PNC Bank 2011 Annual Report Download - page 186

Download and view the complete annual report

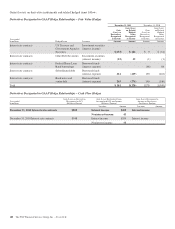

Please find page 186 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net Investment Hedges

We enter into foreign currency forward contracts to hedge

non-U.S. Dollar (USD) net investments in foreign subsidiaries

against adverse changes in foreign exchange rates. We assess

whether the hedging relationship is highly effective in

achieving offsetting changes in the value of the hedge and

hedged item by qualitatively verifying the critical terms of the

hedge and hedged item match at the inception of the hedging

relationship and on an ongoing basis. There were no

components of derivative gains or losses excluded from the

assessment of the hedge effectiveness.

At December 31, 2011, there was no net investment hedge

ineffectiveness and the loss recognized in Accumulated other

comprehensive income was less than $1 million to PNC’s

results of operations.

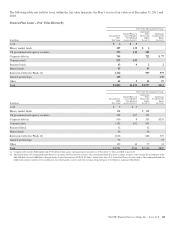

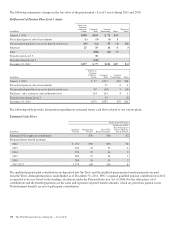

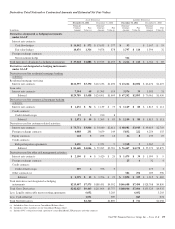

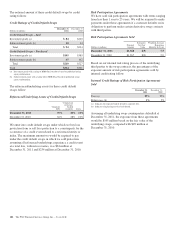

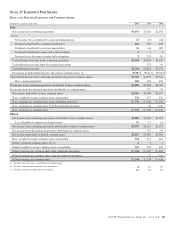

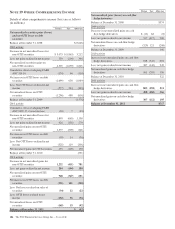

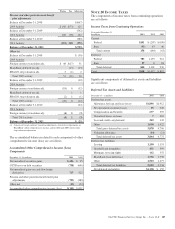

Further detail regarding the notional amounts, fair values and

gains and losses recognized related to derivatives used in fair

value and cash flow hedge strategies is presented in the tables

that follow.

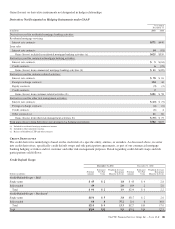

D

ERIVATIVES

N

OT

D

ESIGNATED IN

H

EDGE

R

ELATIONSHIPS

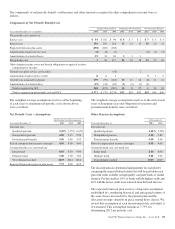

We also enter into derivatives that are not designated as

accounting hedges under GAAP.

The majority of these derivatives are used to manage risk

related to residential and commercial mortgage banking

activities and are considered economic hedges. Although these

derivatives are used to hedge risk, they are not designated as

accounting hedges because the contracts they are hedging are

typically also carried at fair value on the balance sheet,

resulting in symmetrical accounting treatment for both the

hedging instrument and the hedged item.

Our residential mortgage banking activities consist of

originating, selling and servicing mortgage loans. Residential

mortgage loans that will be sold in the secondary market, and

the related loan commitments, which are considered

derivatives, are accounted for at fair value. Changes in the fair

value of the loans and commitments due to interest rate risk

are hedged with forward loan sale contracts as well as US

Treasury and Eurodollar futures and options. Gains and losses

on the loans and commitments held for sale and the

derivatives used to economically hedge them are included in

residential mortgage noninterest income on the Consolidated

Income Statement.

We typically retain the servicing rights related to residential

mortgage loans that we sell. Residential mortgage servicing

rights are accounted for at fair value with changes in fair value

influenced primarily by changes in interest rates. Derivatives

used to hedge the fair value of residential mortgage servicing

rights include interest rate futures, swaps, options (including

caps, floors, and swaptions), and forward contracts to

purchase mortgage-backed securities. Gains and losses on

residential mortgage servicing rights and the related

derivatives used for hedging are included in Residential

mortgage noninterest income.

Certain commercial mortgage loans are also sold into the

secondary market as part of our commercial mortgage banking

activities and the loans, and the related loan commitments,

which are considered derivatives, are accounted for at fair

value. Derivatives used to economically hedge these loans and

commitments from changes in fair value due to interest rate

risk and credit risk include forward loan sale contracts,

interest rate swaps, and credit default swaps. Gains and losses

on the commitments, loans and derivatives are included in

Other noninterest income.

The residential and commercial loan commitments associated

with loans to be sold which are accounted for as derivatives

are valued based on the estimated fair value of the underlying

loan and the probability that the loan will fund within the

terms of the commitment. The fair value also takes into

account the fair value of the embedded servicing right.

We offer derivatives to our customers in connection with their

risk management needs. These derivatives primarily consist of

interest rate swaps, interest rate caps, floors, swaptions,

foreign exchange contracts, and equity contracts. We

primarily manage our market risk exposure from customer

transactions by entering into a variety of hedging transactions

with third-party dealers. Gains and losses on customer-related

derivatives are included in Other noninterest income.

The derivatives portfolio also includes derivatives used for

other risk management activities. These derivatives are

entered into based on stated risk management objectives.

This segment of the portfolio includes credit default swaps

(CDS) used to mitigate the risk of economic loss on a portion

of our loan exposure. We also sell loss protection to mitigate

the net premium cost and the impact of mark-to-market

accounting on CDS purchases to hedge the loan portfolio. The

fair values of these derivatives typically are based on related

credit spreads. Gains and losses on the derivatives entered into

for other risk management are included in Other noninterest

income.

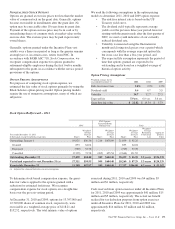

Included in the customer, mortgage banking risk management,

and other risk management portfolios are written interest-rate

caps and floors entered into with customers and for risk

management purposes. We receive an upfront premium from

the counterparty and are obligated to make payments to the

counterparty if the underlying market interest rate rises above

or falls below a certain level designated in the contract. At

December 31, 2011, the fair value of the written caps and

floors liability on our Consolidated Balance Sheet was $6

million compared with $15 million at December 31, 2010. Our

ultimate obligation under written options is based on future

market conditions and is only quantifiable at settlement.

The PNC Financial Services Group, Inc. – Form 10-K 177