PNC Bank 2011 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R

ECOURSE AND

R

EPURCHASE

O

BLIGATIONS

As discussed in Note 3 Loans Sale and Servicing Activities

and Variable Interest Entities, PNC has sold commercial

mortgage and residential mortgage loans directly or indirectly

in securitizations and whole-loan sale transactions with

continuing involvement. One form of continuing involvement

includes certain recourse and loan repurchase obligations

associated with the transferred assets in these transactions.

C

OMMERCIAL

M

ORTGAGE

L

OAN

R

ECOURSE

O

BLIGATIONS

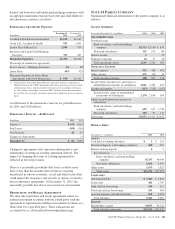

We originate, close and service certain multi-family

commercial mortgage loans which are sold to FNMA under

FNMA’s DUS program. We participated in a similar program

with the FHLMC.

Under these programs, we generally assume up to a one-third

pari passu risk of loss on unpaid principal balances through a

loss share arrangement. At December 31, 2011 and

December 31, 2010, the unpaid principal balance outstanding

of loans sold as a participant in these programs was $13.0

billion and $13.2 billion, respectively. The potential maximum

exposure under the loss share arrangements was $4.0 billion at

both December 31, 2011 and December 31, 2010. We

maintain a reserve for estimated losses based upon our

exposure. The reserve for losses under these programs totaled

$47 million and $54 million as of December 31, 2011 and

December 31, 2010, respectively, and is included in Other

liabilities on our Consolidated Balance Sheet. If payment is

required under these programs, we would not have a

contractual interest in the collateral underlying the mortgage

loans on which losses occurred, although the value of the

collateral is taken into account in determining our share of

such losses. Our exposure and activity associated with these

recourse obligations are reported in the Corporate &

Institutional Banking segment.

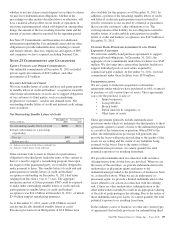

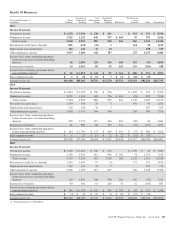

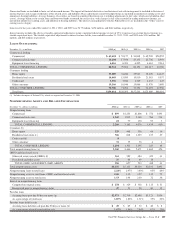

Analysis of Commercial Mortgage Recourse Obligations

In millions 2011 2010

January 1 $54 $71

Reserve adjustments, net 19

Losses – loan repurchases and settlements (8) (2)

Loan sales (24)

December 31 $47 $54

R

ESIDENTIAL

M

ORTGAGE

L

OAN AND

H

OME

E

QUITY

R

EPURCHASE

O

BLIGATIONS

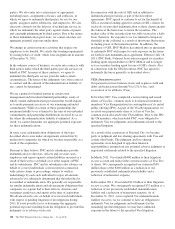

While residential mortgage loans are sold on a non-recourse

basis, we assume certain loan repurchase obligations

associated with mortgage loans we have sold to investors.

These loan repurchase obligations primarily relate to

situations where PNC is alleged to have breached certain

origination covenants and representations and warranties

made to purchasers of the loans in the respective purchase and

sale agreements. Residential mortgage loans covered by these

loan repurchase obligations include first and second-lien

mortgage loans we have sold through Agency securitizations,

Non-Agency securitizations, and whole-loan sale transactions.

As discussed in Note 3 in this Report, Agency securitizations

consist of mortgage loans sale transactions with FNMA,

FHLMC, and GNMA, while Non-Agency securitizations and

whole-loan sale transactions consist of mortgage loans sale

transactions with private investors. Our historical exposure

and activity associated with Agency securitization repurchase

obligations has primarily been related to transactions with

FNMA and FHLMC, as indemnification and repurchase losses

associated with FHA and VA-insured and uninsured loans

pooled in GNMA securitizations historically have been

minimal. Repurchase obligation activity associated with

residential mortgages is reported in the Residential Mortgage

Banking segment.

PNC’s repurchase obligations also include certain brokered

home equity loans/lines that were sold to a limited number of

private investors in the financial services industry by National

City prior to our acquisition. PNC is no longer engaged in the

brokered home equity lending business, and our exposure

under these loan repurchase obligations is limited to

repurchases of whole-loans sold in these transactions.

Repurchase activity associated with brokered home equity

loans/lines is reported in the Non-Strategic Assets Portfolio

segment.

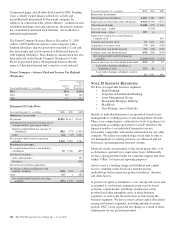

Loan covenants and representations and warranties are

established through loan sale agreements with various

investors to provide assurance that PNC has sold loans to

investors of sufficient investment quality. Key aspects of such

covenants and representations and warranties include the

loan’s compliance with any applicable loan criteria established

by the investor, including underwriting standards, delivery of

all required loan documents to the investor or its designated

party, sufficient collateral valuation, and the validity of the

lien securing the loan. As a result of alleged breaches of these

contractual obligations, investors may request PNC to

indemnify them against losses on certain loans or to

repurchase loans.

These investor indemnification or repurchase claims are

typically settled on an individual loan basis through make-

whole payments or loan repurchases; however, on occasion

we may negotiate pooled settlements with investors.

Indemnifications for loss or loan repurchases typically occur

when, after review of the claim, we agree insufficient

evidence exists to dispute the investor’s claim that a breach of

a loan covenant and representation and warranty has occurred,

such breach has not been cured, and the effect of such breach

is deemed to have had a material and adverse effect on the

value of the transferred loan. Depending on the sale agreement

and upon proper notice from the investor, we typically

respond to such indemnification and repurchase requests

within 60 days, although final resolution of the claim may take

a longer period of time. With the exception of the sales

The PNC Financial Services Group, Inc. – Form 10-K 199