PNC Bank 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

From October 14, 2008 through December 31, 2009, PNC

Bank, National Association (PNC Bank, N.A.) participated in

the TLGP-Transaction Account Guarantee Program. Under

this program, all non-interest bearing transaction accounts

were fully guaranteed by the FDIC for the entire amount in the

account.

Beginning January 1, 2010, PNC Bank, N.A. ceased

participating in the FDIC’s TLGP-Transaction Account

Guarantee Program. Dodd-Frank, however, extended for two

years, beginning December 31, 2010, unlimited deposit

insurance coverage for non-interest bearing transaction

accounts held at all banks. Therefore, eligible accounts at PNC

Bank, N.A. are again eligible for unlimited deposit insurance,

through December 31, 2012. Coverage under this extension is

in addition to, and separate from, the coverage available under

the FDIC’s general deposit insurance rules.

Home Affordable Modification Program (HAMP)

As part of its effort to stabilize the US housing market, in

March 2009 the Obama Administration published detailed

guidelines implementing HAMP, and authorized servicers to

begin loan modifications. PNC began participating in HAMP

through its then subsidiary National City Bank in May 2009

and directly through PNC Bank, N.A. in July 2009, and

entered into an agreement on October 1, 2010 to participate in

the Second Lien Program. HAMP was scheduled to terminate

as of December 31, 2012; however, the Administration has

announced that the HAMP program deadline will be extended

to December 31, 2013.

Home Affordable Refinance Program (HARP)

Another part of its efforts to stabilize the US housing market

is the Obama Administration’s Home Affordable Refinance

Program (HARP), which provided a means for certain

borrowers to refinance their mortgage loans. PNC began

participating in HARP in May 2009. In 2011, the Obama

Administration revised the program to increase borrower

eligibility and extended it for another twelve months with a

new termination date of December 31, 2013.

K

EY

F

ACTORS

A

FFECTING

F

INANCIAL

P

ERFORMANCE

Our financial performance is substantially affected by a

number of external factors outside of our control, including

the following:

• General economic conditions, including the

continuity, speed and stamina of the moderate

economic recovery in general and on our customers

in particular,

• The level of, and direction, timing and magnitude of

movement in, interest rates and the shape of the

interest rate yield curve,

• The functioning and other performance of, and

availability of liquidity in, the capital and other

financial markets,

• Loan demand, utilization of credit commitments and

standby letters of credit, and asset quality,

• Customer demand for non-loan products and

services,

• Changes in the competitive and regulatory landscape

and in counterparty creditworthiness and

performance as the financial services industry

restructures in the current environment,

• The impact of the extensive reforms enacted in the

Dodd-Frank legislation and other legislative,

regulatory and administrative initiatives, including

those outlined elsewhere in this Report, and

• The impact of market credit spreads on asset

valuations.

In addition, our success will depend, among other things,

upon:

• Further success in the acquisition, growth and

retention of customers,

• Continued development of the geographic markets

related to our recent acquisitions, including full

deployment of our product offerings,

• Closing the pending RBC Bank (USA) acquisition

and integrating its business into PNC after closing,

• Revenue growth and our ability to provide innovative

and valued products to our customers,

• Our ability to utilize technology to develop and

deliver products and services to our customers,

• Our ability to manage and implement strategic

business objectives within the changing regulatory

environment,

• A sustained focus on expense management,

• Managing the non-strategic assets portfolio and

impaired assets,

• Improving our overall asset quality and continuing to

meet evolving regulatory capital standards,

• Continuing to maintain and grow our deposit base as

a low-cost funding source,

• Prudent risk and capital management related to our

efforts to maintain our desired moderate risk profile,

• Actions we take within the capital and other financial

markets, and

• The impact of legal and regulatory contingencies.

For additional information, please see Risk Factors in Item 1A

of this Report and the Cautionary Statement Regarding

Forward-Looking Information section in this Item 7.

S

UMMARY

F

INANCIAL

R

ESULTS

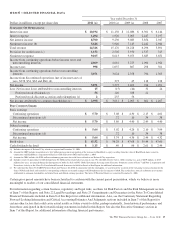

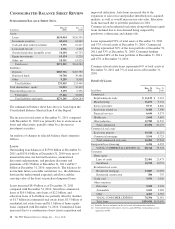

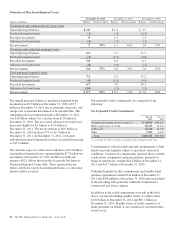

Year ended December 31 2011 2010

Net income (millions) $3,071 $3,397

Diluted earnings per common share

Continuing operations $ 5.64 $ 5.02

Discontinued operations .72

Net income $ 5.64 $ 5.74

Return from net income on:

Average common shareholders’ equity 9.56% 10.88%

Average assets 1.16% 1.28%

32 The PNC Financial Services Group, Inc. – Form 10-K