PNC Bank 2011 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

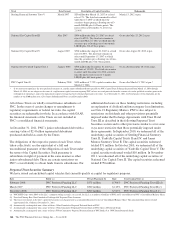

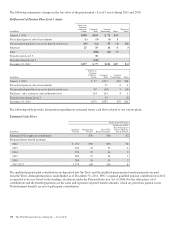

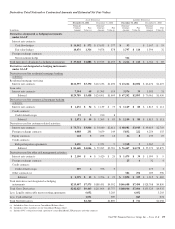

The health care cost trend rate assumptions shown in the

preceding tables relate only to the postretirement benefit

plans. A one-percentage-point change in assumed health care

cost trend rates would have the following effects:

Effect of One Percent Change in Assumed Health Care Cost

Year ended December 31, 2011

In millions Increase Decrease

Effect on total service and interest cost $1 $(1)

Effect on year-end benefit obligation $13 $(13)

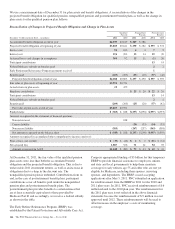

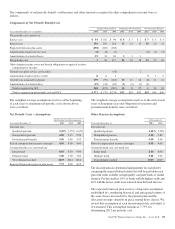

Unamortized actuarial gains and losses and prior service costs

and credits are recognized in AOCI each December 31, with

amortization of these amounts through net periodic benefit

cost. The estimated amounts that will be amortized in 2012 are

as follows:

Estimated Amortization of Unamortized Actuarial Gains and

Losses – 2012

2012 Estimate

Year ended December 31

In millions

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

Prior service (credit) $ (8) $(3)

Net actuarial loss 88 $6 2

Total $80 $6 $(1)

D

EFINED

C

ONTRIBUTION

P

LANS

We have a qualified defined contribution plan that covers all

eligible PNC employees. Effective January 1, 2010, the

employer matching contribution under the PNC Incentive

Savings Plan was reduced from a maximum of 6% to 4% of a

participant’s eligible compensation. Certain changes to the

plan’s eligibility and vesting requirements also became

effective January 1, 2010. Employees hired prior to January 1,

2010 became 100% vested immediately, while employees

hired on or after January 1, 2010 become vested 100% after

three years of service. Employee benefits expense related to

defined contribution plans was $105 million in 2011, $90

million in 2010 and $136 million in 2009. We measure

employee benefits expense as the fair value of the shares and

cash contributed to the plan by PNC.

Under the PNC Incentive Savings Plan, employee

contributions up to 4% of eligible compensation as defined by

the plan are matched 100%, subject to Code limitations. PNC

will contribute a minimum matching contribution of $2,000 to

employees who contribute at least 4% of eligible

compensation every pay period during the year . This amount

is prorated for certain employees, including part-time

employees and those who are eligible for the company match

for less than a full year. Additionally, for participants who

meet the annual deferral limit or the annual compensation

limit before the end of a calendar year, PNC makes a true-up

matching contribution to ensure that such participants receive

the full company match available. The plan is a 401(k) Plan

and includes a stock ownership (ESOP) feature. Employee

contributions are invested in a number of mutual fund

investment options available under the plan at the direction of

the employee. Although employees were also historically

permitted to direct the investment of their contributions into

the PNC common stock fund, this fund was frozen to future

investments of such contributions effective January 1, 2010.

All shares of PNC common stock held by the plan are part of

the ESOP. Employee contributions to the plan for 2010 and

2009 were matched primarily by shares of PNC common

stock held in treasury or reserve, except in the case of those

participants who have exercised their diversification election

rights to have their matching portion in other investments

available within the plan. Effective January 1, 2011, employer

matching contributions are now made in cash.

Prior to July 1, 2010, PNC sponsored a separate qualified

defined contribution plan that covered substantially all

US-based GIS employees not covered by our plan. The plan

was a 401(k) plan and included an ESOP feature. Under this

plan, employee contributions of up to 6% of eligible

compensation as defined by the plan were eligible to be

matched annually based on GIS performance levels. Employee

benefits expense for this plan was $6 million in 2010, and $8

million in 2009. We measured employee benefits expense as

the fair value of the shares and cash contributed to the plan.

As described in Note 2 Divestiture, on July 1, 2010 we sold

GIS. Plan assets of $239 million were transferred to The Bank

of New York Mellon Corporation 401(k) Savings Plan on that

date. Prior to July 1, 2010, the Plan continued to operate under

the provisions of the original plan document, as amended.

We also maintain a nonqualified supplemental savings plan

for certain employees, known as The PNC Supplemental

Incentive Savings Plan. Effective January 1, 2010, the

employer match was discontinued in that plan. Effective

January 1, 2012, the Supplemental Incentive Savings Plan was

frozen to new participants and for any deferrals of amounts

earned on or after such date. It was replaced by a new plan

called the Deferred Compensation and Incentive Plan.

N

OTE

15 S

TOCK

B

ASED

C

OMPENSATION

P

LANS

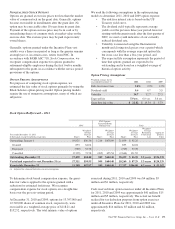

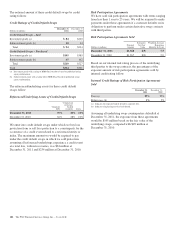

We have long-term incentive award plans (Incentive Plans)

that provide for the granting of incentive stock options,

nonqualified stock options, stock appreciation rights, incentive

shares/performance units, restricted stock, restricted share

units, other share-based awards and dollar-denominated

awards to executives and, other than incentive stock options,

to non-employee directors. Certain Incentive Plan awards may

be paid in stock, cash or a combination of stock and cash. We

typically grant a substantial portion of our stock-based

compensation awards during the first quarter of the year. As of

December 31, 2011, no stock appreciation rights were

outstanding. Total compensation expense recognized related

to all share-based payment arrangements during 2011, 2010

and 2009 was approximately $103 million, $107 million and

$93 million, respectively.

172 The PNC Financial Services Group, Inc. – Form 10-K