO credit scores, geographic concentration and

increases in updated LTV ratios. GAAP requires these loans to be

recorded at fair value at acquisition date and prohibits the

“carrying over” or the creation of valuation allowances in the

initial accounting for such loans acquired in a transfer.

GAAP allows purchasers to aggregate purchased impaired loans

acquired in the same fiscal quarter into one or more pools,

provided that the loans have common risk characteristics. A

140 The PNC Financial Services Group, Inc. – Form 10-K